|

Special thanks for those of you who have signed-up for my Trade Alerts Service! As you may know this project has been in development for over a year now. It really means a lot to me that there is now a surprisingly large interest in my expertise. I will do my very best to not disappoint with my calls!

Many other services provide recommendations of what to buy or sell, but they avoid putting their money on the line together with their clients’ money. My Trade Alerts are the actual trades that I execute – so my money is on the line together with yours! Moving on to market action. |

|

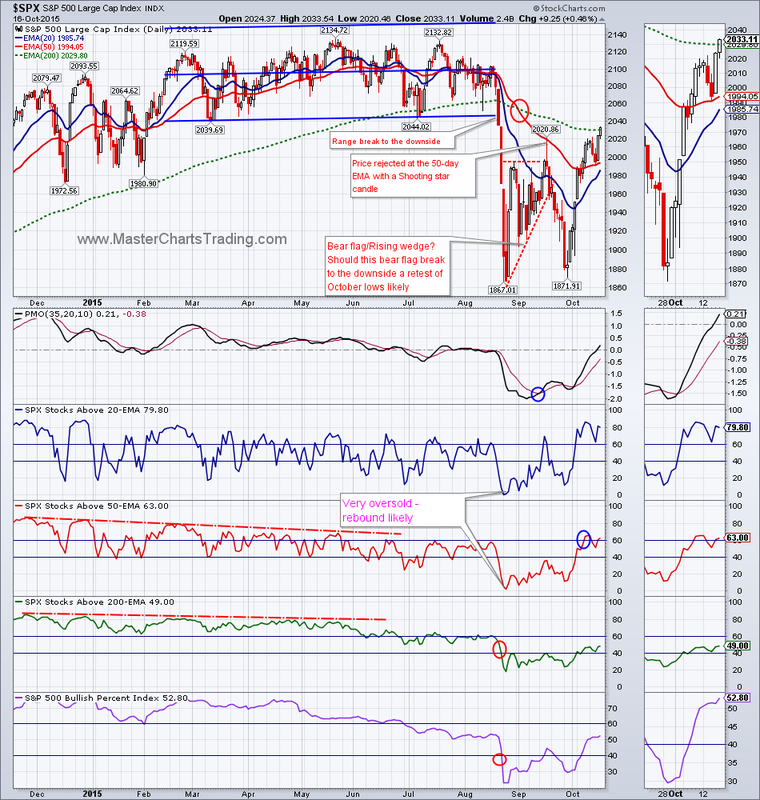

Charts of SPY and $SPX

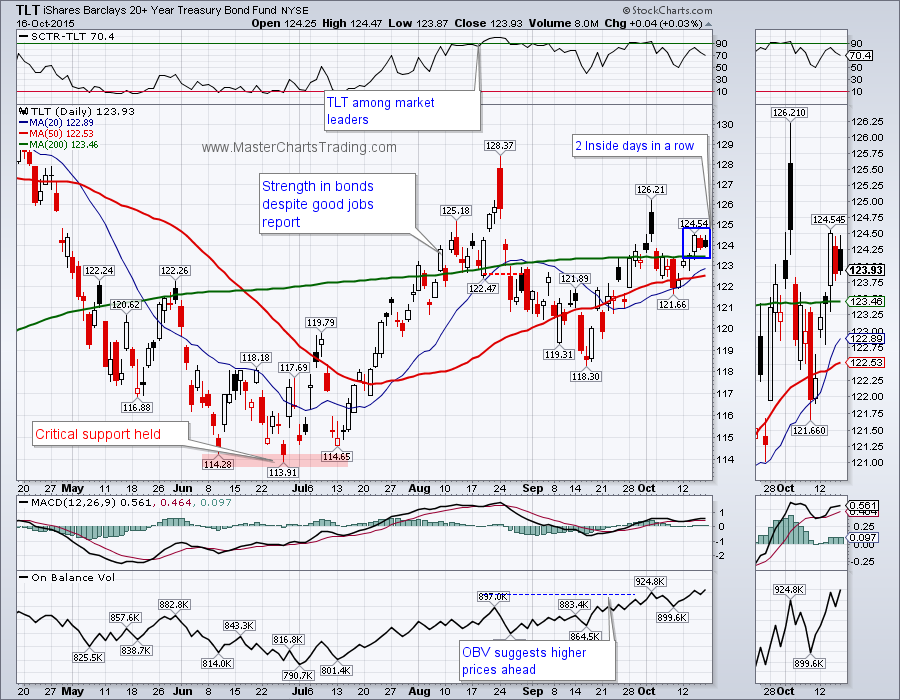

Chart of TLT_

Fans of the yellow metal were happy this week as gold gained almost 2% and was able to close above the 200-day moving average for the first time since May. Could this short covering rally that started in July turn into an honest-to goodness bottom in gold prices? I will keep an open mind to that possibility. In the meantime I do not see much evidence to counter my hypothesis that the bear market in gold that started in 2012-2013 is over. Trend in motion stays in motion and long-term charts of gold are very much still bearish.

CHART OF GOLD

As I mentioned last week, the market breadth for GDX still has a lot of work cut out for it. The AD-Lines for GDX haven’t been able to exceed even the August highs – a bearish sign. Bottom line – GDX is overbought and in a downtrend. If you read my previous blog entries you know what I am going to say next: it’s a shorting opportunity.

CHART OF GDX

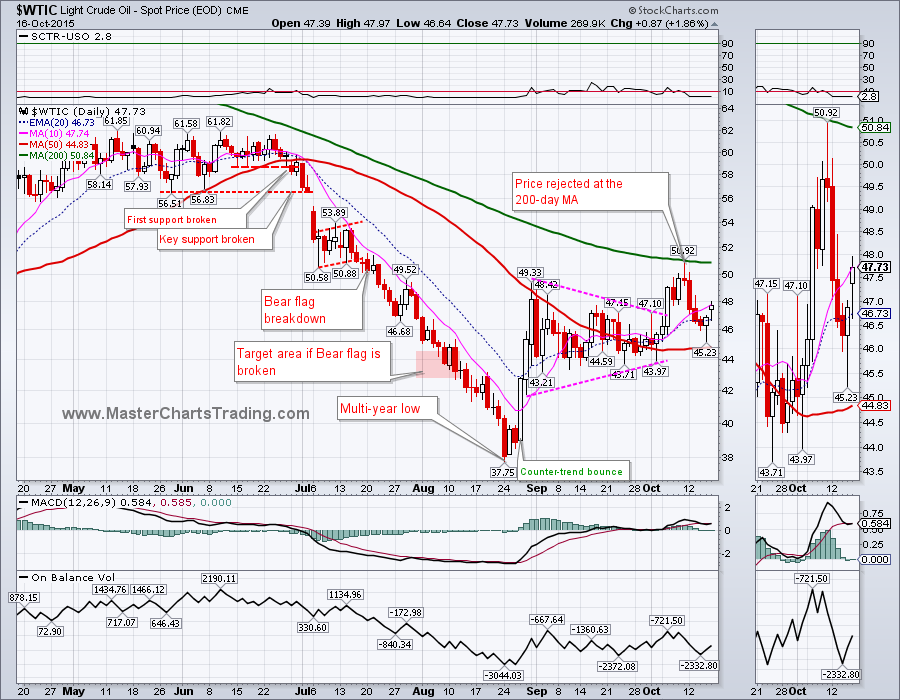

CHART OF OIL

CHART OF $NATGAS

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed