|

It appears that the support from the lows set on August 25, have held. SPY, the S&P 500 tracking ETF, tested it on Tuesday, but lower prices were rejected. For now. Short-term rally is on. I still think that, at the very least, we are either in the middle of a correction, or possibly the beginning of a bear market, time will tell. For now both the regular indicators and the market breadth indicators are pointing to more corrective action, rather then a V-Shaped recovery.

Chart of SPY |

|

Chart of SPX with market breadth

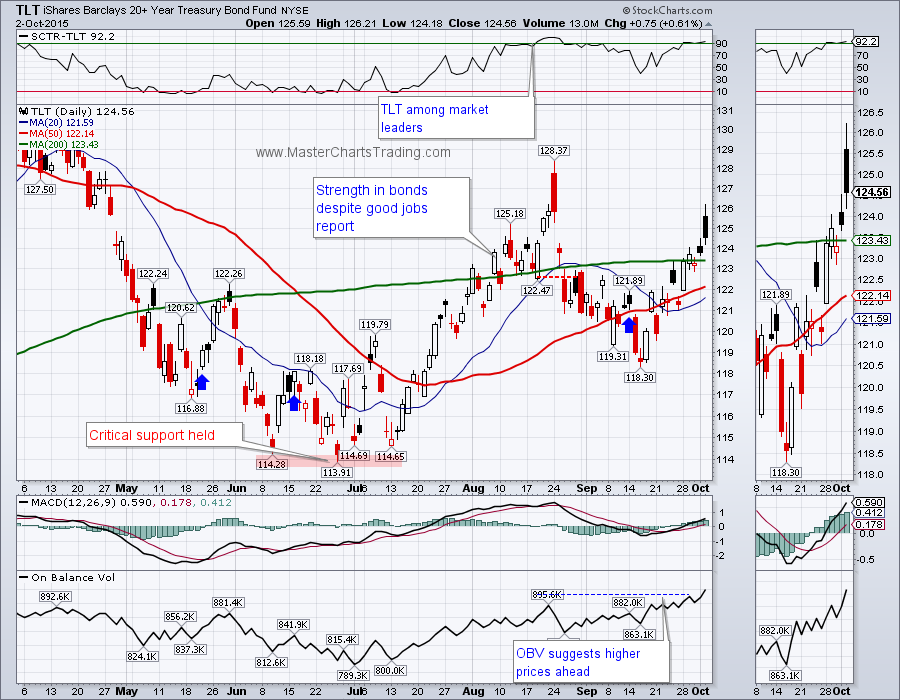

Chart of TLT

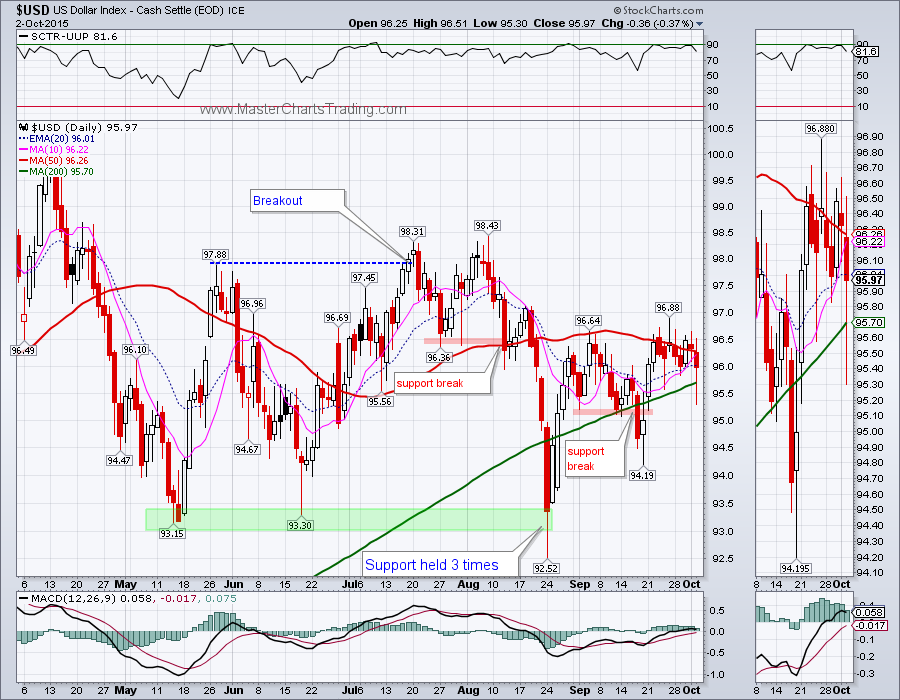

Chart of dollar index

Chart of gold

Chart of GDX

Chart of $NATGAS

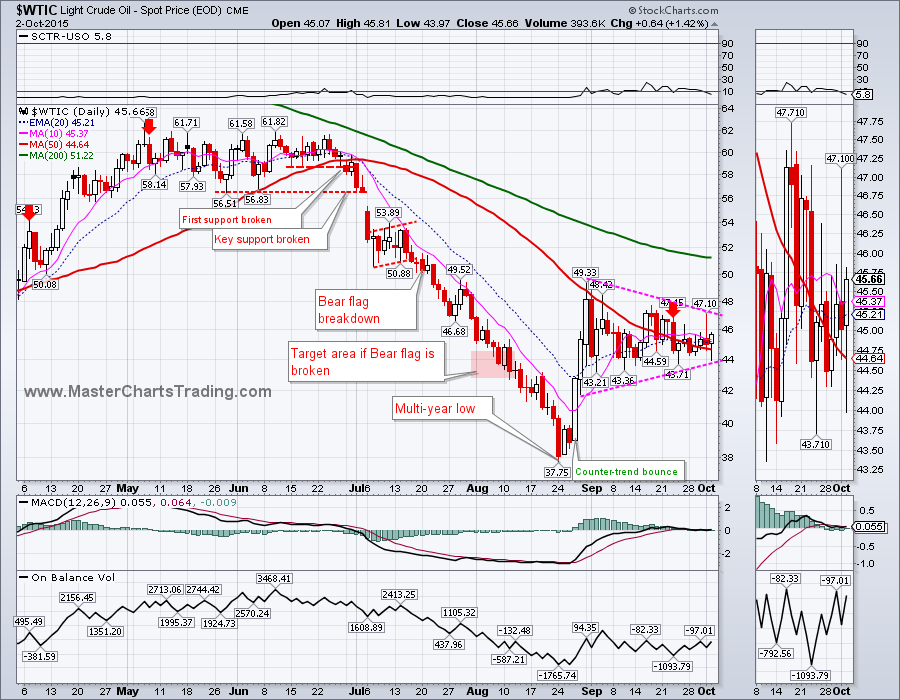

Chart of $WTIC.

Best Regards and have another great trading week!

** Special Announcement**

We are close (hopefully October 10th) to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discoun

ted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed