|

** Special Announcement** Trade Alerts Service is now live! Please sign-up for it here. A tough week for those playing the downside in the stock market. S&P 500 ($SPX, SPY) was up over 3% for the week on improving breath. Currently stocks are overbought and I still think $SPX is now in a long-term downtrend. If this is indeed the case, then we have a short setup in stocks right now. Chart of SPY |

|

Chart of $SPX

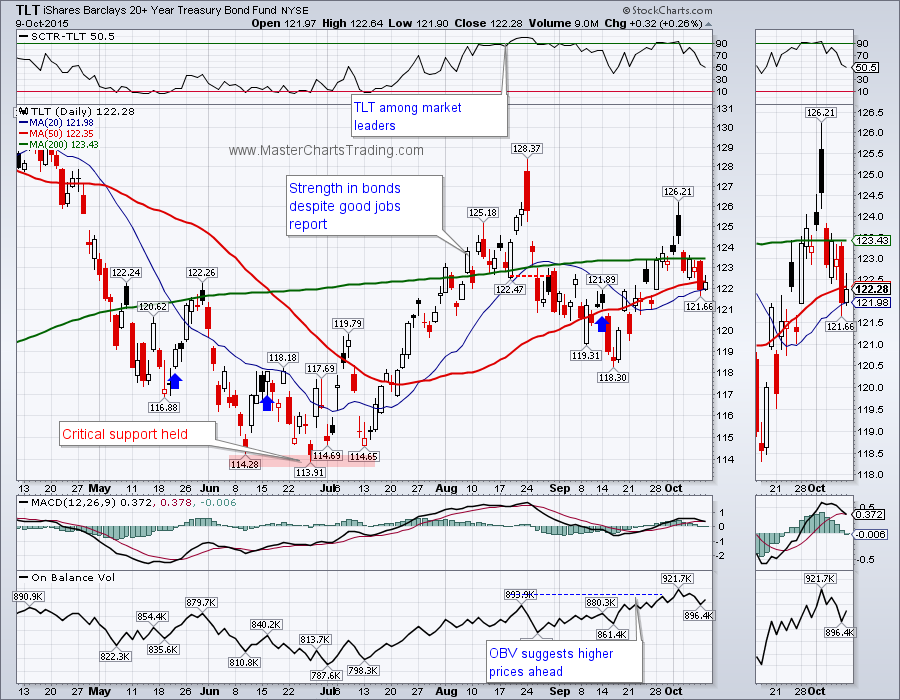

Chart of TLT

Chart of gold

- GDX broke out above mid-August highs

- On-Balance volume is showing a bullish divergence going all the way back to July

- The Bullish percent index ($BPGDM) is currently at 30% after it bottomed out at zero a few weeks ago. Back in the beginning of the year $BPGDM topped out at 50%, so we have some room to run to the upside

- GDX is long-term bearish, so overbought readings (like right now should be shorted

- Advance-Decline (AD) and AD-Volume lines did not brake out above mid-August highs while price did – this is a bearish divergence

Chart of GDX

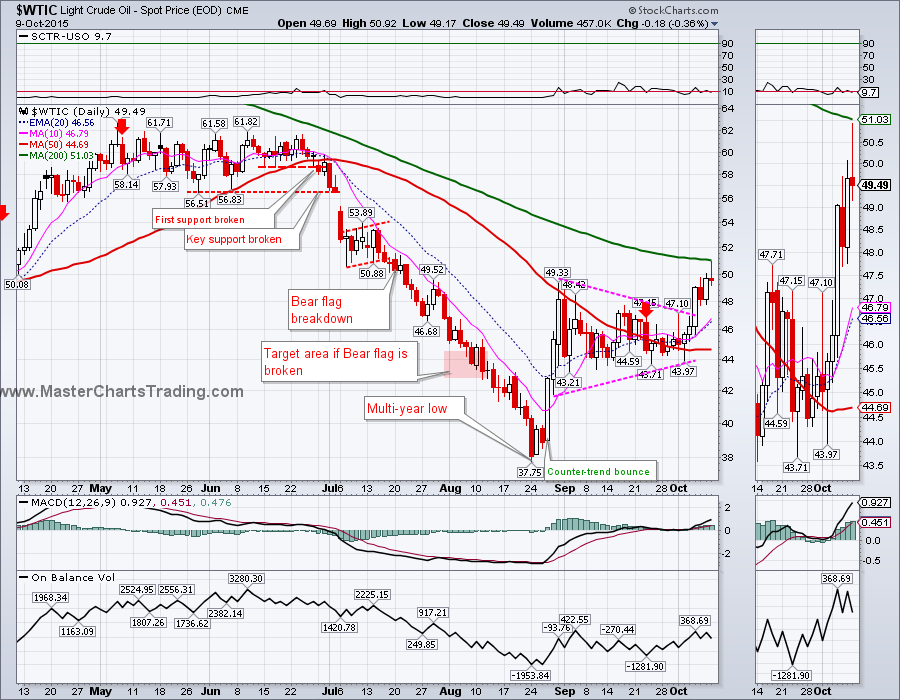

Chart of $WTIC Oil

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed