|

Watch this week's video here https://youtu.be/jgoa2WxhScI

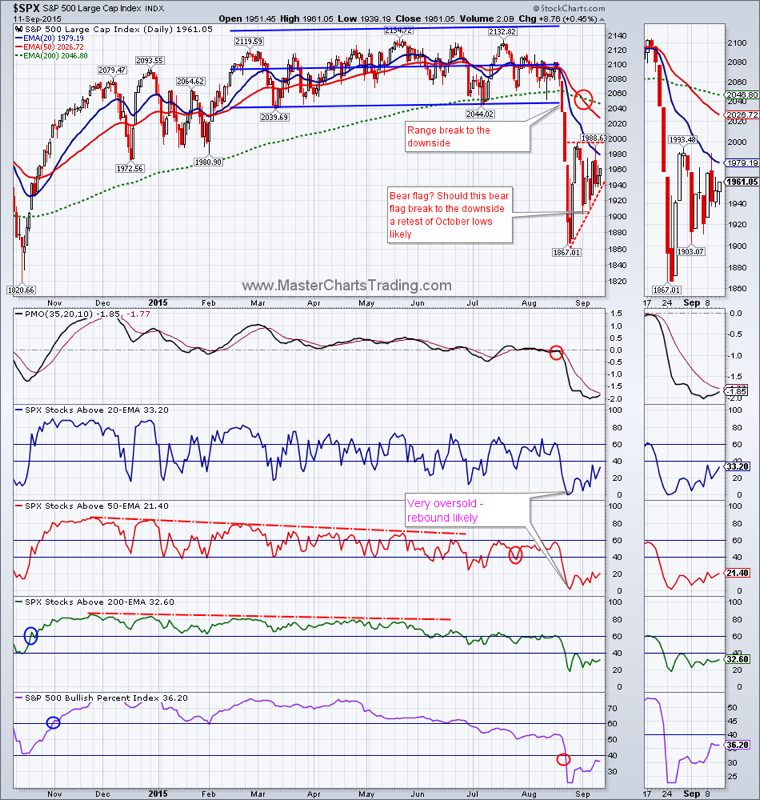

Not much has changed in the markets from the newsletter and video published 2 weeks ago. $SPX attempted to rally on Wednesday, but was turned back decisively by the bears at the 20-day moving average (MA). If we look on the chart of $SPX, one could argue that a Bear Flag of sorts is being traced out. Should this Bear Flag break down, a re-test of October lows is almost certainly possible. Bearish evidence continues to mount: the 50-day MA is now below the 200-day MA on the charts of $SPX, $COMPQ and $NYA. Pretty much every single market breadth indicator I follow is in the bearish territory. Of the major stock indices, QQQ is one of the few holdouts, since its 50-day is still above the 200-day. Charts of major indices here |

|

TLT chart here

GDX fared much worse then gold itself. In late August GDX failed to close above the 50-day moving average and collapsed back down to support at around $13. Back in late August I mentioned that, as with gold, I was not yet ready to short and wanted to see more upside. This may not happen, especially if Monday GDX falls through the support at $13. For now, I am keeping an open mind about a possibility of a rally in GDX. Market breadth for GDX hit new lows on Thursday as AD-Lines broke through prior support levels.

Gold charts here

Chart of copper

That’s it for this week’s market recap,

Best Regards and have another great trading week!

** Special Announcement**

We are close (hopefully October 1st) to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed