|

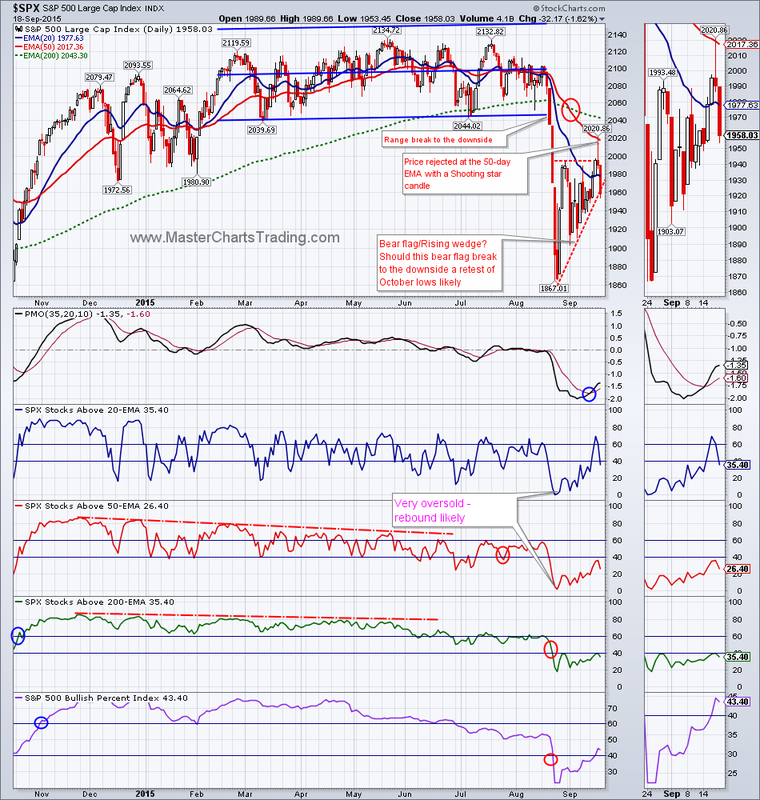

Following a support break in mid-August, the S&P 500 ($SPX) bottomed out in late August at 1867.01. It then went on to rebound over 8% to the high for the move set this Thursday at 2020.86. The Fed’s decision caused significant selling to take place and Thursday’s candlestick print was a classic Shooting Star – prices spiked intraday only to sell off and finish below the opening by the close. The Shooting star was later confirmed on Friday with more selling. We may now possibly have a rising wedge/bear flag break on the chart of $SPX. Should this break be confirmed, $SPX is likely to retest the October lows again.

Live chart of S&P 500 |

|

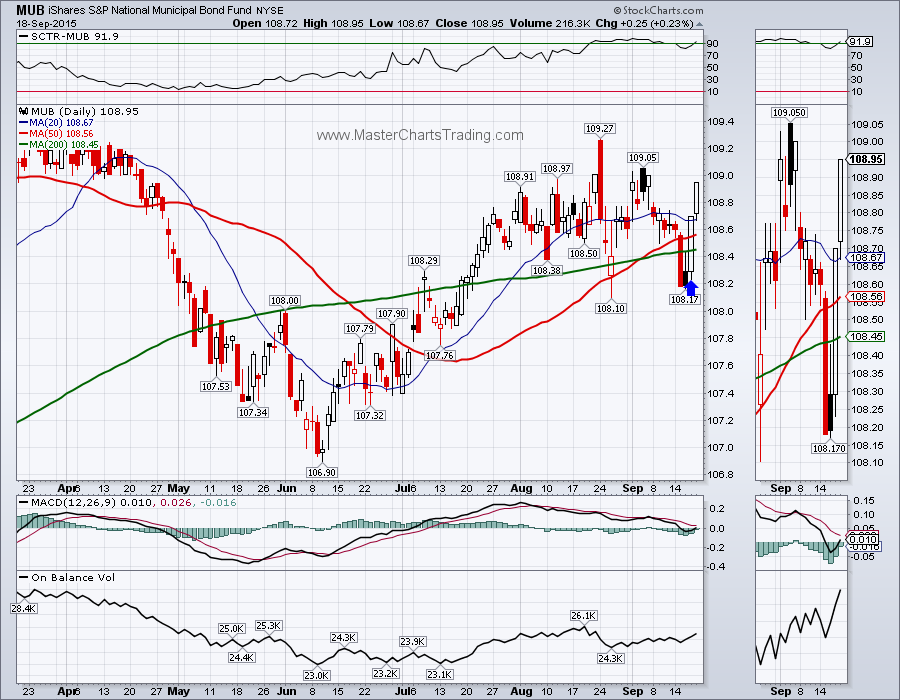

Charts of TLT, AGG and MUB

Charts of gold and precious metals

GDX followed suit, and rebounded strongly from support at $13. GDX managed to close above the 50-day moving average – a feat it wasn’t able to achieve since early June. This a positive sign for GDX bulls. On-Balance volume indicator is showing a bullish divergence - GDX traded flat, while the On-Balance volume made a higher low over the past couple of month. Similarly, the Bullish Percent index also is bouncing from extremely oversold level of zero. As with gold, GDX is in a long-term downtrend, but is currently in a middle of a counter-trend bounce.

Chart of GDX here

Best Regards and have another great trading week!

** Special Announcement**

We are close (hopefully October 10th) to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed