|

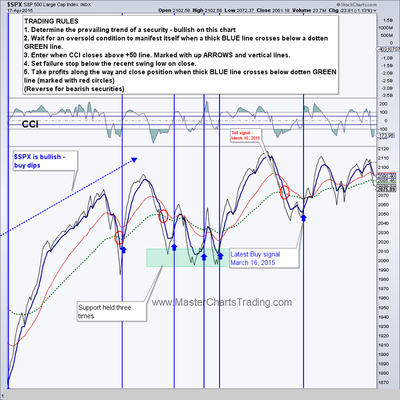

It was a rather uneventful week until Friday. Stocks meandered Monday through Thursday then sank on Friday. All major indices and most sectors were down for the week. In the bigger context of the uptrends in stocks, this week probably won’t matter that much. Just more chopping around without a clear breakout or a breakdown. QQQ and the Technology ETF – XLK were the leaders to the downside this week. XLK actually generated a sell signal less then a week after generating a buy signal. Charts of $SPX and QQQ here

|

|

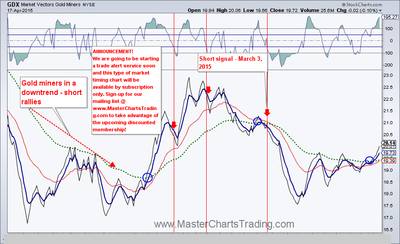

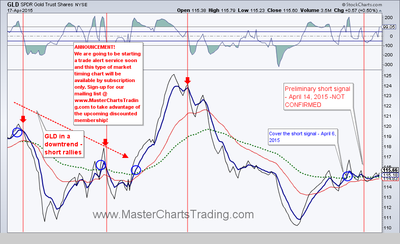

GDX did manage to close above the 50-day exponential moving average (EMA) and held support at around 19.55. If you are a gold bull then the next step is to hope for GDX to push above the gap-down resistance from early March in the $20 area.

Gold and gold miners charts located here

No doubt XLE’s stellar run was due to a strong rebound in oil. West Texas Intermediate ($WTIC) gained over 30% since its low in mid-March. On Wednesday $WTIC closed above the resistance levels dating back to February. Again, oil is long-term bearish and already may be overbought at these levels. I am waiting for a good set-up to short both oil and XLE.

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

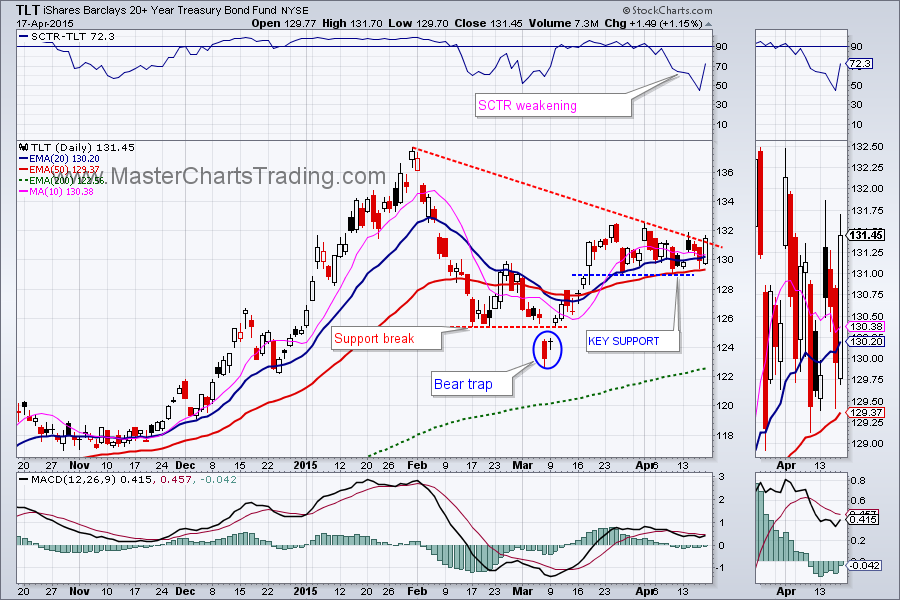

Open positions: SPY, LULU, TLT

New position:

Closed position:

RSS Feed

RSS Feed