|

Friday, April 24, 2015 Weekly Market Recap.

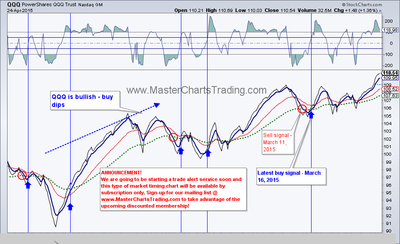

Major indices hit new 52-week highs this week on the heels of strong earnings, especially in the tech sector. QQQ gapped up on Friday and continued higher – a sure sign of strength. There is broad strength within the stock markets. Breadth indicators such as the AD Lines, New-Highs New-Lows indices and Breadth Momentum Oscillators are confirming the new highs. Charts of SPX and QQQ here. |

|

Interest rate-sensitive Home Construction ETF - ITB corrected steeply following the drop in bond prices. ITB has been one of the market leaders, but is now relatively underperforming along with bonds.

We opened a speculative position in one of the momentum names –Electronic Arts (EA) several days ago. So far the trade is working in our favor and EA hit a new high yesterday. EA reports on May 5th and we plan on at least booking profits by then – no need to risk a disappointing report.

Gold miners (GDX) and especially the Junior Gold miners (GDXJ) followed gold lower. There is now a rising wedge chart pattern on the GDX chart. If this pattern is broken it could take GDX down to December lows (or lower). We opened a position in JDST (inverse 3x ETF of Junior Gold miners) to play this swing down in gold and gold miners.

Gold and miners charts are here

In my one of my previous recent posts ( http://www.masterchartstrading.com/blog/short-signal-on-energy-xle1 ) I highlighted a short signal on the Energy fund – XLE. The bearish divergences within XLE continue and we may be getting a bearish breadth thrust shortly. Could the move in XLE precede the move in oil itself?

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: SPY, LULU

New position: EA, JDST

Closed position: TLT

RSS Feed

RSS Feed