|

This week the S&P 500 and other major indices tested and held their first supports. $SPX is up a fraction of a percent. $SPX dropped below our stop-loss on Tuesday, but buying was already evident on Wednesday. By end of day on Wednesday $SPX printed a hammer-like candlestick. Next day a powerful rally confirmed that the support held for now. Charts of SPX, QQQ and IWM here

|

|

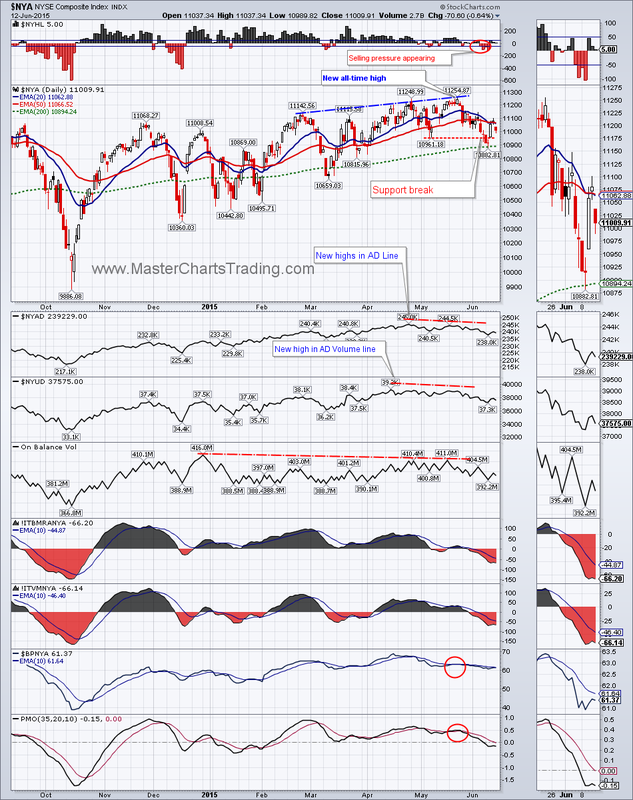

We may be seeing some weakness underneath the surface in the markets, however, especially in the large-cap universe. I highlighted the ongoing divergence in the On-Balance Volume for $SPX for past few weeks. Now we can add a divergence in the AD-Line for $SPX to the list of (mild) concerns. The AD-Line broke below the low from March 11 this Tuesday while the index itself made a higher low. Bearish divergences at all-time highs are generally not a good sign.

NYA chart here

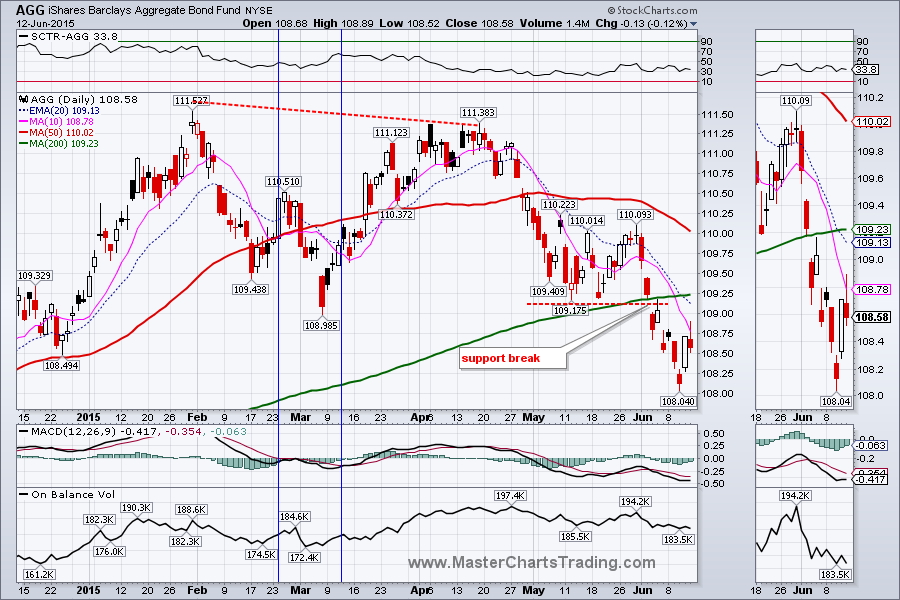

AGG chart

GDX, the gold miners ETF, is acting considerably weaker then gold. Could it be the leading indicator? GDX lost almost 1.5% for the week and broke yet another rising wedge formation on Thursday of this week. More telling, however is the fact that the Advance-Decline lines for GDX hit new lows on Friday, while GDX itself is still about 12% away from its 52-week lows set in November.

Gold charts here

XLE Chart here

That is the reason I spend a lot of time and effort first determining what is a major, primary trend of a stock. If it is up, I will ignore all bearish setups and only trade on the long side. If the trend is down, I will ignore all bullish setups and trade only on the short side. Sure, you will miss some bear market rallies and an occasional breakout in stock. But going with a trend is like floating down the river instead of trying to fight the current – it is just easier.

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed