|

The S&P 500 ended the week on a rather weak note, closing below the 50-day moving average. MACD indicator for $SPX is also very close to a centerline crossover. The ITBM (breadth momentum oscillator) is also in the negative territory and still falling. Could more downside be in the cards for $SPX? It is certainly a possibility. Chart of S&P500

|

|

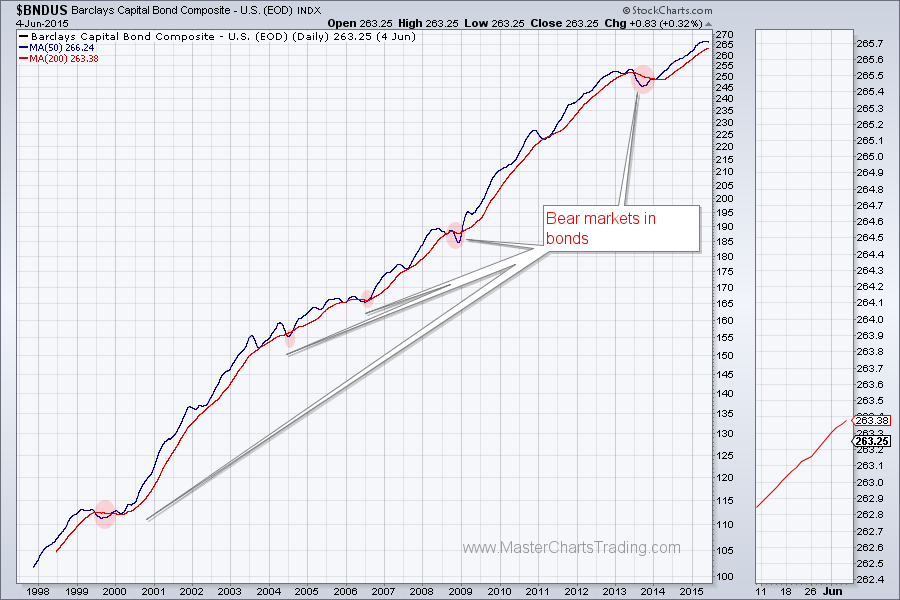

There were 5 instances on this chart when the 50-day was below the 200-day. As one can see the bear markets were relatively brief and associated with only minor price drops. Currently, the 50-day moving average is still above the 200-day moving average on this chart. To me this indicates that bonds are still in a bull market.

Live Gold chart here

That’s it for this week’s market recap,

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed