|

Friday, May 15th, 2015 Weekly Market Recap.

The S&P 500 hit an all-time closing high on Friday and is just a few points away from hitting an all-time high. This reaffirms our assumption that the stock market is bullish. Both QQQ and IWM hit all-time highs in late April, but since pulled back. Charts of S&P and other major indices |

|

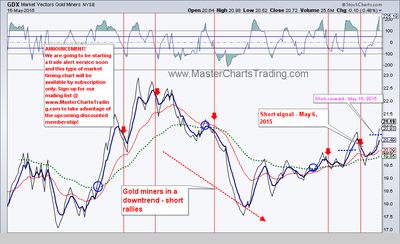

Breakdown in GDX clearly did not materialize and the security rebounded to the top of the Raff regression channel and challenged the overhead 200-day moving average at around $21. Again, GDX is in a long-term downtrend, but may be showing signs of life as some new 52-week highs were registered for some stocks within the index.

Newmont mining (NEM) is one of those stocks. NEM is showing surprising strength. Its technical rank (SCTR) is now at a very strong 99 – right up there with biotech and Chinese stocks. It also hit a 52-week high. Newmont Mining is now on my list of stocks to buy on a pullback.

Gold, gold mining and Newmont Mining charts located here

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

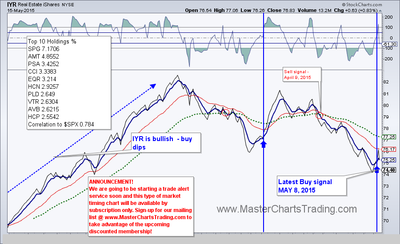

Open positions: IBB, XSD, IWM, IYR, LULU

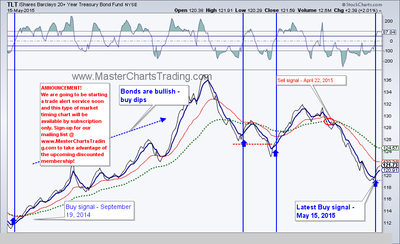

New position: TAN, TLT

Closed position: DUST

RSS Feed

RSS Feed