|

Friday, May 1st, 2015 Weekly Market Recap.

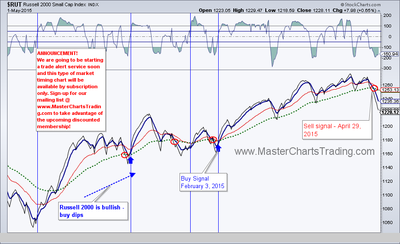

S&P 500 retested support in the 2070 area and held it for now. The buyers stepped in on Friday and pushed $SPX right back above the 50-day and the 10-day moving averages. So far no sell signal generated on the $SPX per our trading system. Charts for SPX and IWM here. |

|

Market breadth has deteriorated somewhat especially in the small cap universe. Breadth Momentum Oscillators has rolled over below their 10-day exponential moving averages. In the past it meant less upside potential and maybe even more downside potential. Market breadth is kind of like a wind when sailing – it’s always better to have it at your back.

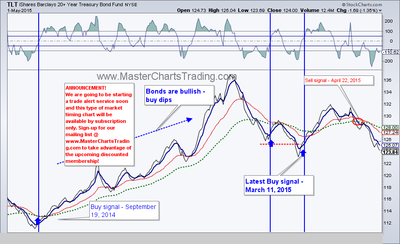

Treasury bonds (TLT) were off another 3.73% this week. On Thursday it looked like bond bulls were going to make a stand and TLT was going rally. Yet Friday TLT closed below the support level from February. Unless it rallies from here, the next stop for TLT might be the 200-day moving average, currently around 122.

GDX may be drawing out what appears to be a rising wedge formation. A break below the lower line of the wedge may call for a retest of December lows. For now GDX is rapidly coming up on a major resistance zone defined by the 200-day moving average and the peak from February - around $21.50.

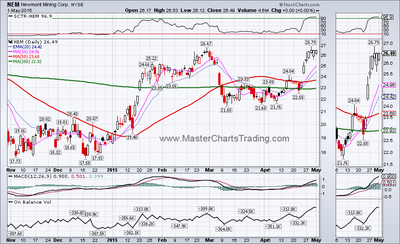

It’s always a good idea to be cognizant of the opposing view. To that degree I question myself to see if my assumption about a stock is correct. In other words - what if I am wrong? One of the stronger stocks in the gold mining complex Newmont Mining (NEM) became an outright market leader this week. Its SCTR (Stockcharts technical rank) is now above 90, which means it’s in the top 10 percent of all large cap stocks. This shows that money may be rotating into the gold and the natural resources sectors again.

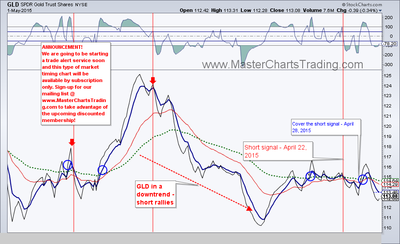

Gold and gold miners charts are located here

Natural gas ($NATGAS) may have put in a double bottom. It rebounded from the low of $2.48 on Monday and closed above the 50-day moving average for the second day in a row on Friday. A quick move below the 50-day moving average next week would reaffirm the longer-term downtrend in gas. Again, I would be looking for shorting opportunities until proven otherwise especially should the dollar rally.

Commodities charts located here

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: SPY, LULU, EA (took profits)

New position:

Closed position: JDST

RSS Feed

RSS Feed