|

Friday, May 22nd, 2015 Weekly Market Recap.

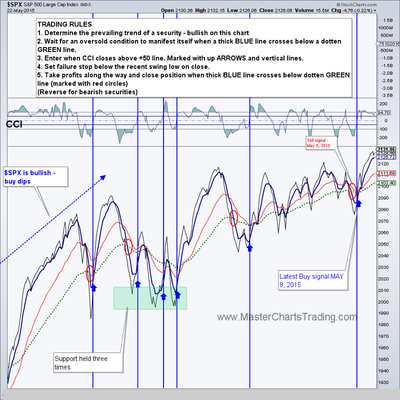

The S&P 500 index hit an intraday all-time high on Wednesday and an all-time closing high on Thursday. The NASDAQ 100 ETF – QQQ, hit an all time high back in April, corrected into May and hit another all-time closing high on Thursday. This again reaffirms that stocks are still very much bullish. Market breadth is uninspiring, but is on the upswing - consistent with a slow grind higher vs. a melt-up in prices. The Advance-Decline line for $SPX hit an all-time high this week. I wrote about a divergence between the AD-line and price of $SPX for past few weeks. This seems to have resolved in the bullish direction. Charts for S&P 500, QQQ |

|

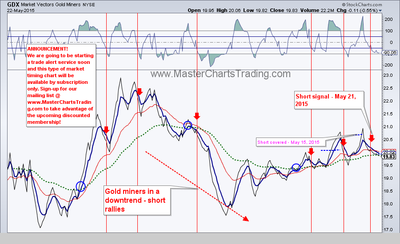

Gold charts

UNG candlestick chart and market timing chart

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: IBB, XSD, IWM, IYR, LULU, TLT

New position: DUST

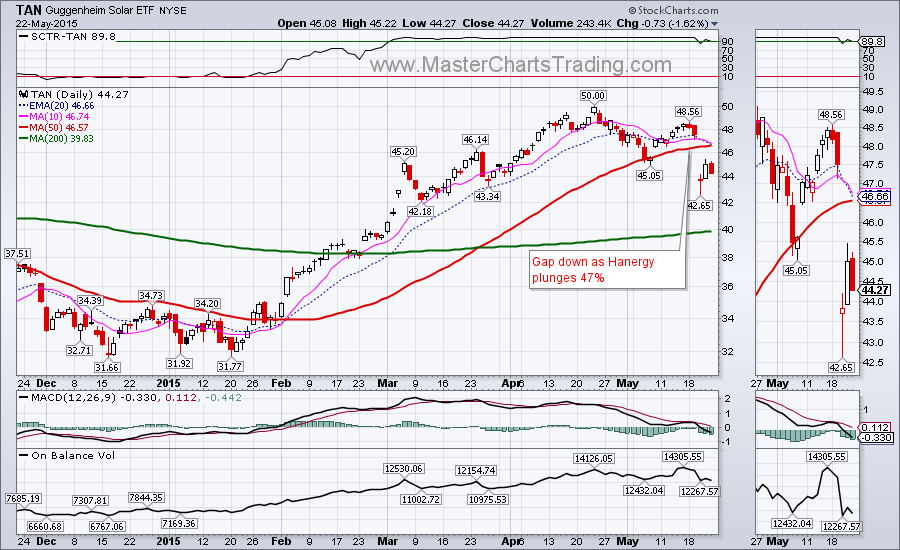

Closed position: TAN

RSS Feed

RSS Feed