Weekly Market Recap Video Recap

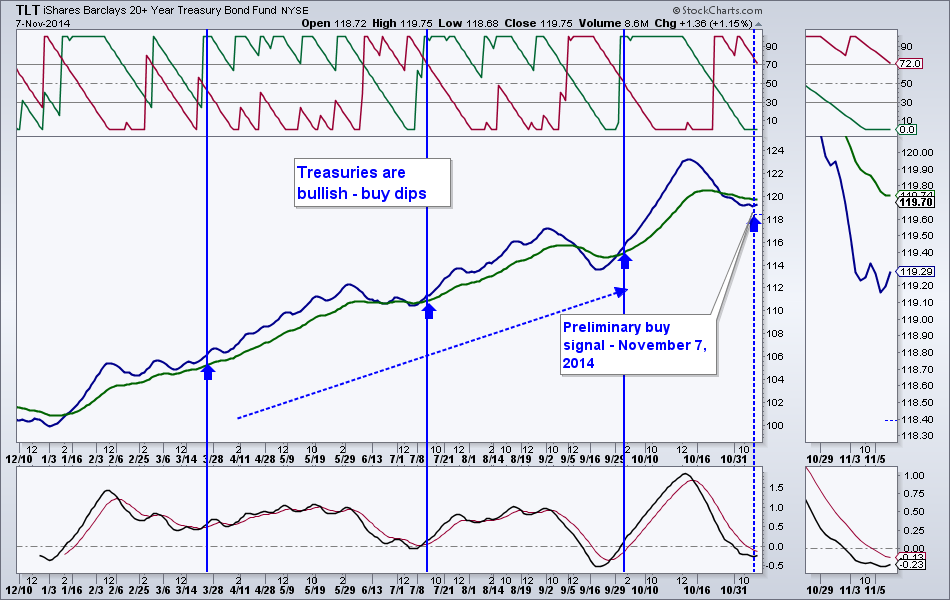

The Friday employment report was met with little enthusiasm by stock traders. Needless to say it was a very positive report: non-farm employment rose by 214,000, while the unemployment rate ticked down to 5.8%! Yet I did not observe a strong push higher by the stocks. Instead I saw a strong push higher by the bonds, indicating more fear and uncertainty.

Best Regards,

Alexander Berger (www.MasterChartsTrading.com)

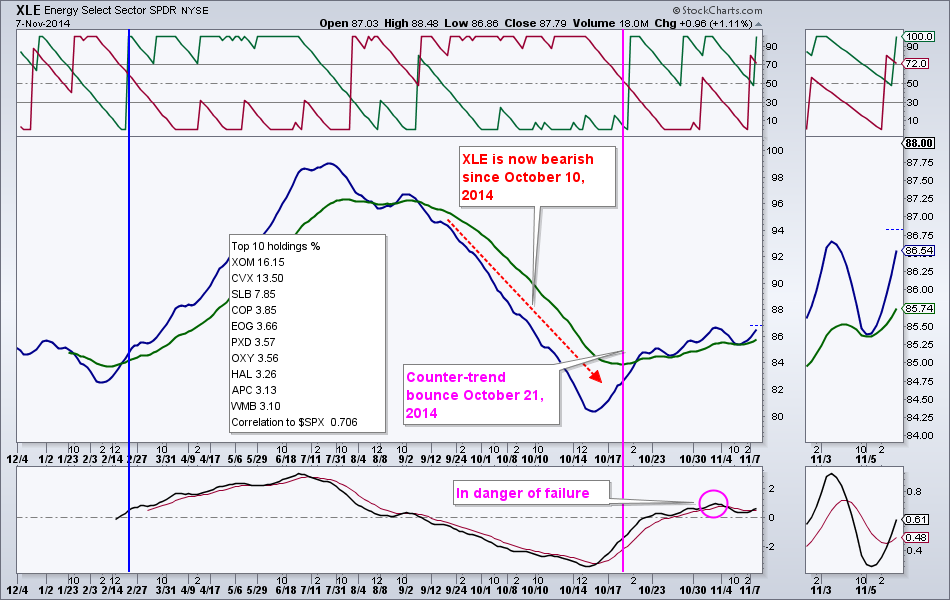

Disclaimer we have open positions in: SPY, AGG, TLT and XLE.

RSS Feed

RSS Feed