|

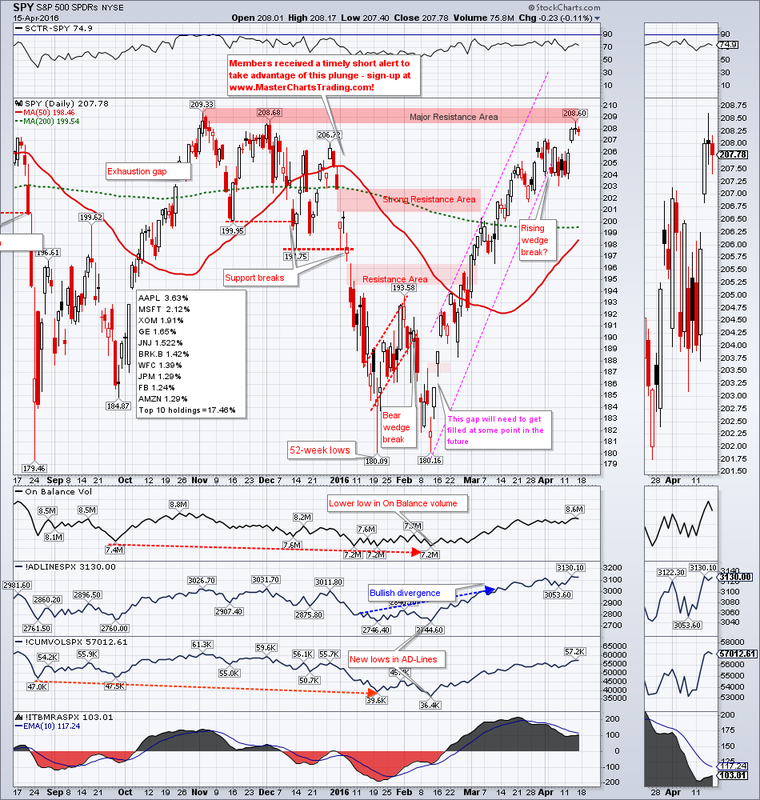

Another tough week for the bears. Stocks gapped-up on Wednesday above the recent highs. SPY hit the high for the move on Thursday, and touched a major resistance in the 208-209 area. Bulls, especially those that bought back in February, are probably feeling very good right now since they are sitting on an about 15% gain. Could we gap above this resistance and simply make another all-time high? Absolutely! But after such a strong rally some sort of a retracement or a pullback is highly likely.

CHART OF SPY |

|

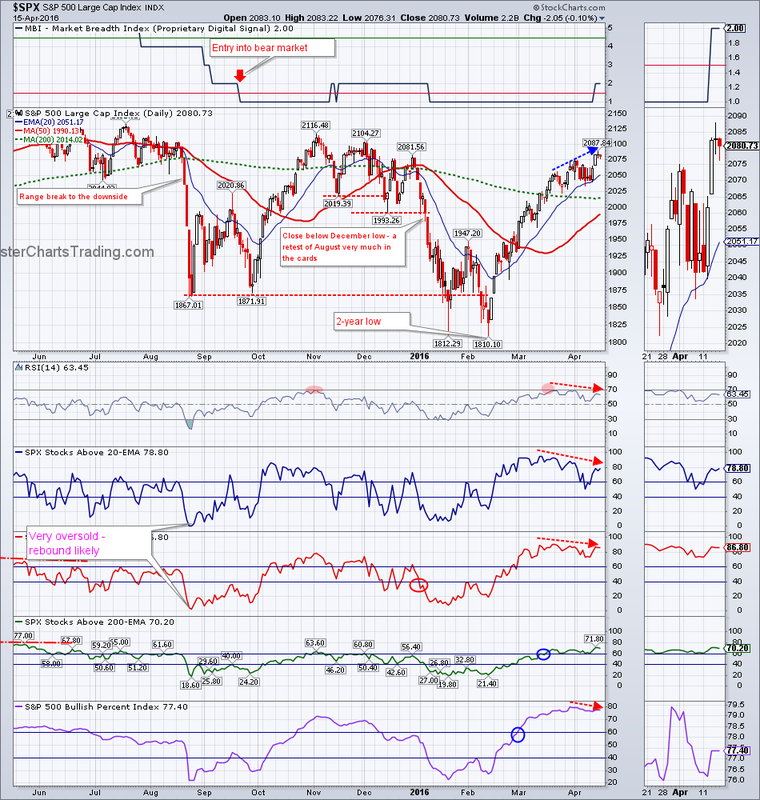

My long-term model stock market model (MBI) has flipped into the bear mode as early as September of last year and is yet to even begin improving. By extension I have a bearish outlook.

CHART OF $SPX

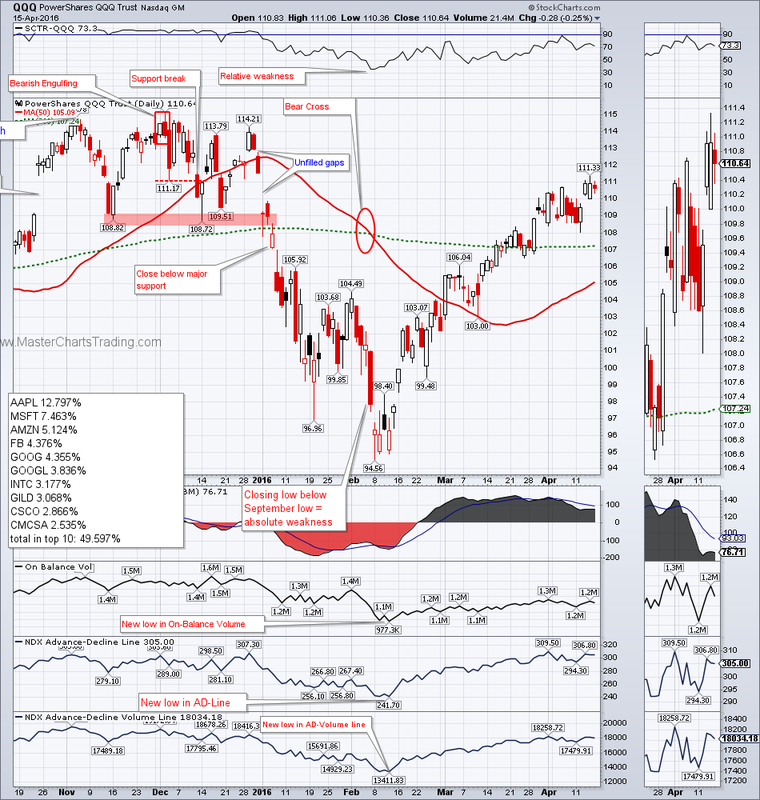

Similar divergences are appearing on the chart of NASDAQ 100.

CHART OF QQQ

CHART OF AAPL

TLT corrected from February all-time highs into March. It then held support at the 50-day moving average and bounced higher. There is now a very good chance that TLT will attempt to re-challenge the all-time highs again. This is indicative of risk aversion by investors.

CHART OF TLT

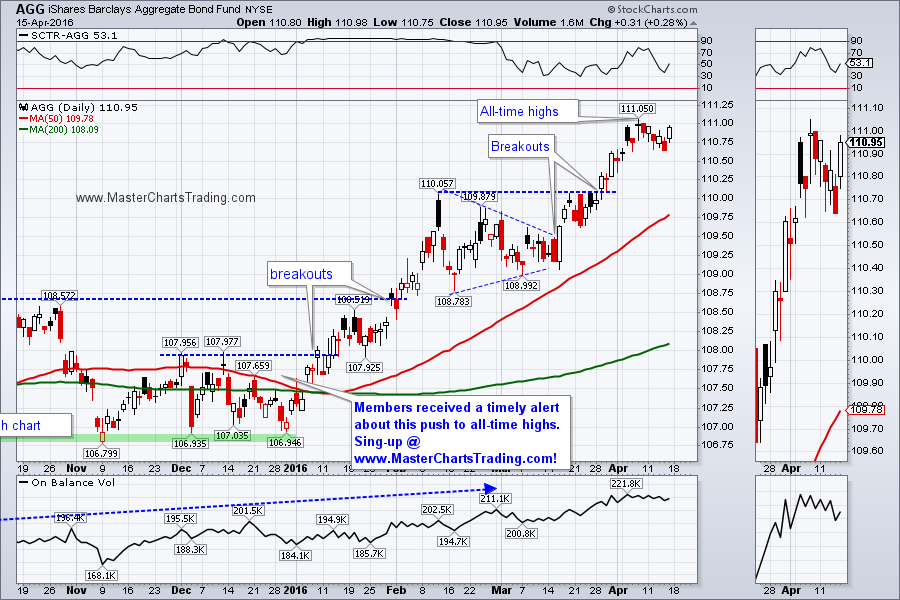

AGG is looking even more bullish as it consolidates near all-time highs.

CHART OF AGG.

Municipal bonds are acting even stronger as MUB hit an all-time high on Friday and then managed to close at an all-time closing high. This is very bullish and is showing strong buying interest and the presence of elevated levels of fear.

CHART OF MUB

CHART OF $USD

LONG-TERM CHART OF $USD

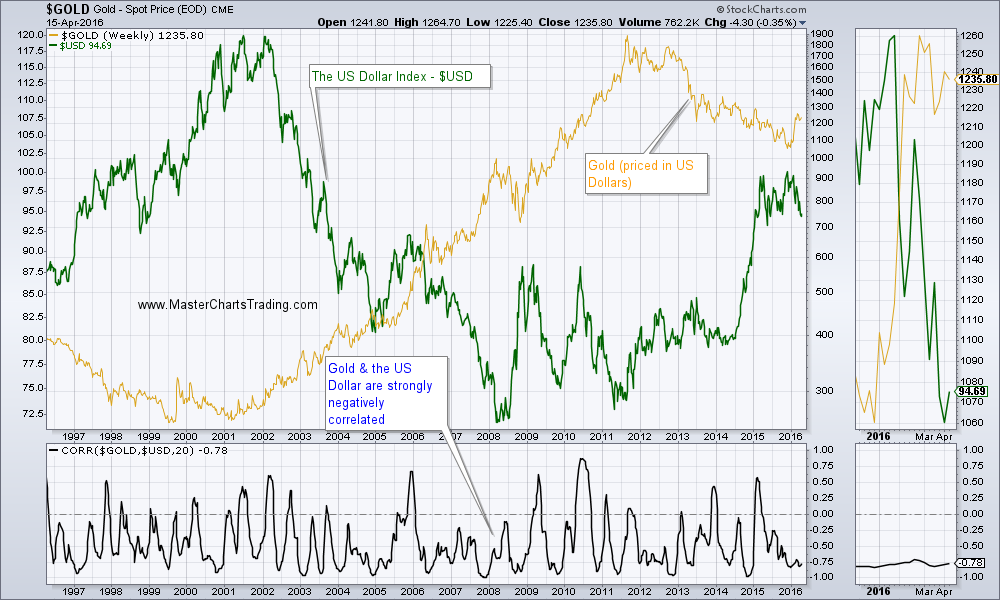

GOLD vs. US DOLLAR

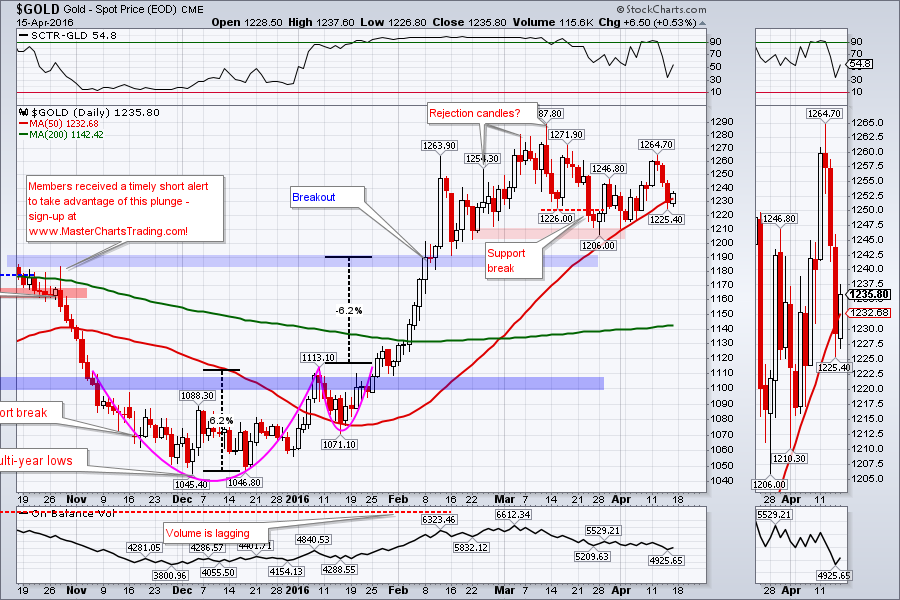

Few weeks ago I mentioned that my long-term gold model (GBI) has flipped into a bull market and I am now looking to buy gold and to trade it on the upside. However gold needs to correct quite a bit more for me to become interested opening a long. A retest of gold’s recent breakout could be upon us soon. $1191 is the level to watch.

GOLD CHART

As with gold, GDX is overextended to the upside, so a pullback may provide for an opportunity to partake in this new bull market.

CHART OF GDX

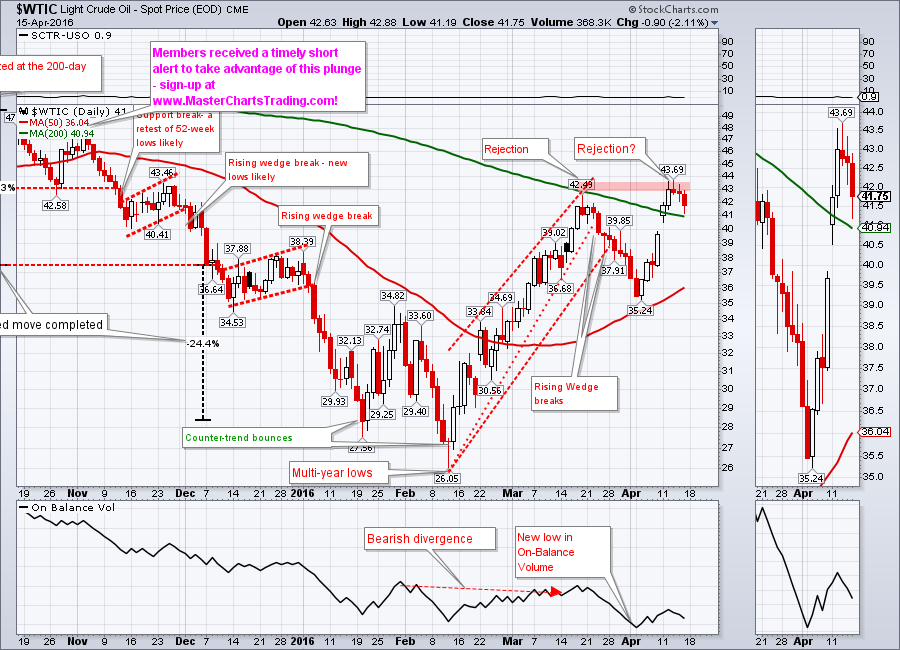

CHART OF $WTIC

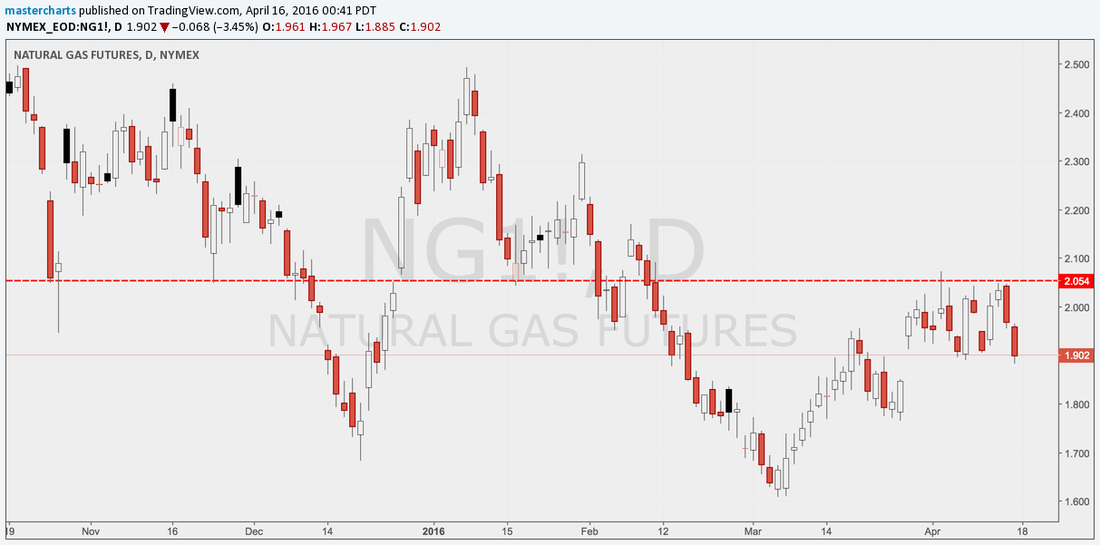

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed