|

Guest presentation by Dr. Marie Felberg, Psychologist/Life Coach starts at mark 25:55 on the video, click to play! -->

Big news of the week was a possible Rising Wedge break on the chart of S&P 500 ETF SPY. I still say “possible” because Mr. Market has a way to make the life hard for pretty much every participant out there. Maybe the wedge is broken and we now collapse back down to February lows. Maybe the opposite will happen and we will punch through resistance and make all-time highs. Or maybe something completely different will happen and we will meander sideways for month on end. CHART OF SPY |

|

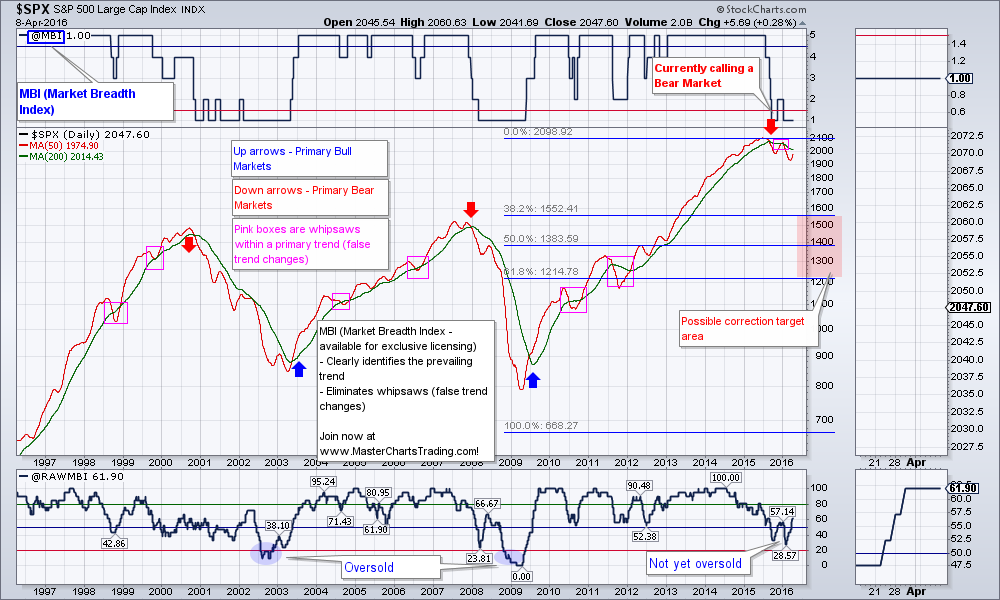

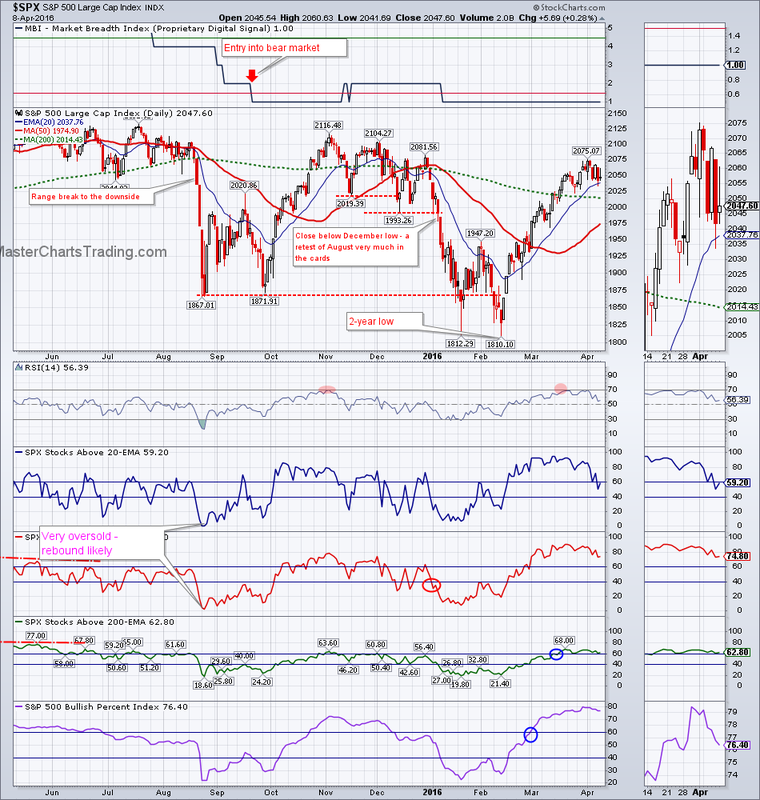

CHART OF $SPX

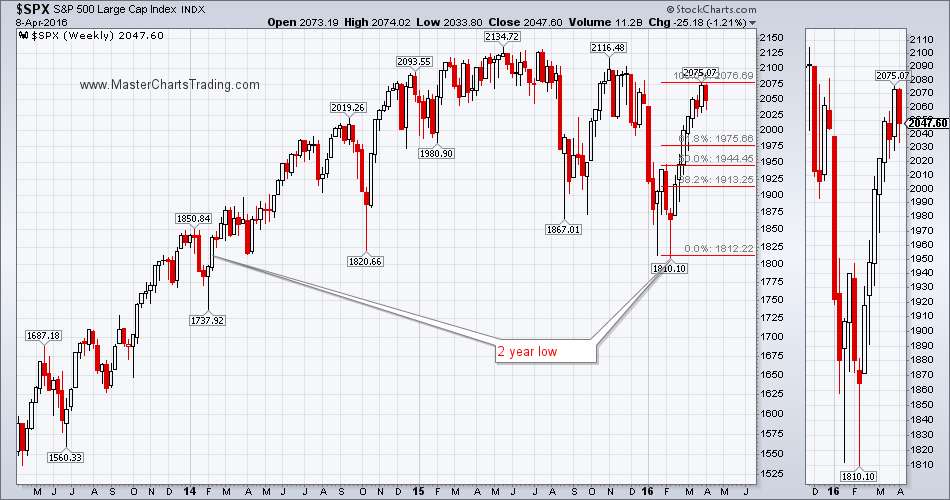

CHART OF $SPX with Fibonacci retracements

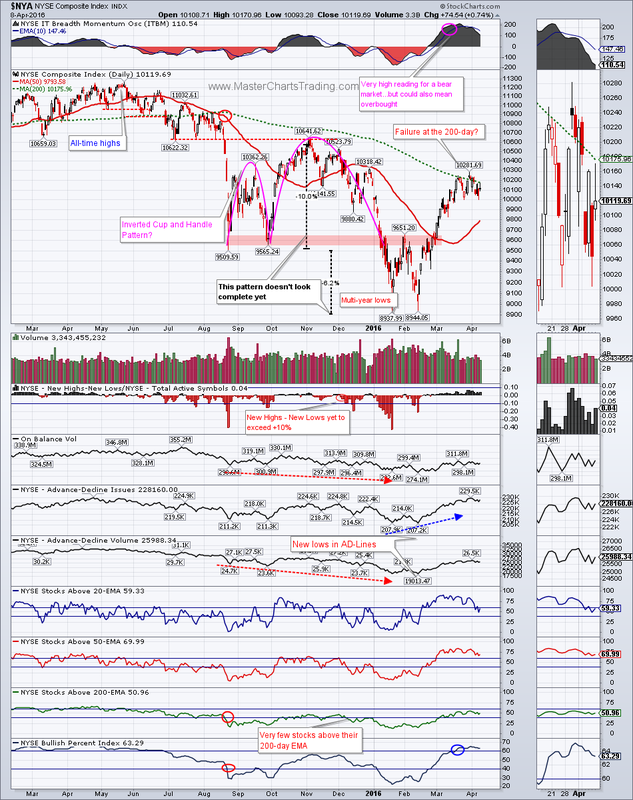

CHART OF $NYA

TLT broke out above the falling wedge in late March and continued up this week. It is now within a percentage point of its all-time highs.

CHART OF TLT

Long-term TLT chart may be showing a giant Cup and Handle formation spanning about a year. If I am correct and this indeed is a Cup and Handle, then a breakout above the lip of this cup could be massively bullish for bonds. We could see TLT appreciate by around 20%. If true, this will be quite bearish for stocks.

LONG-TERM TLT CHART

Similar patterns are present of the diversified bonds fund – AGG, however AGG already broke out to new all-time highs and just keeps going. As with TLT, AGG has a similar bullish-looking pattern on the long-term chart. This pattern is suggesting much higher prices ahead for AGG.

CHART OF AGG

LONG-TERM CHART OF AGG

CHART OF $USD

LONG-TERM CHART OF $USD

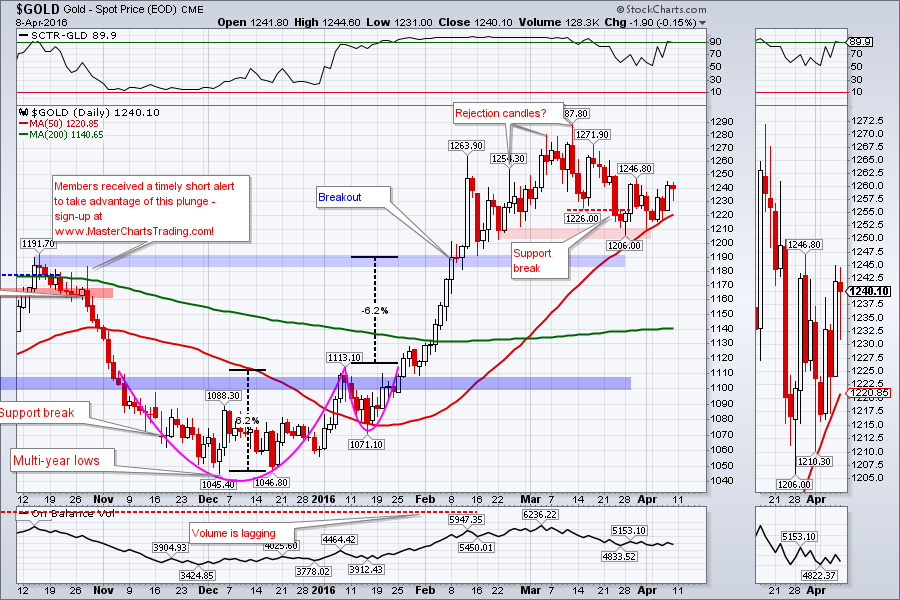

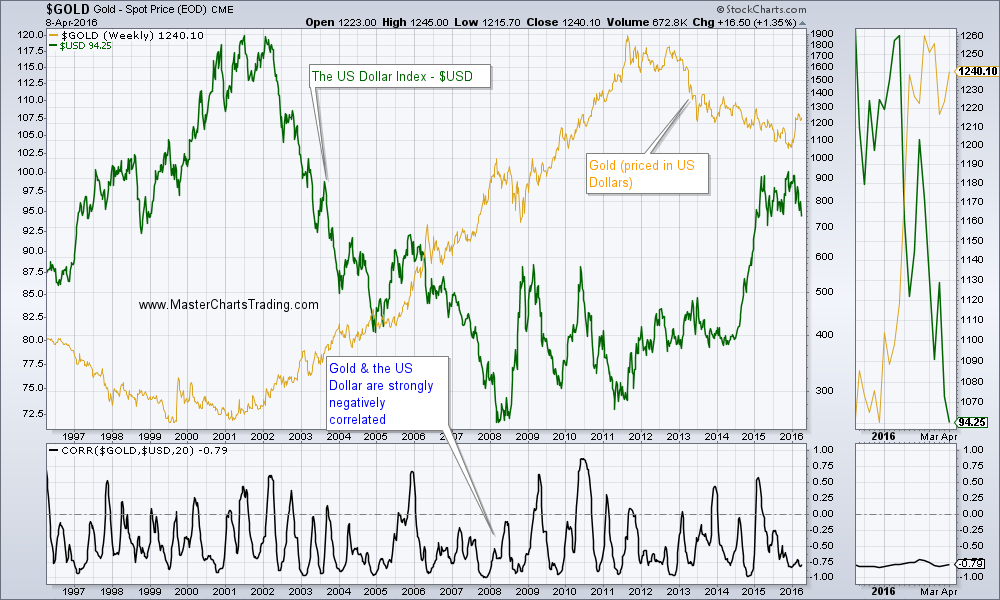

Few weeks ago I mentioned that my long-term gold model (GBI) has flipped into a bull market and I am now looking to buy gold and to trade it on the upside. However gold needs to correct quite a bit more for me to become interested opening a long. A retest of its recent breakout could be upon us soon. $1191 is the level to watch.

GOLD CHART

CHART OF GDX

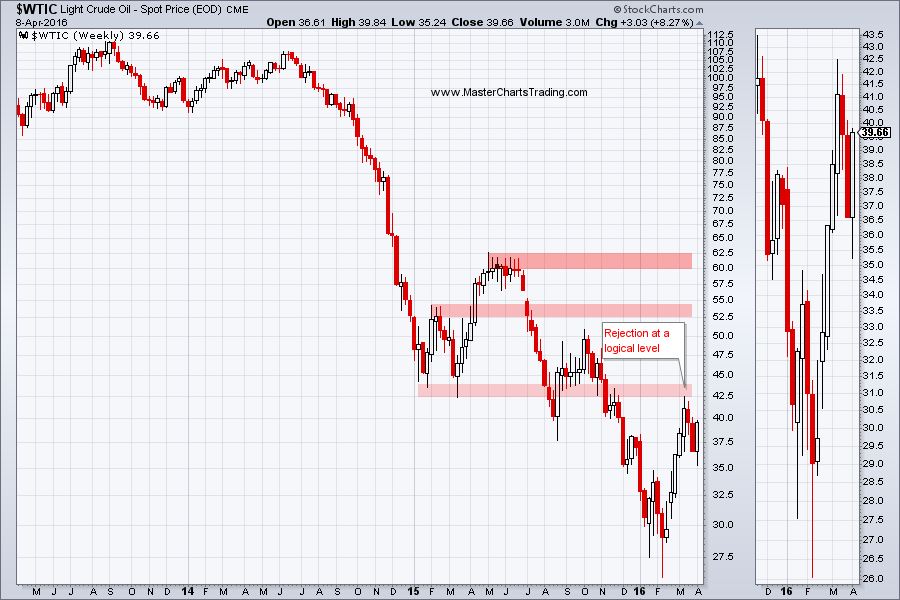

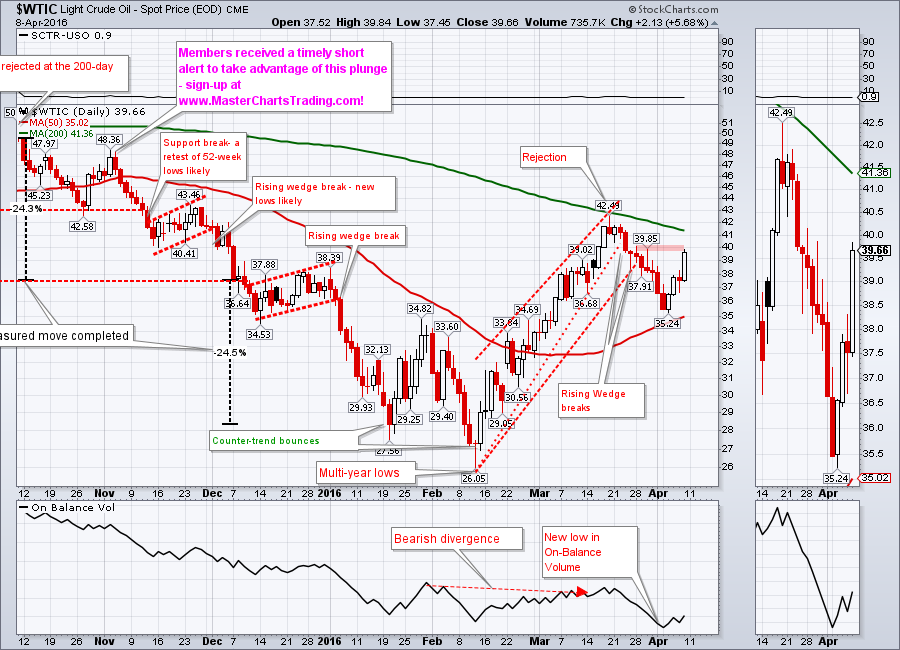

Long-term chart of oil shows rejection at a logical level of $42.50. This is the level where oil held support on two occasions in 2015, but ultimately broke it twice later same year.

CHART OF $WTIC

LONG-TERM CHART OF $WTIC

Significant resistance level lies about 5% higher at 2.17. Bears would most likely attempt to push the prices lower around there.

More significant resistance is around 2.315 and the very important one is at 2.50.

CHART OF NATGAS

Long-term picture hasn’t changed much, so I am quoting from last week. “The 2.50 level is of a particular importance because it is around there that NATGAS failed last September. It is also around 2.50 where the price was rejected in January. Currently there several bullish divergences present on the long-term chart of NATGAS (price made a lower low, but indicators made higher lows).”

LONG-TERM CHART OF NATGAS

by Dr. Marie Felberg, Psychologist/Life Coach -visit her site to get help with your trading performance today!

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed