|

Although the weekly losses for the S&P 500 ($SPX) was only 0.34%, the manner in which this loss occurred is indeed concerning if you are a stock bull. The past two weeks saw increased volatility in many asset classes due to the speeches by chairs of both the European Central Bank and the Federal Reserve. The initial reaction to Janet Yellen’s announcement of a ¼ percent interest rate rise was positive, but things completely fall apart by the end of the week. Chart of SPY now shows a confirmed Bearish Engulfing (Outside reversal) pattern. Friday’s close also put the ETF below its November low for the 2nd time this week.

CHART OF SPY |

|

CHART OF NYA

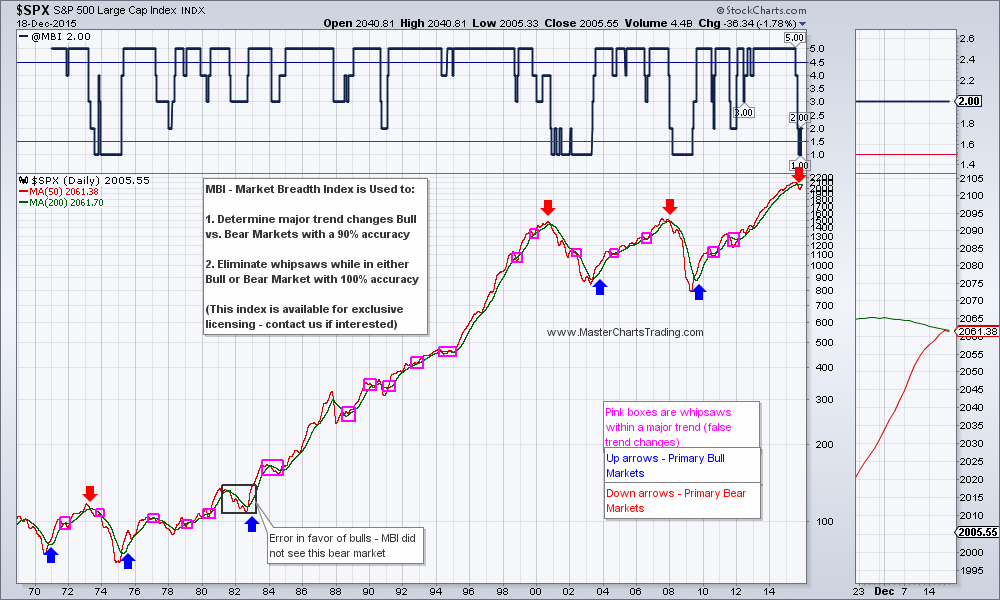

Our in-house Market Breadth Index (MBI) has been flashing Bear Market warning signs since mid-September. In our back testing going all the way to 1970, MBI was able to call 8 out of the 9 secular Bull and Bear market inflection points. What’s even more impressive is the fact that MBI would have also been able to eliminate the annoying whipsaws – false trend changes. (This index is available for exclusive licensing – contact us if interested.)

Based on the various momentum, market breadth and trend data series that I follow, the overall preponderance of evidence paints a picture of beginning stages of a bear market. So for now I am going to trust the data I am seeing and continue to look for shorting opportunities within the general stock market.

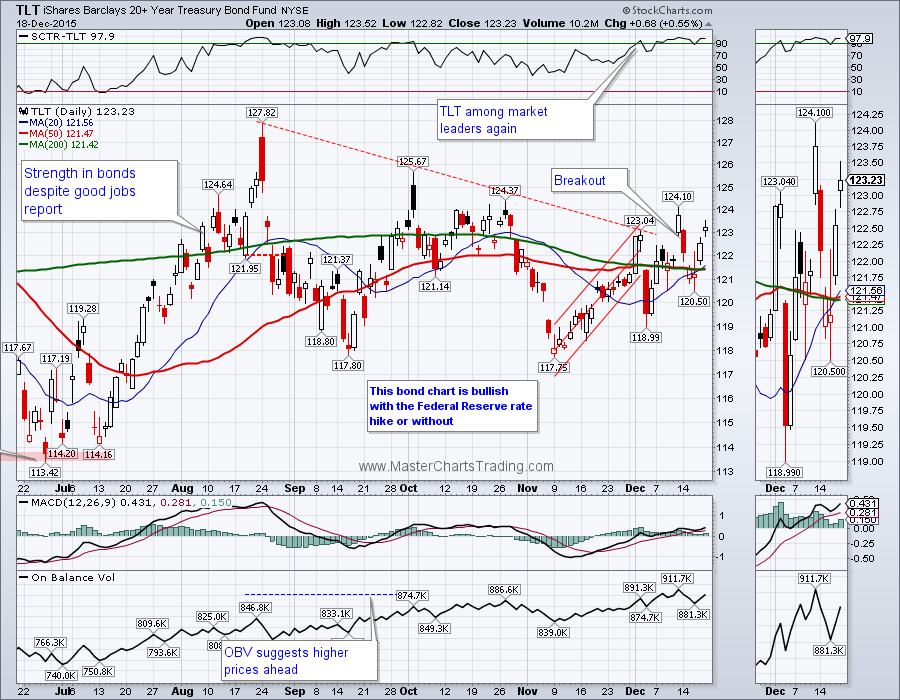

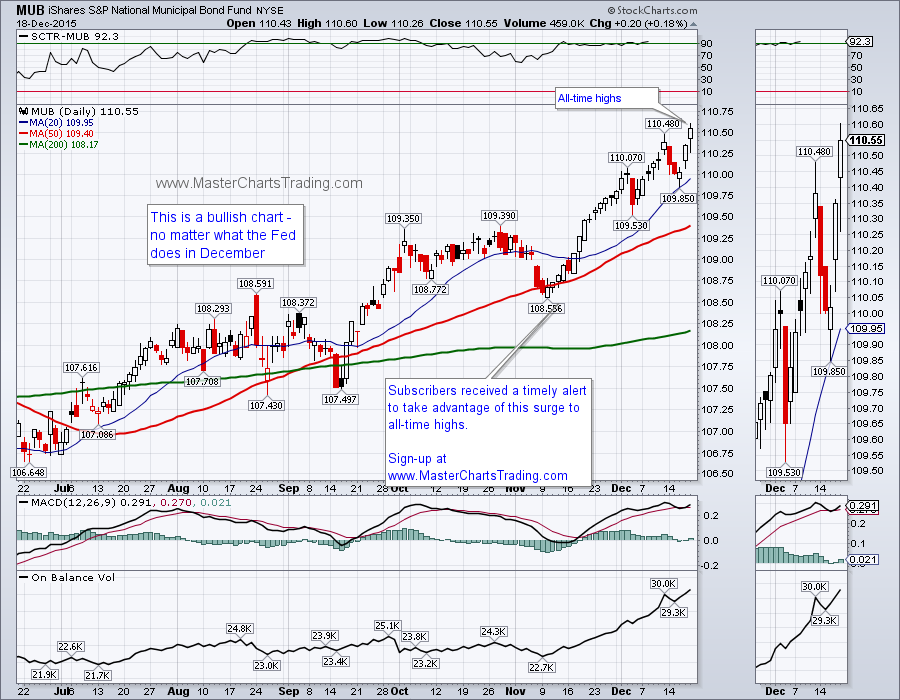

TLT CHART, MUB CHART

CHART OF $USD

- A rebound to around $1100-$1140, maybe even $1160 and a failure there.

- A drop below the recent lows and continuation to around $1000, or lower.

GOLD CHART

Gold miners (GDX) are again trading near the $13 magical area. This is perhaps the 8th time in the past 6 month that GDX attempts to break below this level, but keeps failing. Will this time be different? In the ideal world, I would like to see a rebound for GDX to around $15-16 for a good setup. If the dollar weakens, gold and GDX may rebound and provide for another shorting opportunity in the near future.

GDX CHART

CHART OF OIL, CHART OF XES

CHART OF $NATGAS, CHART OF FCG

Trade Alerts Service is now live – please sign-up here!

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed