|

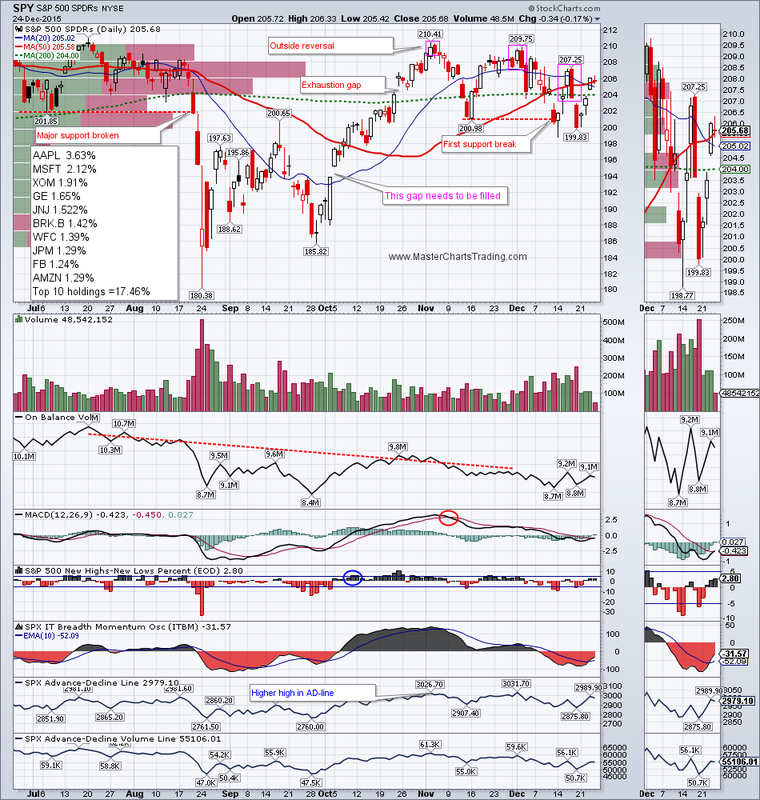

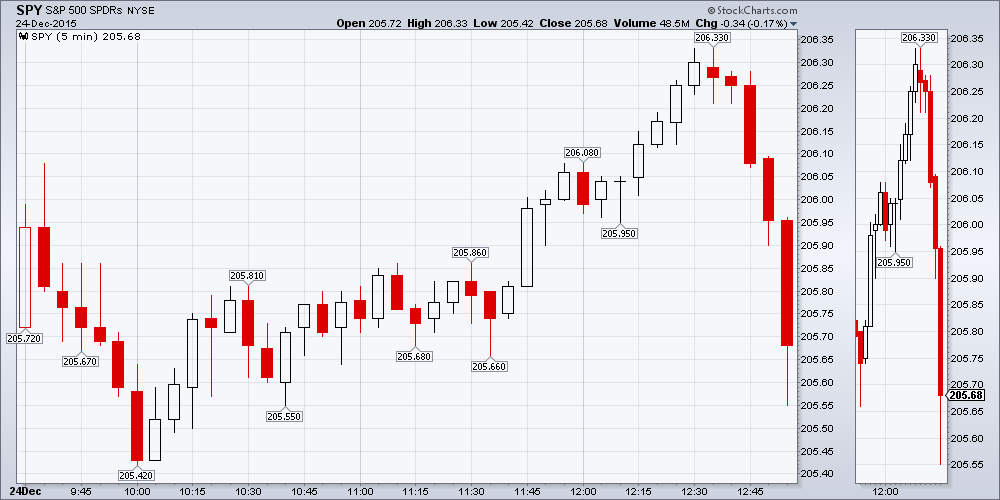

The bulls were able to make some progress during this short trading week. SPY gained almost 3% to close at $205.68. If you have been reading my writing for the past few months, you would have noticed that I have been bearish on stocks. For now the long-term bearish case remains alive and well. There is plenty of resistance in the $206-$208 area. This Christmas Eve’s action was notable for the fact that markets sold-off literally in the last 5 minutes of trading to close in the negative territory for the day. One could argue that a shooting star candlestick was printed on Friday. This was all on holiday volume though, so I would like to see more confirmation of resistance next week.

CHART OF SPY |

|

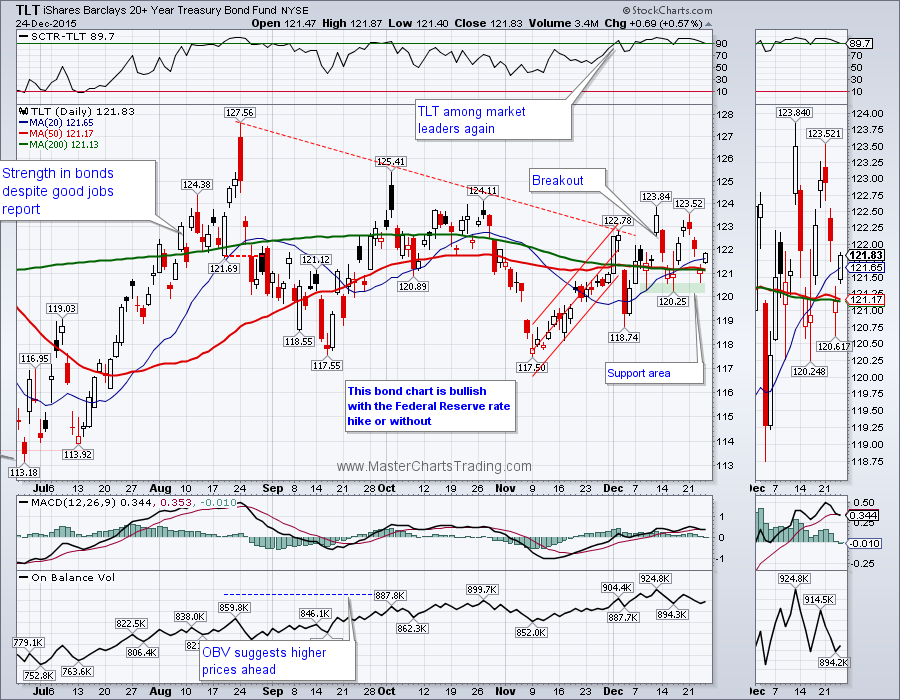

TLT CHART

Municipal bonds pushed ever higher and made another all-time high, albeit, I think munis are now somewhat overbought and may pullback to around $109.30 or so.

MUB CHART

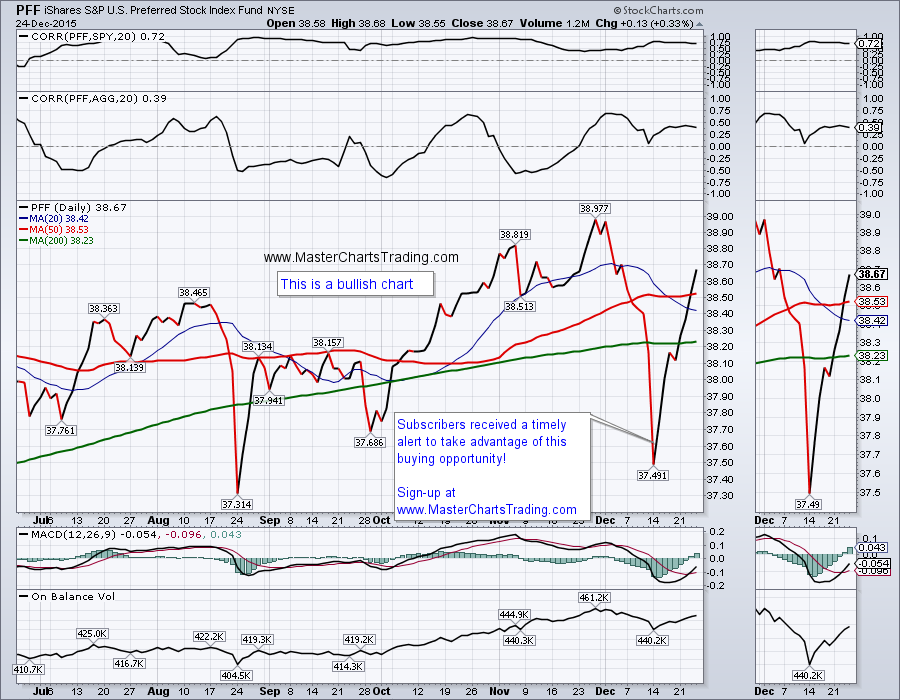

Preferred stock fund (PFF) offered a good setup several weeks ago and here at www.MasterChartsTrading.com we went ahead and took this buying opportunity. Correlation-vise, preferred stock occupies a sort of middle ground between stocks and bonds. Owning some preferred stock could be viewed as a nice diversification tactic away from regular stocks and bonds.

CHART OF PFF

CHART OF $USD (DXY)

CHART OF GOLD

GDX again held support in the $13 area last week and bounced. Friday GDX ended just below the 50-day moving average at $14.27. Maybe we are seeing some sort of a bottoming action in GDX (I am not a perma-bear)? I am seeing a higher high in the Advance-Decline lines for GDX as well as the On-Balance Volume indicator – all before a higher high in the price itself. This is a bullish divergence and should be paid attention to. Maybe we will see higher prices ahead for GDX. I am guessing $16 area is not out of the question, especially if the Dollar comes under more pressure.

CHART OF GDX

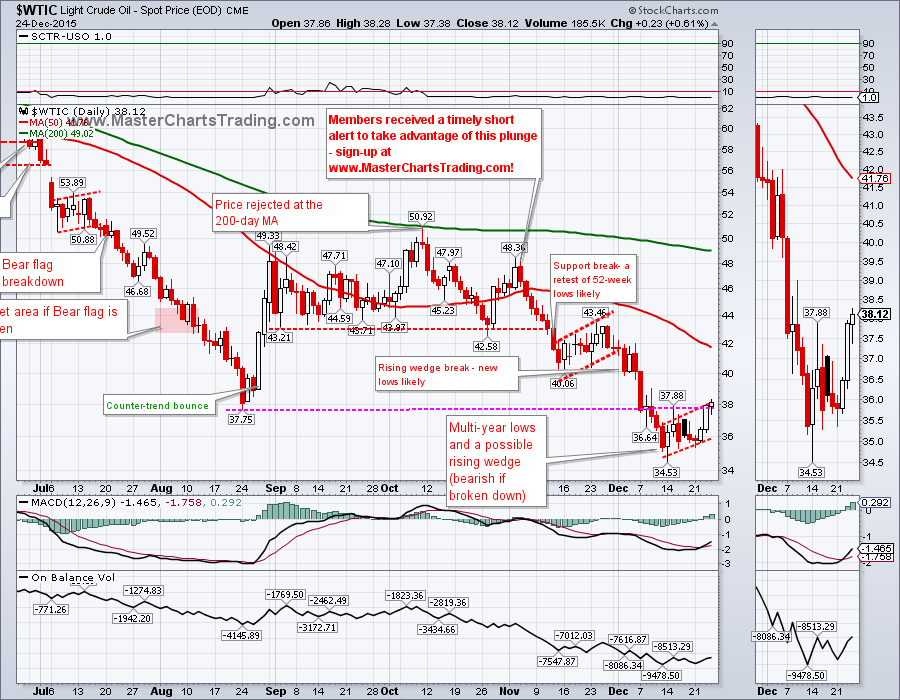

CHART OF OIL

CHART OF NATGAS

Trade Alerts Service is now live – please sign-up here!

That’s it for this week’s market recap,

Merry Christmas and Happy New Year!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed