|

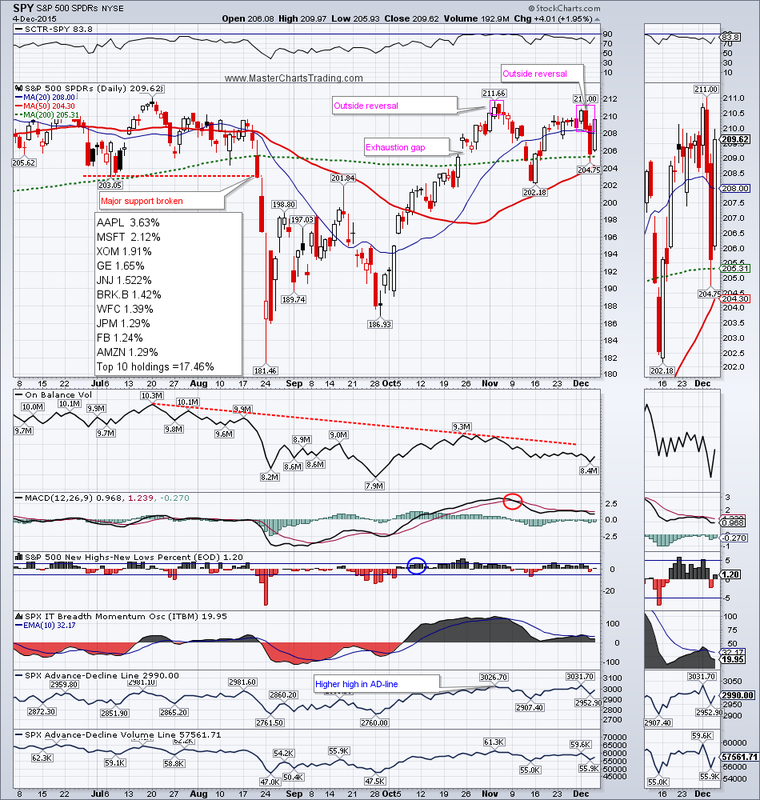

Really a wild week with lots of market-moving events occurring within a short period of time. The markets perceived Mario Draghni’s speech on Thursday negatively. Friday’s positive reaction to the jobs report almost completely negated the Thursday’s drop. Overall the S&P 500 barely moved for the week as it added 0.06 points or 0.03%. I still think that we may have a bona fide Outside Reversal on the chart of SPY and if I am correct, we should see at least a retest of November lows soon.

CHART OF SPY |

|

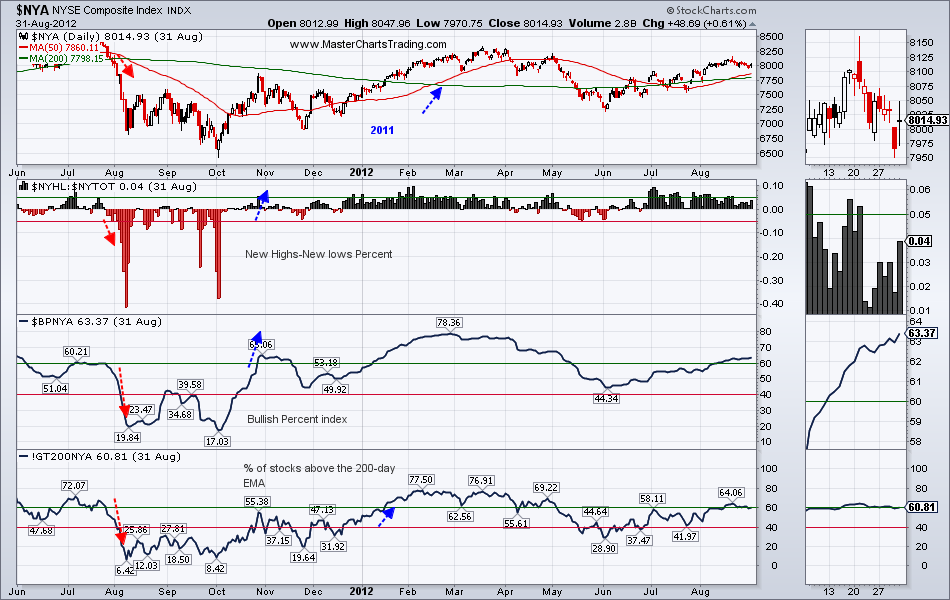

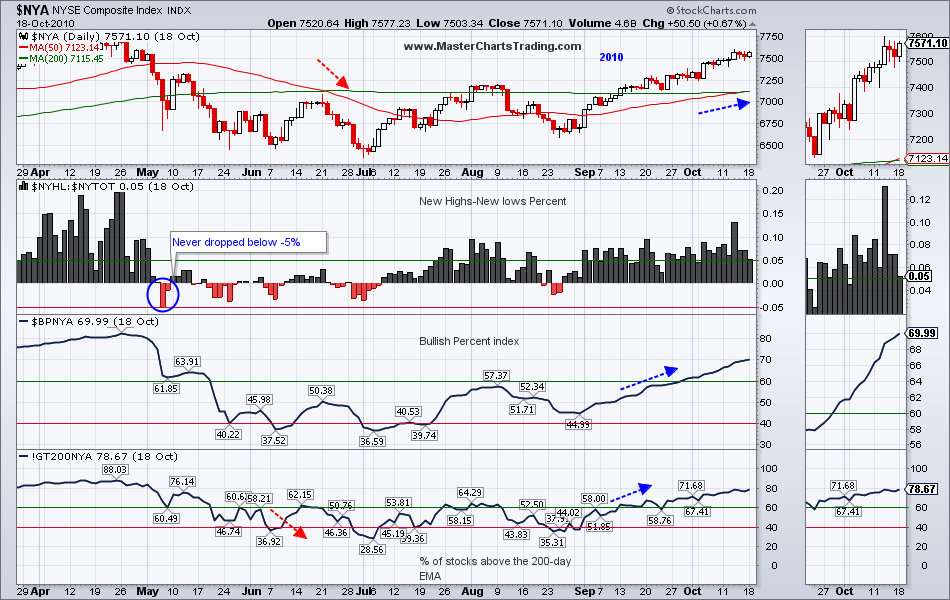

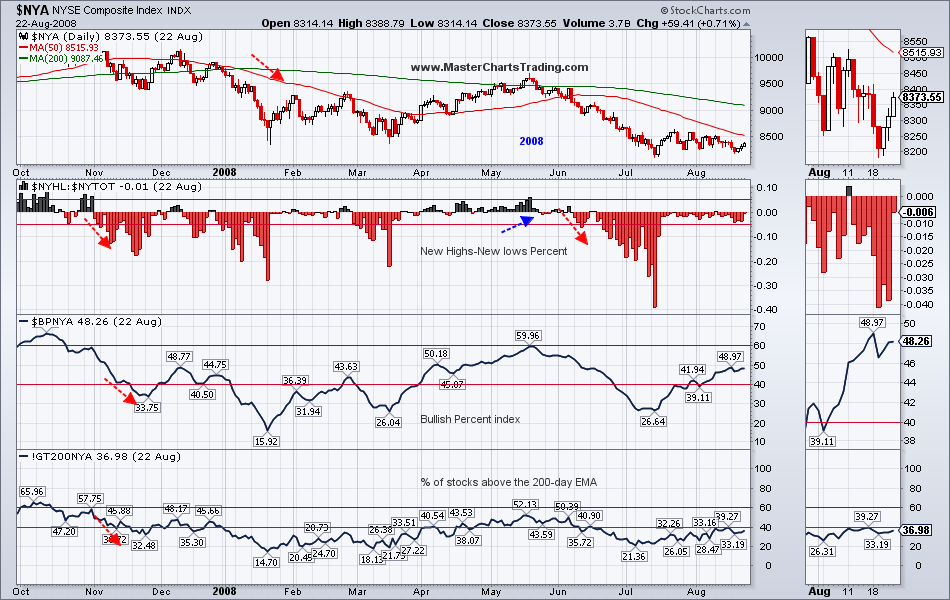

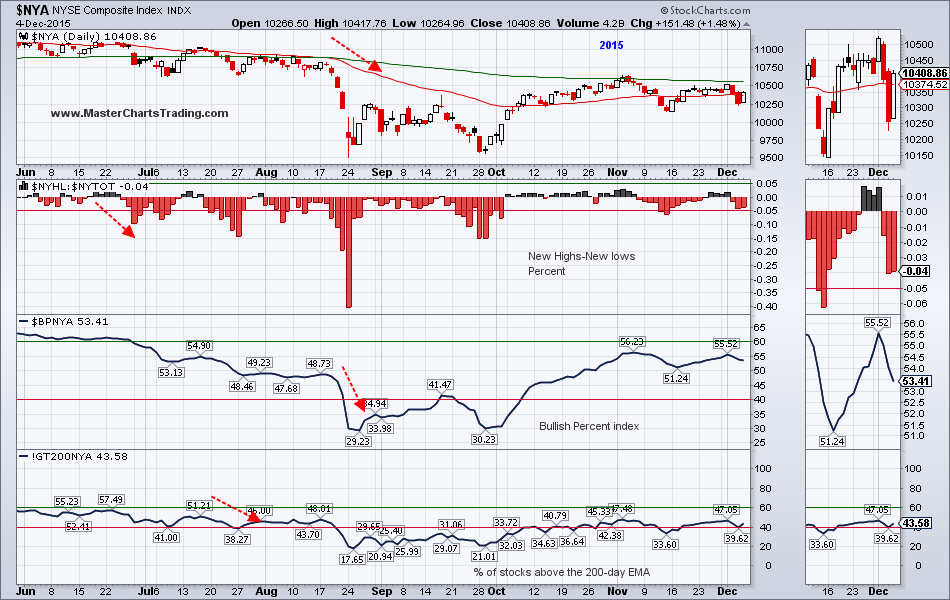

The most common time period to which today’s market is compared is that of 2011 so lets start there.

In August 2011, $NYA experience a sharp drop followed by sideways action and several attempted rallies. Eventually at least 3 of the above indicators crossed into the bullish thresholds and a strong rally ensued.

Currently we have 0 of the above indicators in the bullish camp. Can this change in the near future? Sure it can, but until we see the actual evidence on the charts turn bullish, I will treat the current picture in the general market as bearish.

CHART OF $NYA

CHART OF $USD

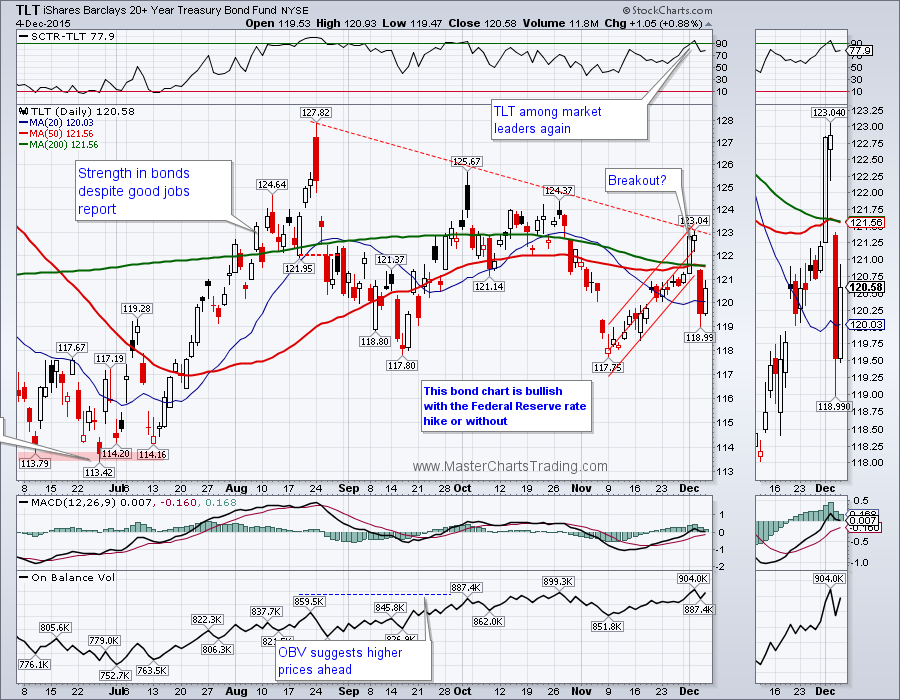

CHART OF TLT

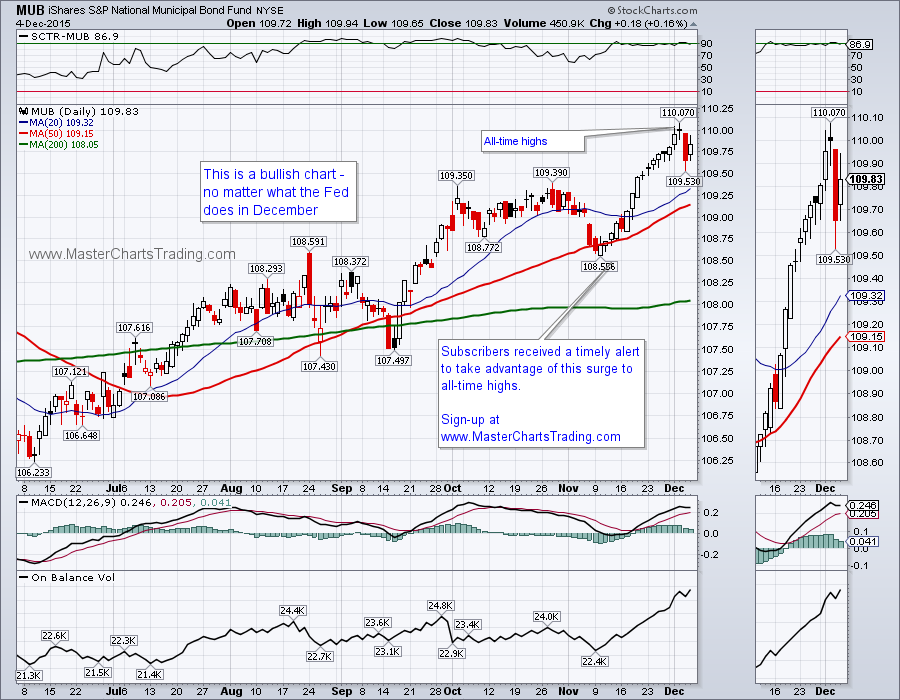

Municipal bonds (MUB), on the other hand, were hitting all-time highs just before ECB, and corrected slightly. I think the uptrend in MUB is still unbroken and the fund looks bullish.

CHART OF MUB

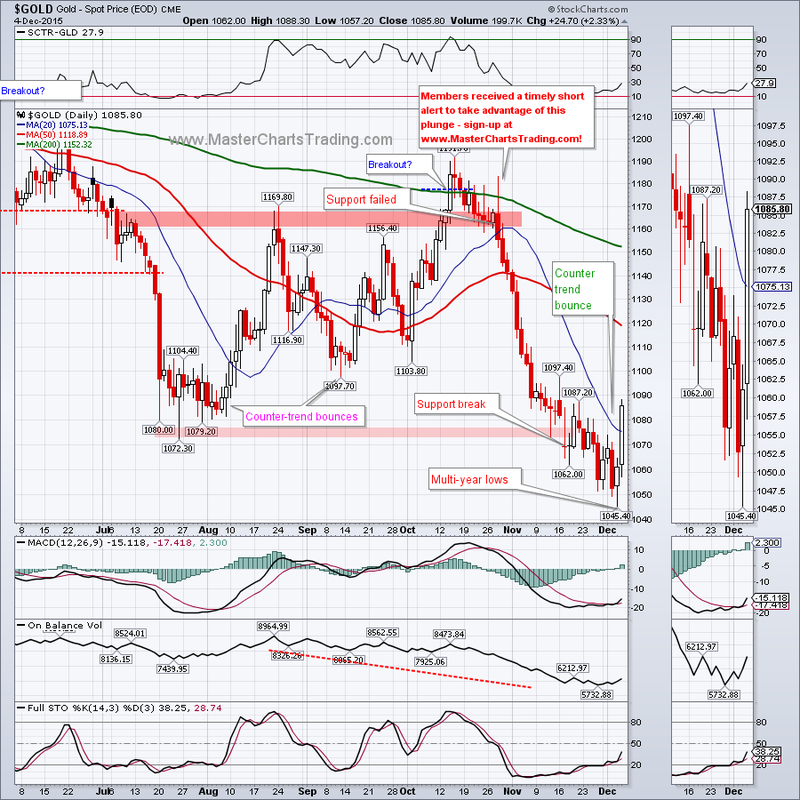

GOLD CHART

CHAT OF GDX

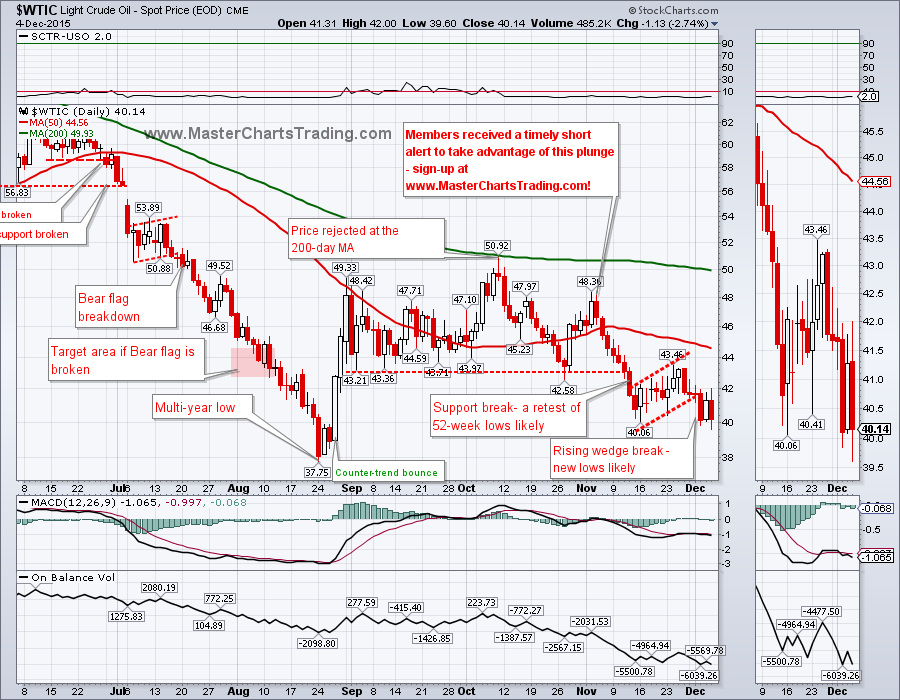

CHART OF OIL

Energy ETF – XLE was one of the losers on Friday, even though the general market rallied strongly. XLE chart sports a possible Head and shoulders pattern and a possible neckline break on Friday. If this is indeed so, we could see multi-year lows retested in the near future again.

CHART OF XLE

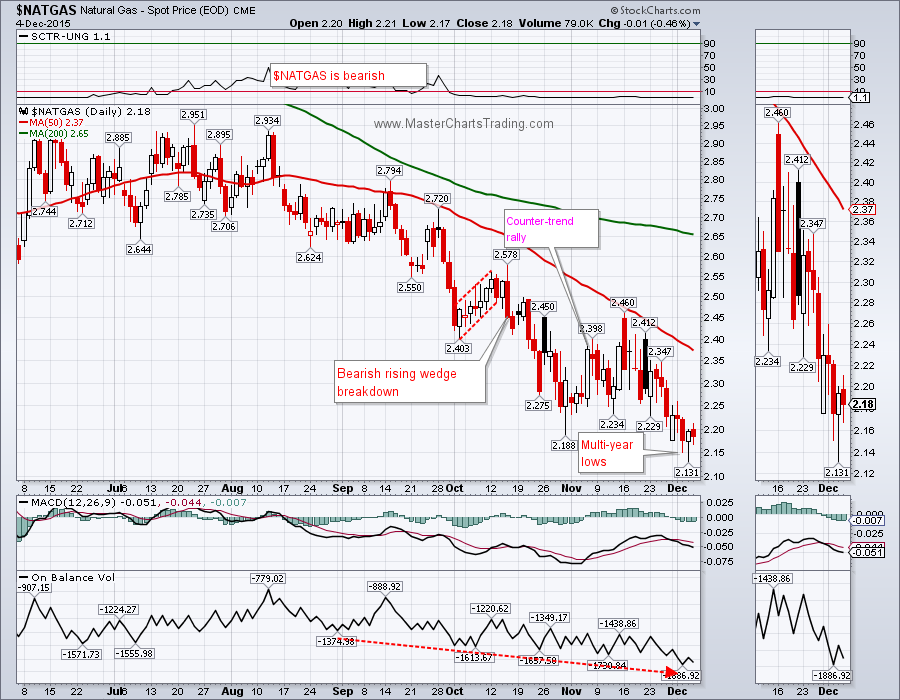

CHART OF $NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed