|

Stocks are down for the week as they erased 3 weeks worth of gains in just a few days. If you watched several of my videos starting around the beginning of September, you will notice that I maintained a bearish bias since then. Powerful rally notwithstanding, I think this was indeed a counter-trend move, and another leg down is just starting.

CHART OF SPY |

|

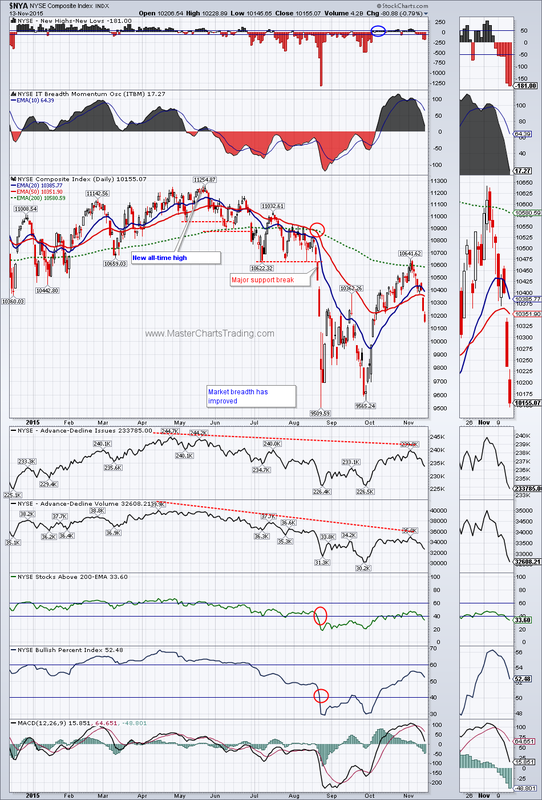

CHART OF $NYA

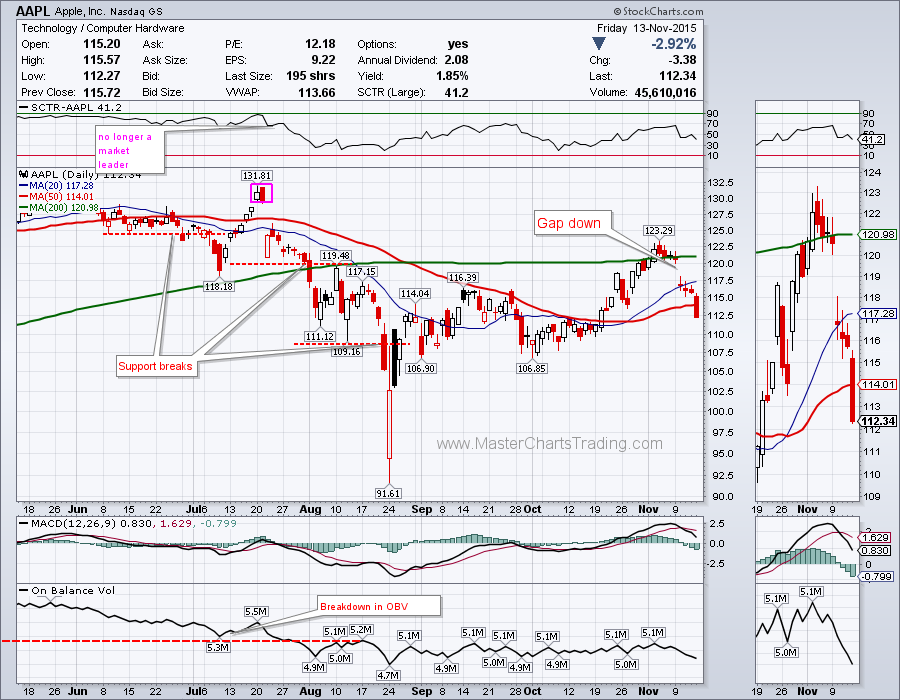

CHART OF AAPL CHART OF QQQ

CHART OF AGG

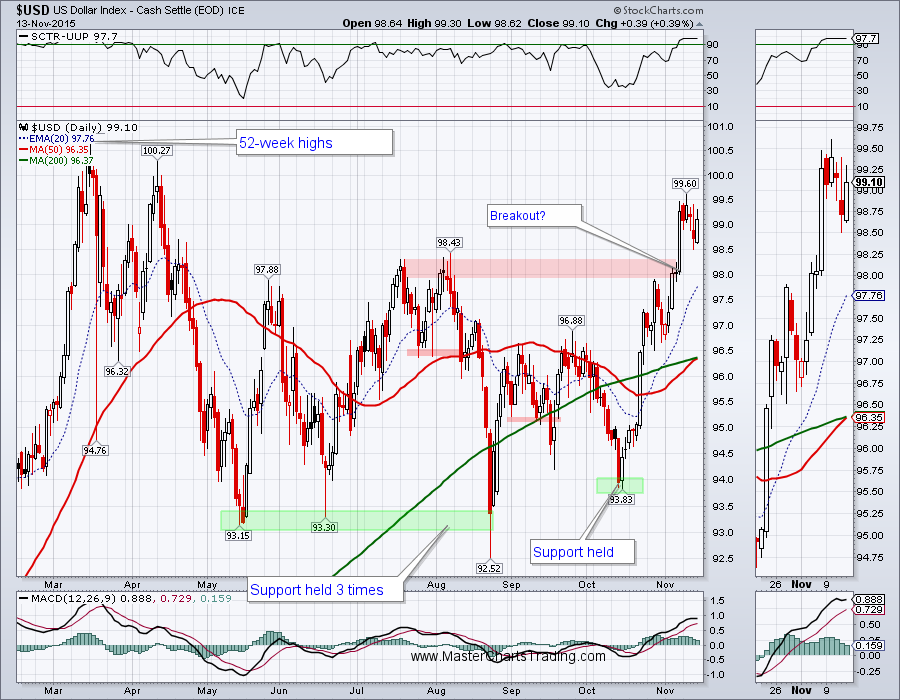

CHART OF $USD

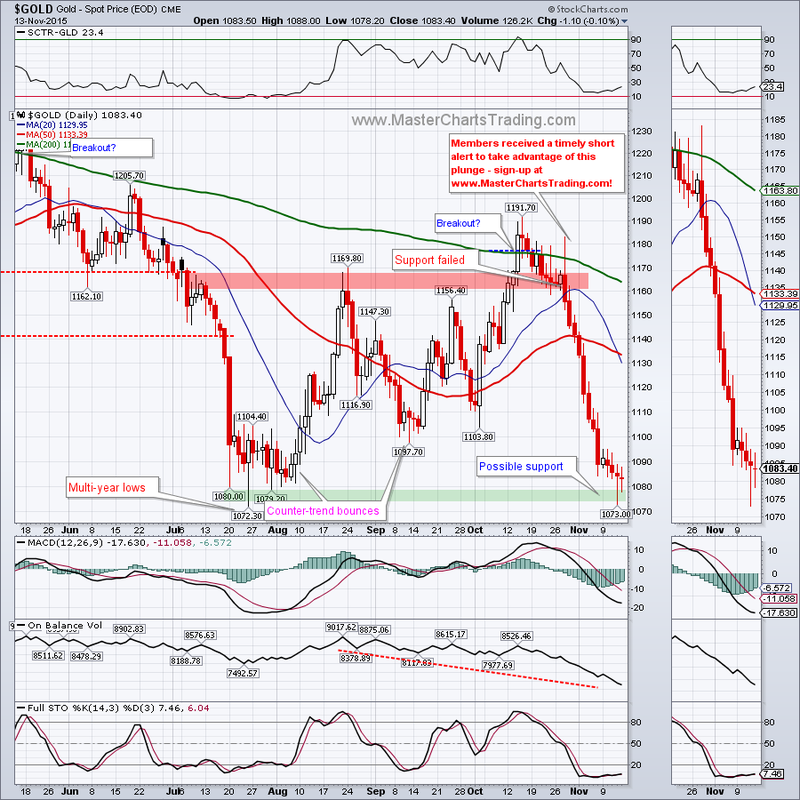

CHART OF GOLD

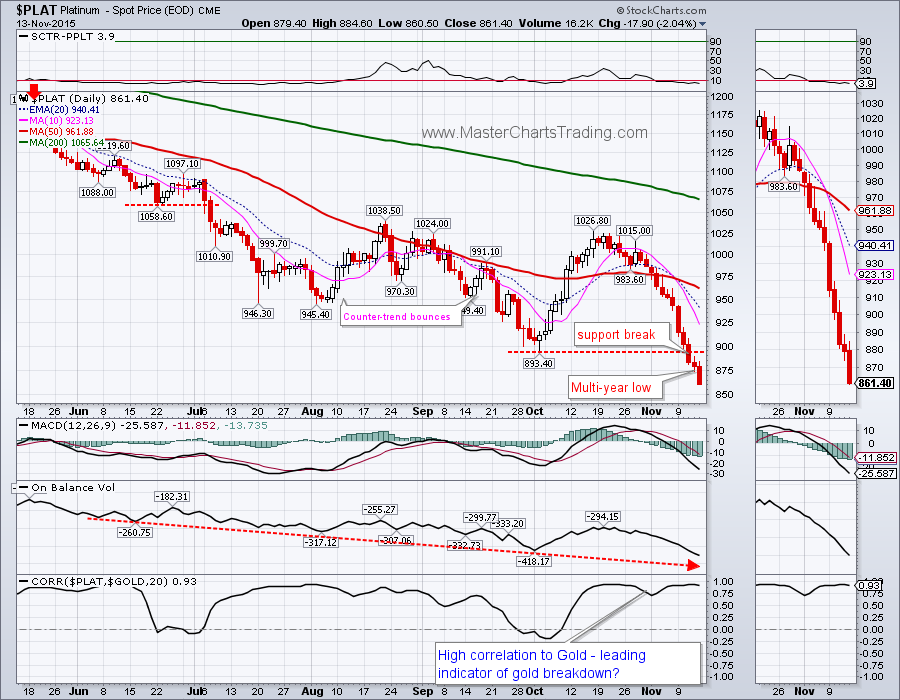

CHART OF PLATINUM

CHART OF GDX

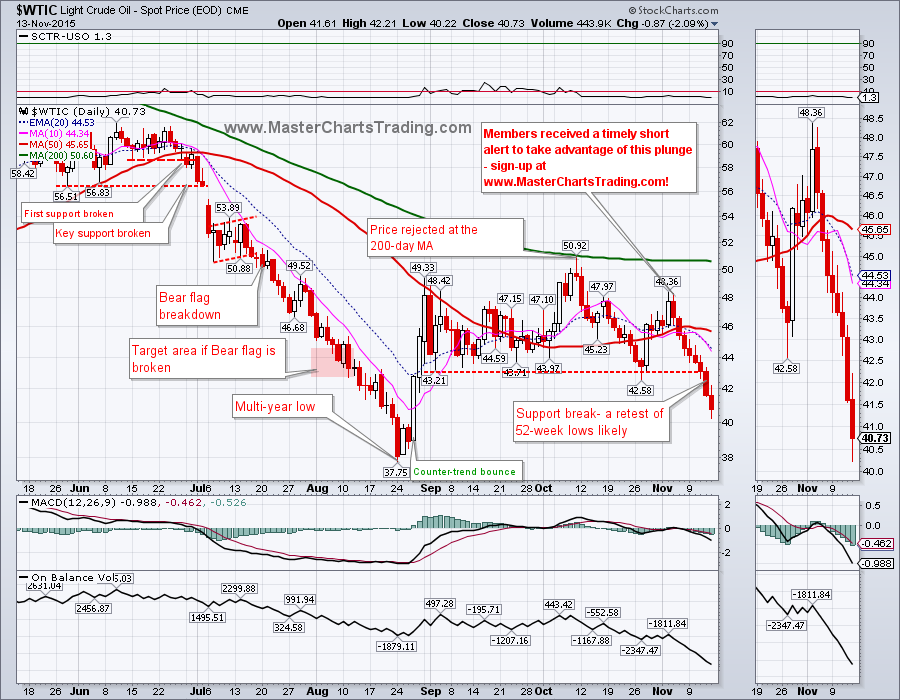

CHART OF OIL

CHART OF $NATGAS

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed