|

“Choppy market environment” - could be the descriptive term for what has been happening in the markets for the past few months. Just last week stocks were down over 3.5%, only to reverse this week and recapture most of the losses. Many commentators and seasoned traders are having trouble explaining this type of action and are subsequently getting whipsawed out. Is the market right now bullish or are we entering a bear market? This should be a relatively simple question to answer; yet there seems to be quite a bit of disagreement even at such basic level. Let us look at some of the historical examples to attempt to answer this question now.

|

|

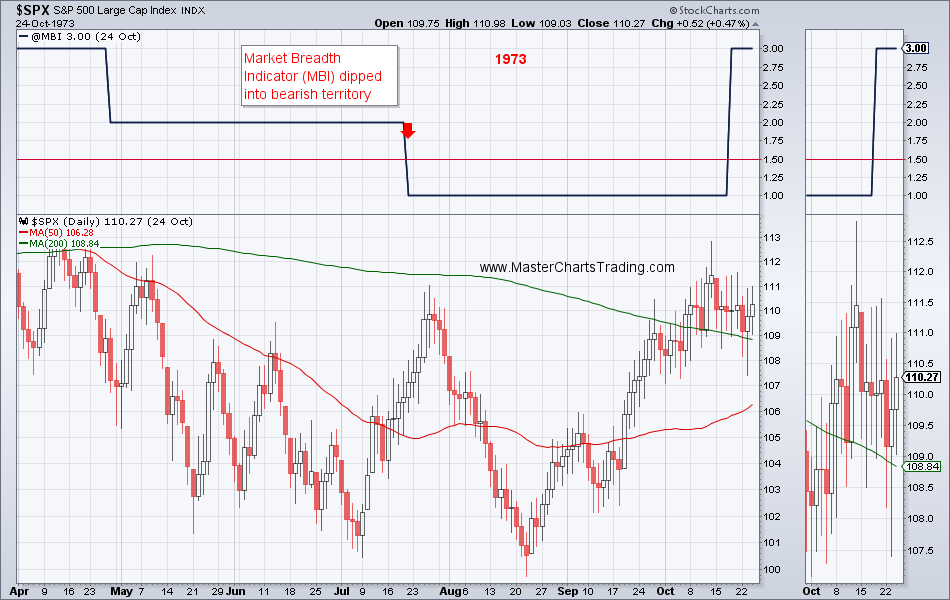

The picture in 1973 was not exactly identical to the one today, but the similarities are there: the 50-day MA was below the 200-day MA and MBI dropped into the bearish territory. After MBI confirmed bear market, there was a sizable rally to above the 200-day MA. However, MBI never crossed above the bullish threshold and the index itself rolled over into a bear market – characterized by lower lows and lower highs with a total loss of about 50%.

CHART OF SPY

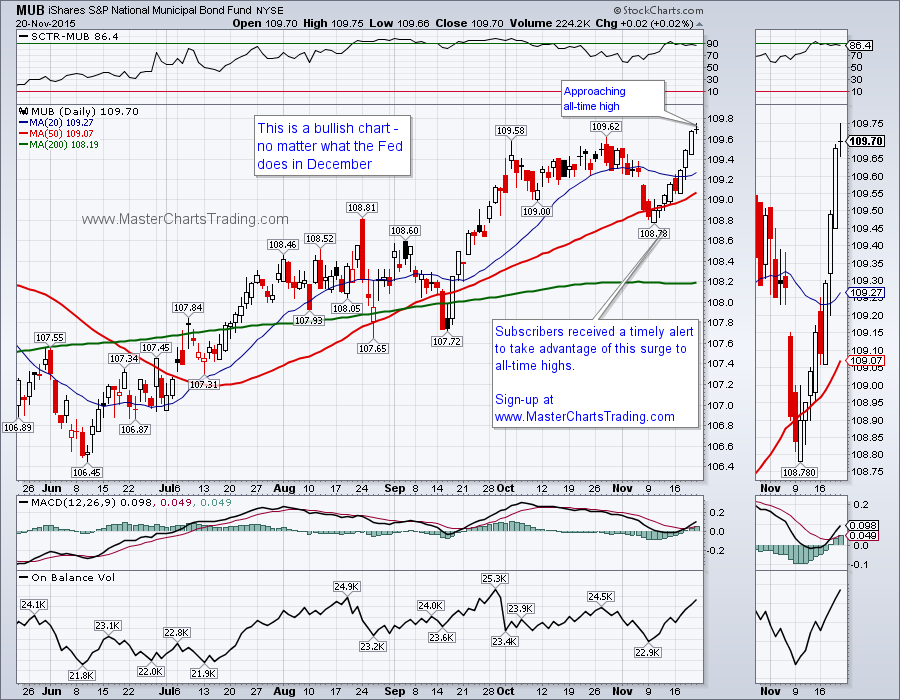

Chart of MUB

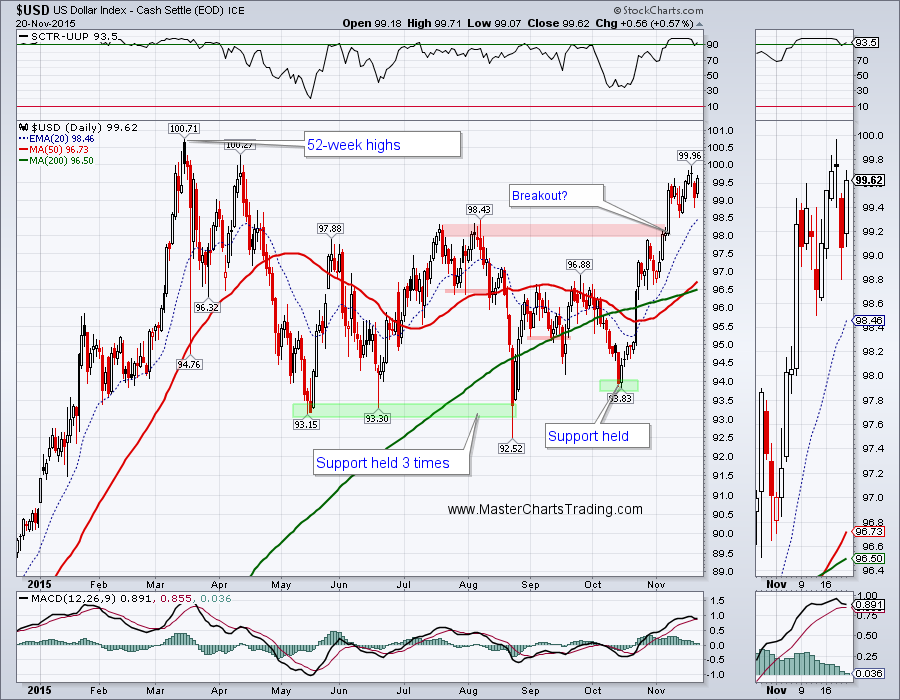

Chart of $USD

CHART OF GOLD

CHART OF GDX

CHART OF OIL

CHART OF UNG

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed