|

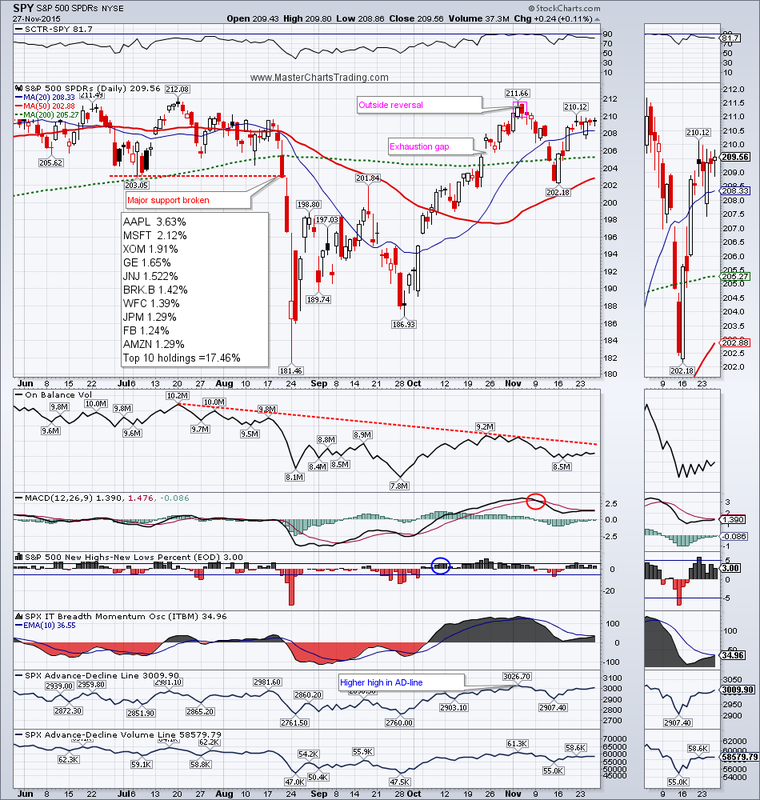

We only had 3 full days of trading and a half-day on Friday; therefore it is difficult to draw any conclusions from the price action during this relatively short period of time. SPY gained a fraction of a percent for the week, while QQQ lost a fraction.

I maintain my bearish outlook for stocks in the near term. A retest of recent November lows is very likely. Should that level fail, a retest of August lows is extremely likely. Various market breadth, momentum and trend indicators that I track have not yet given an all-clear message. CHART OF SPY |

|

CHART OF NYA

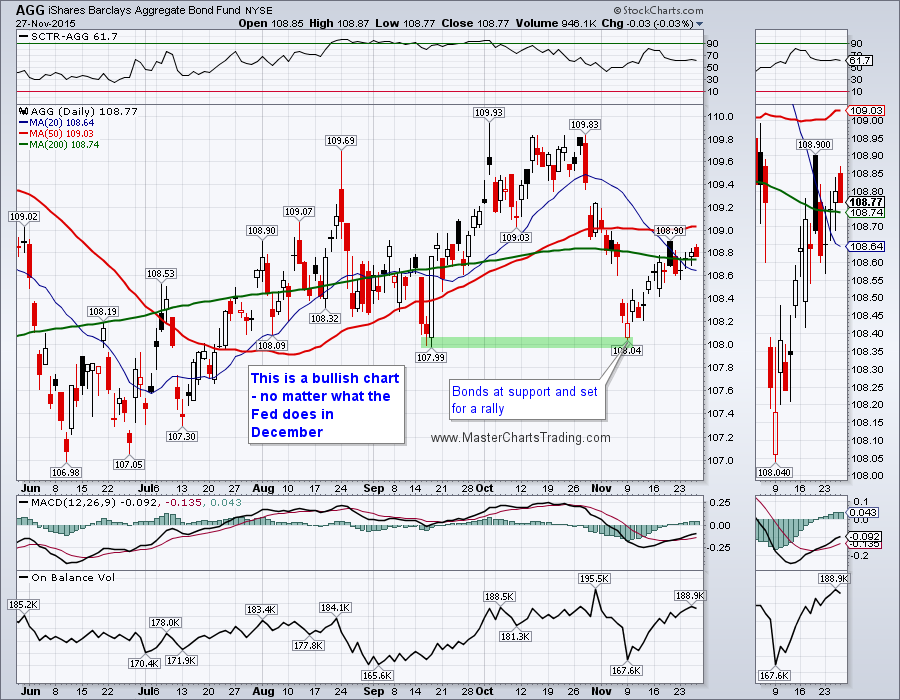

CHART OF AGG

CHART OF MUB

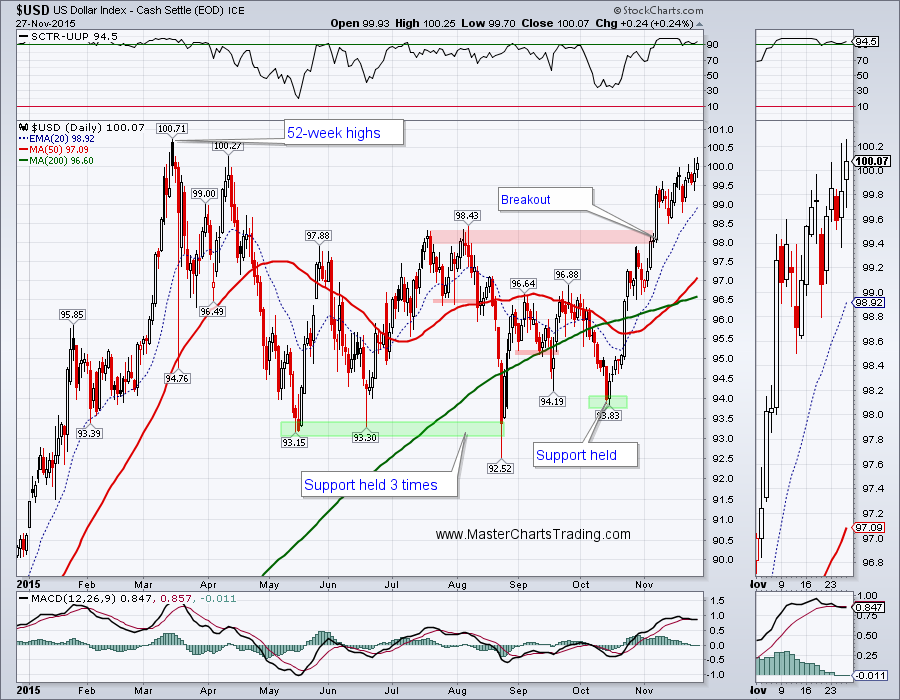

CHART OF $USD

GOLD CHART

CHART OF GDX.

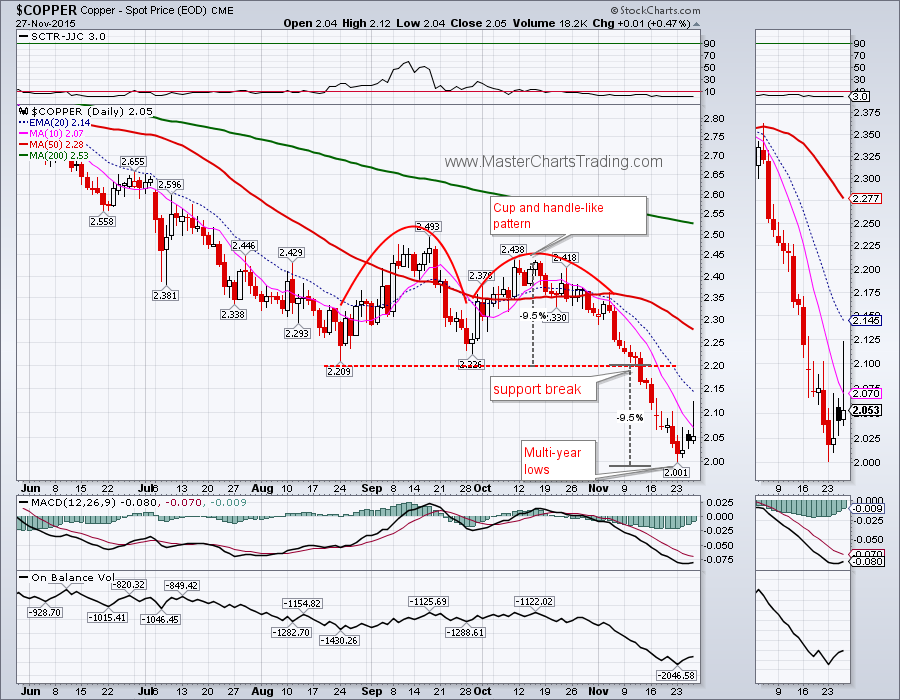

CHART OF COPPER

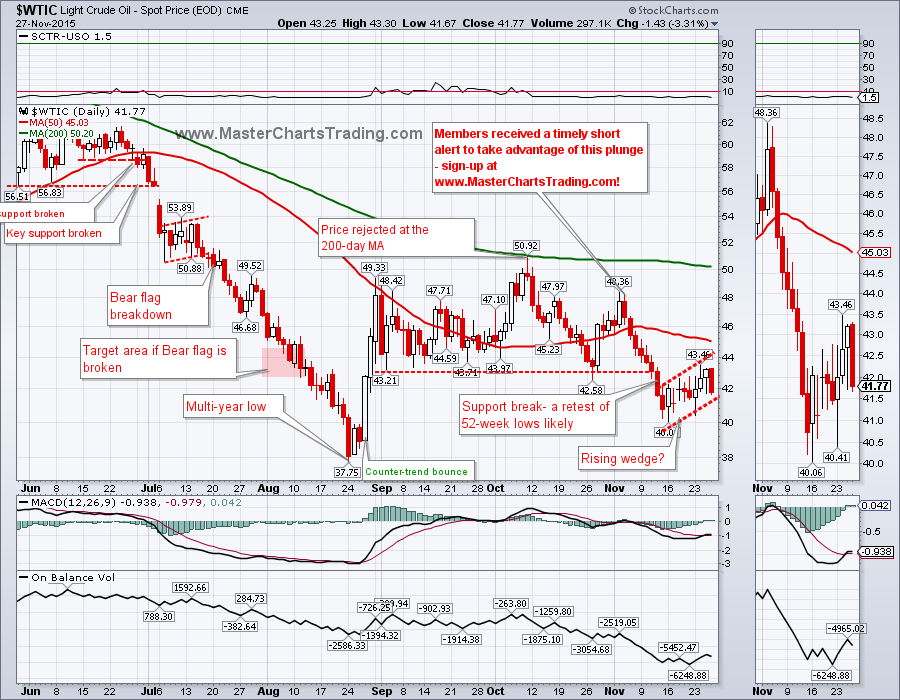

CHART OF OIL

CHART OF $NATGAS

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed