|

Stocks finally ran into some meaningful resistance close to the all-time highs - SPY has been in a corrective mode for the past 3 sessions. Stocks are very overbought on multiple indicators and are certainly ripe for a pullback, but bears are still having trouble sinking their claws in. How this pullback will unfold is anyone’s guess, but this week we will look at the examples of market corrections from 2011 and 2008 to see how they compare to today.

Chart of SPY |

|

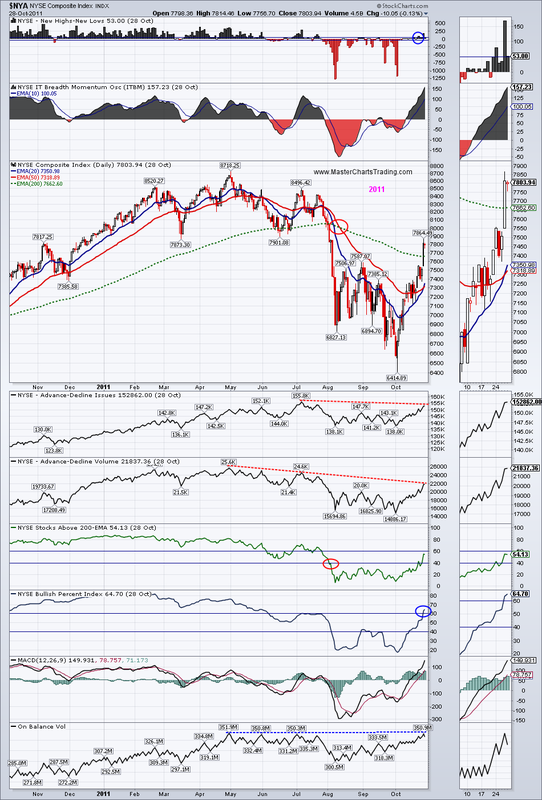

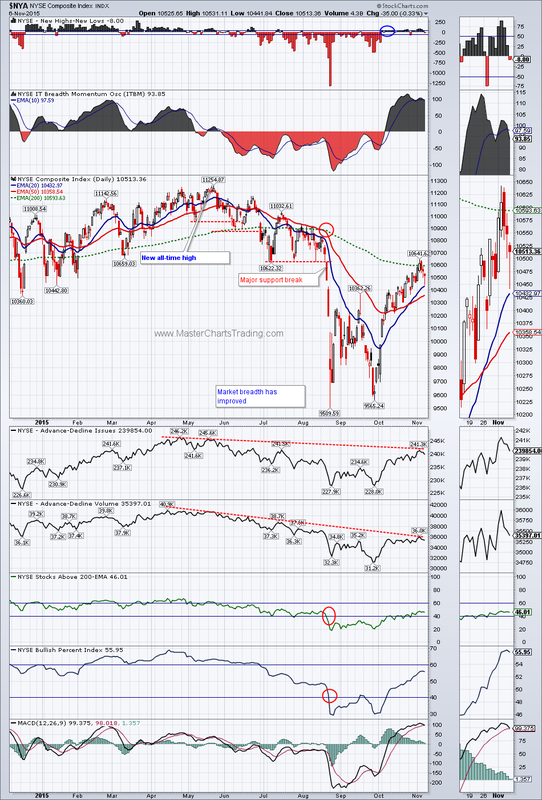

Looking at the underlying market breadth indicators the picture today looks more like the one from 2008 then from 2011. The Advance-Decline (AD) lines and AD-volume lines look very similar in all 3 cases, but the key difference between the 2011 and 2008 was the length of time that AD-lines were trending down. In 2008 and currently, the AD-lines were trending down for an extended period of time. In 2011 the downtrend in AD-lines was relatively short.

Another key difference between the 2011 correction and the start of 2008 bear market was the Bullish Percent index ($BPNYA). In 2011 the $BPNYA recovered above the 60 percent threshold very quickly. In fact by the time $NYA broke out above the 200-day EMA, the $BPNYA was also above its 60% line. In 2008 the $BPNYA came very close to breaking above the 60% line, but failed just short of it. Currently the $BPNYA is below the 60% line and seems to be rolling over again.

Current chart of NYA

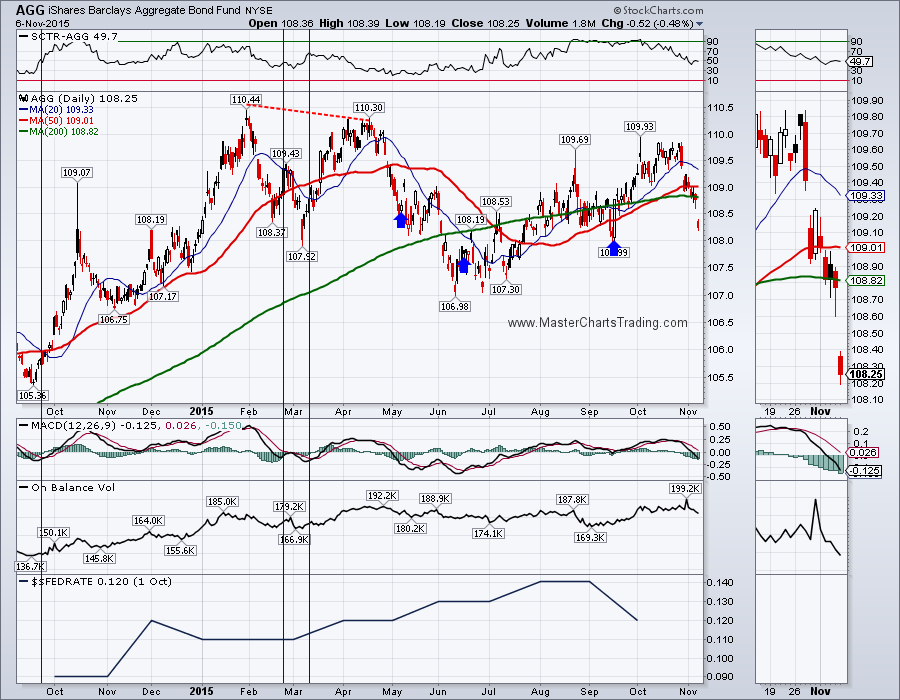

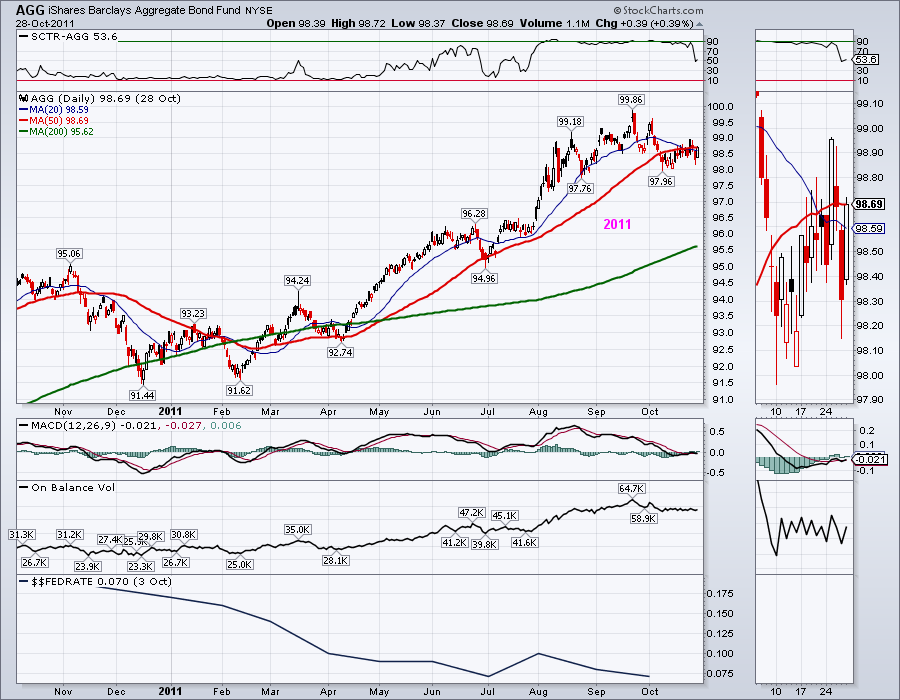

Current AGG chart

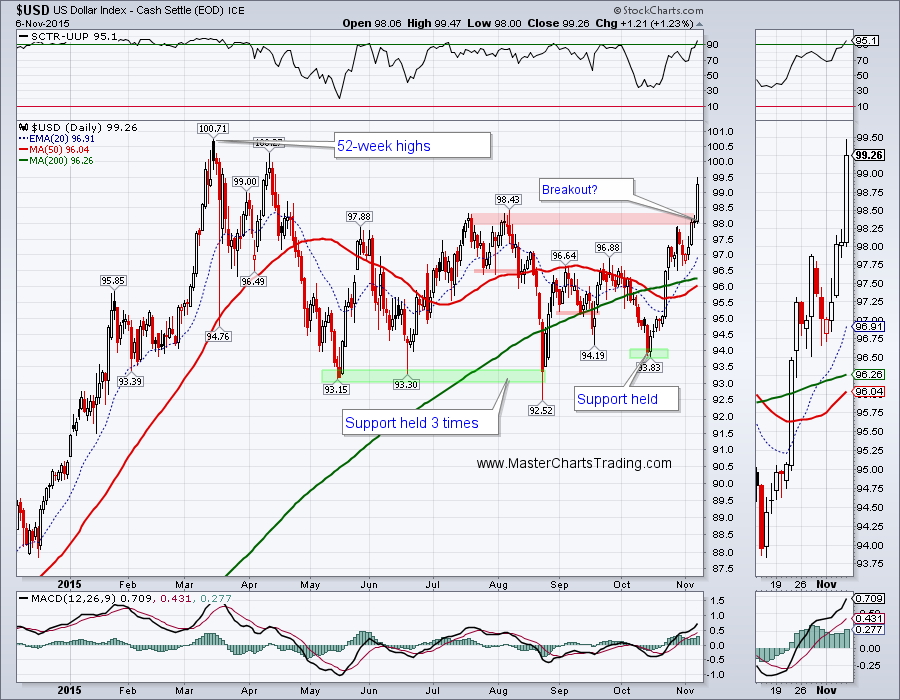

Chart of US dollar index

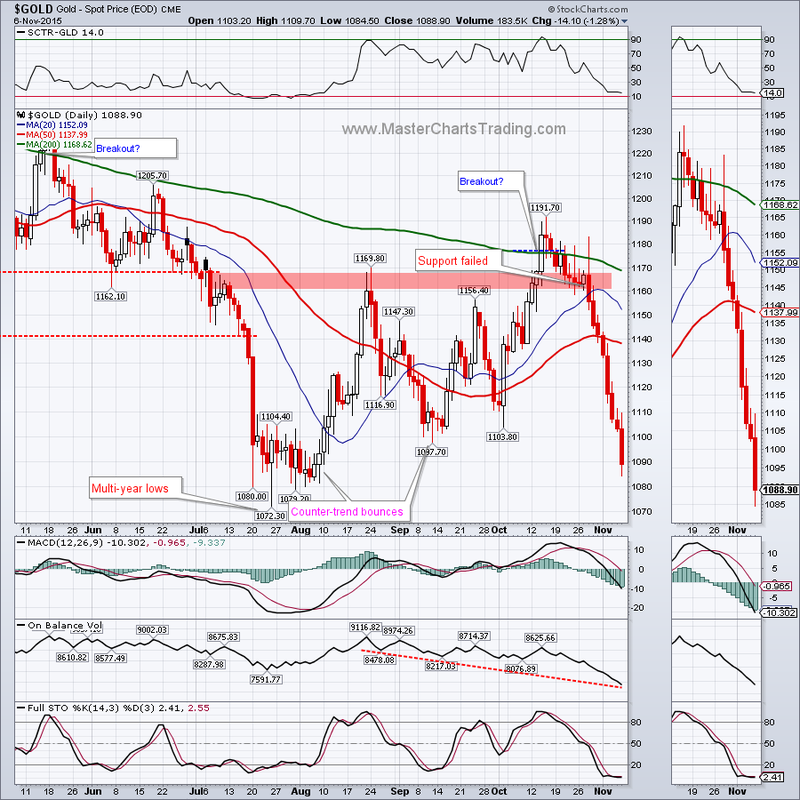

Gold does poorly when US dollar is rising, and this week was no exception as gold lost 4.62%. The price landed at the previous support levels and is again challenging its 52-week lows. Will more selling take place next week? Its hard to say, but should the dollar continue to go up, I would not be surprised if gold breaks the support at $1080 and continues down. Gold is somewhat oversold, especially on the Money Flow Indicator, so a bounce here is also possible.

Gold chart

Chart of GDX

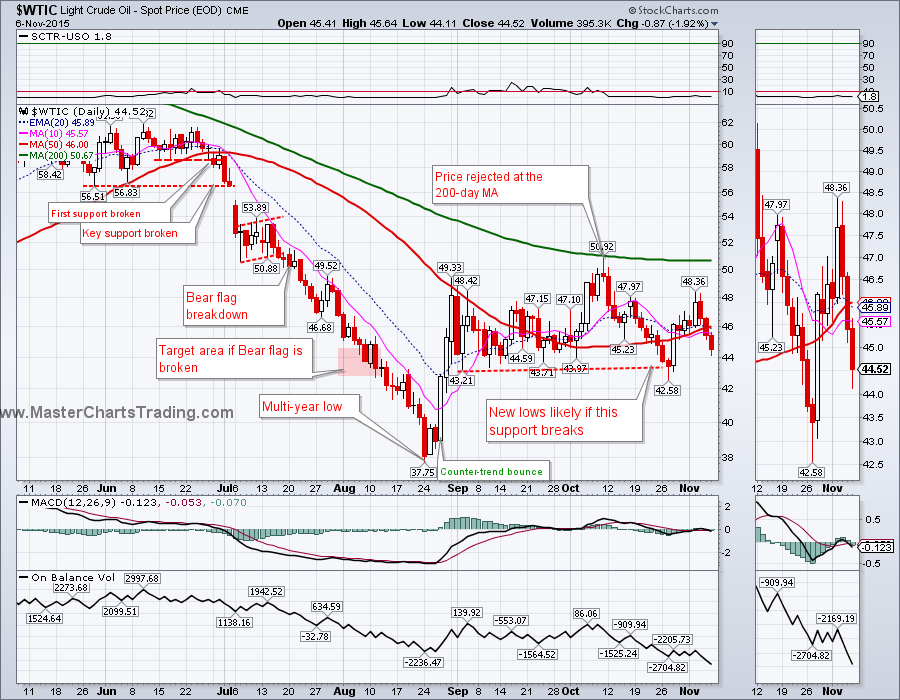

Chart of $WTIC

Chart of $NATGAS.

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed