|

In trend-following strategies, such as the one I adhere to, you have to have a bullish or bearish bias. Is the stock you are trading in a long-term uptrend, or a long-term downtrend? If in an uptrend, it makes sense to look for oversold conditions and time your entries on the long side. Vice versa: if you stock is in a long-term downtrend, it makes sense to short the rallies.

Charts of SPY and SPX |

|

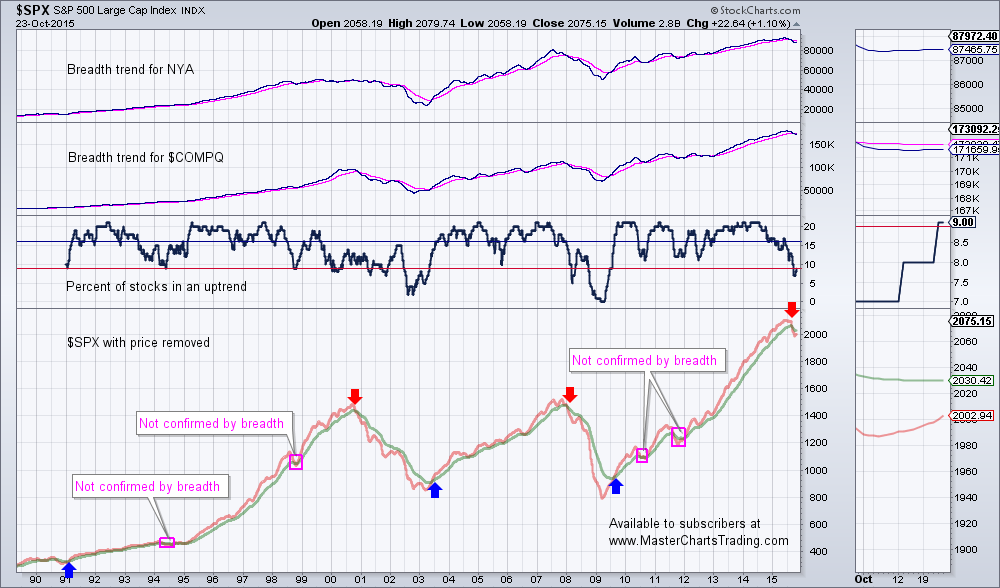

Below is a long-term daily chart of the S&P 500 ($SPX) going back all the way to 1990. During the past 25 years we had 3 bull markets and 2 bear markets. These are marked by up blue arrows and down red arrows, respectively. My 3 favorite indicators are the Breadth Trend for $NYA, Breadth Trend for $COMPQ and a third indicator that I created myself that I call – Percent of Stocks in an Uptrend. Notice that If I used only the moving average crossovers on the price chart of $SPX itself, I would have experienced 4 false signals (they are marked by pink squares). However, by using the breadth to confirm or deny my bias, as provided by moving average crossovers, I would have been able to avoid these false signals. Notice that currently breadth is confirming the signal provided by the moving average crossover and this bearish signal is yet to be negated.

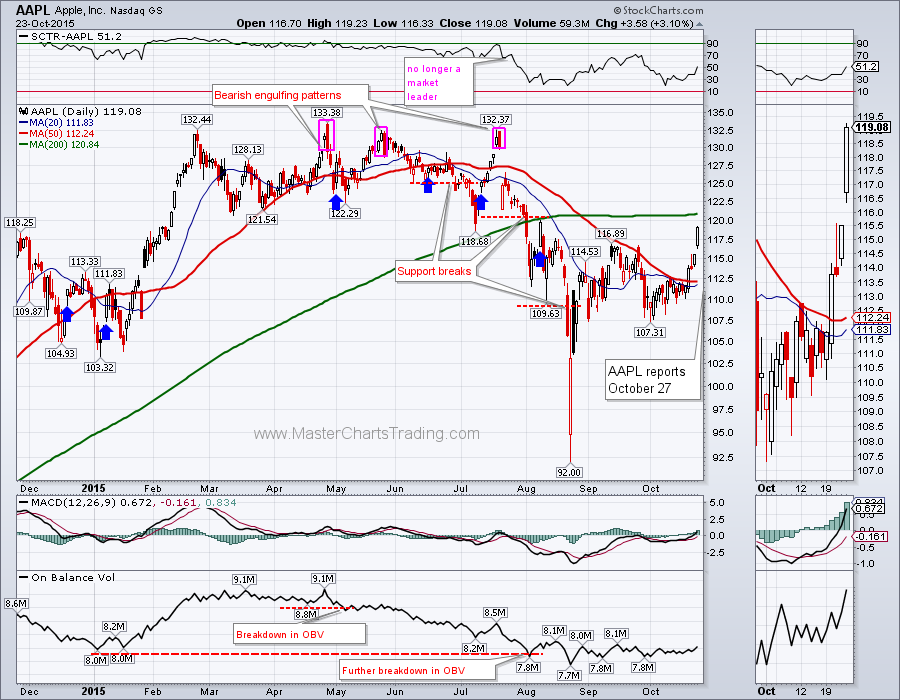

Charts of QQQ (scroll down) and AAPL

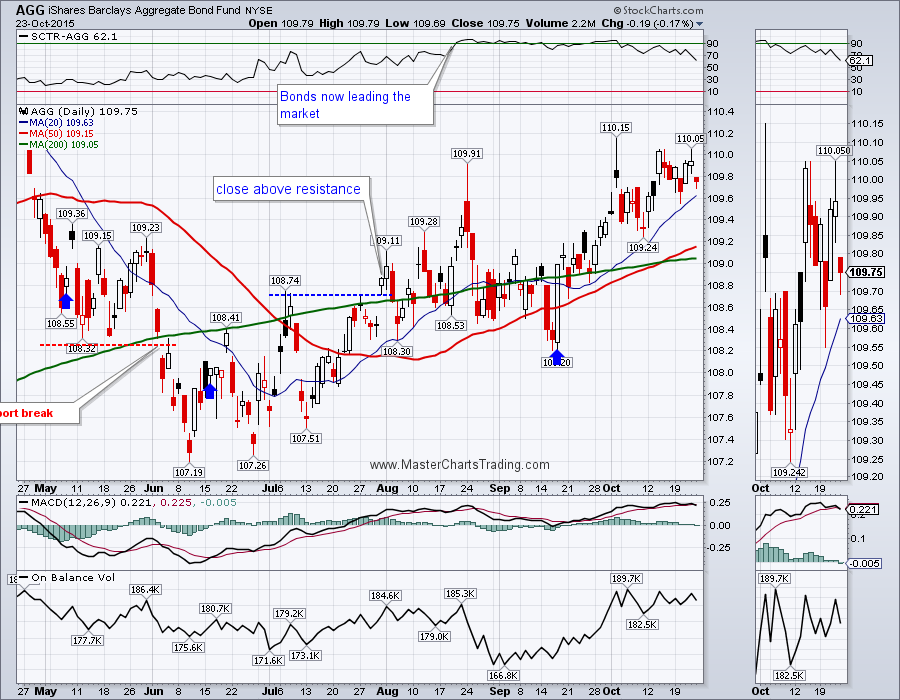

Chart of AGG

GDX was choppy and volatile, as various market forces pulled the gold miners up or down. The Chinese rate cut is bullish for gold, while strong dollar is bearish. GDX along with gold is long-term bearish and currently overbought – a recipe for a drop lower.

Charts of gold, gold miners and precious metals

Chart of oil

Chart of natural gas

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed