|

SPY ran into resistance, as if on cue, in the $208 area on Wednesday. The ETF then gapped down on Thursday and ended the week below its 200-day moving average (MA). This is decidedly not what the bulls want to see happen, especially during one of the most bullish seasonal periods of the year. Next few days should be crucial: the bulls must now make a stand, or we may see a confirmation of the support break below the November lows.

CHART OF SPY |

|

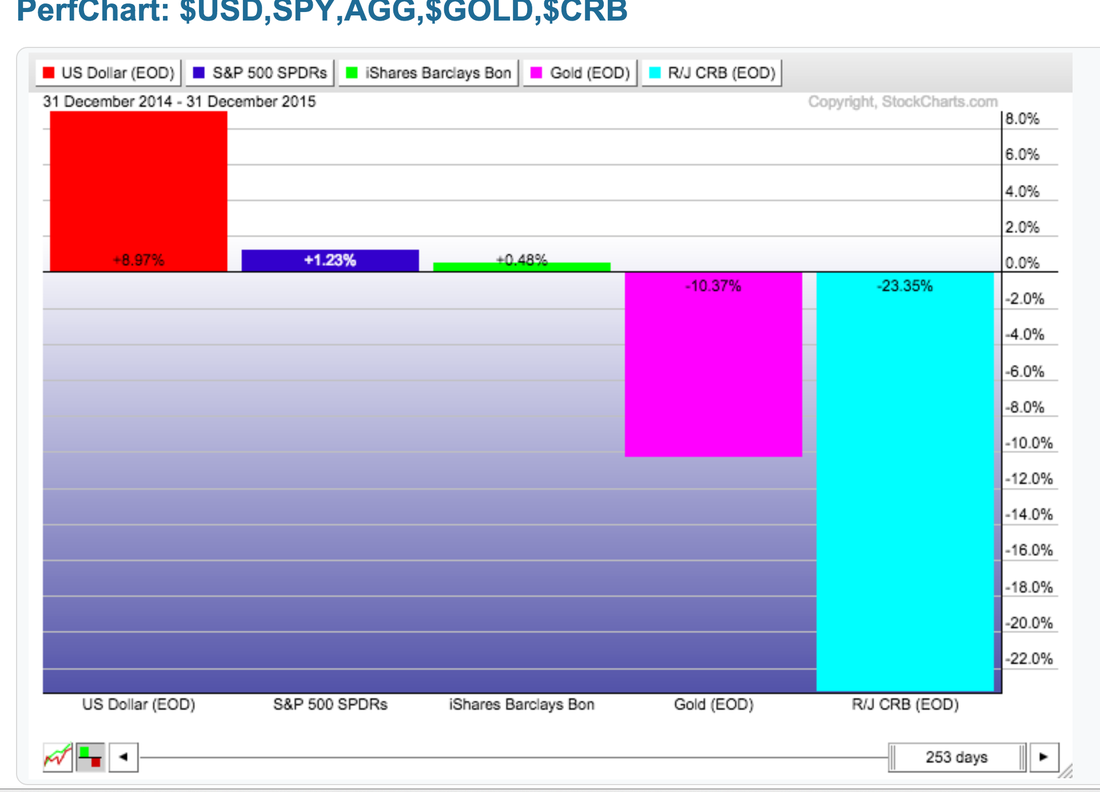

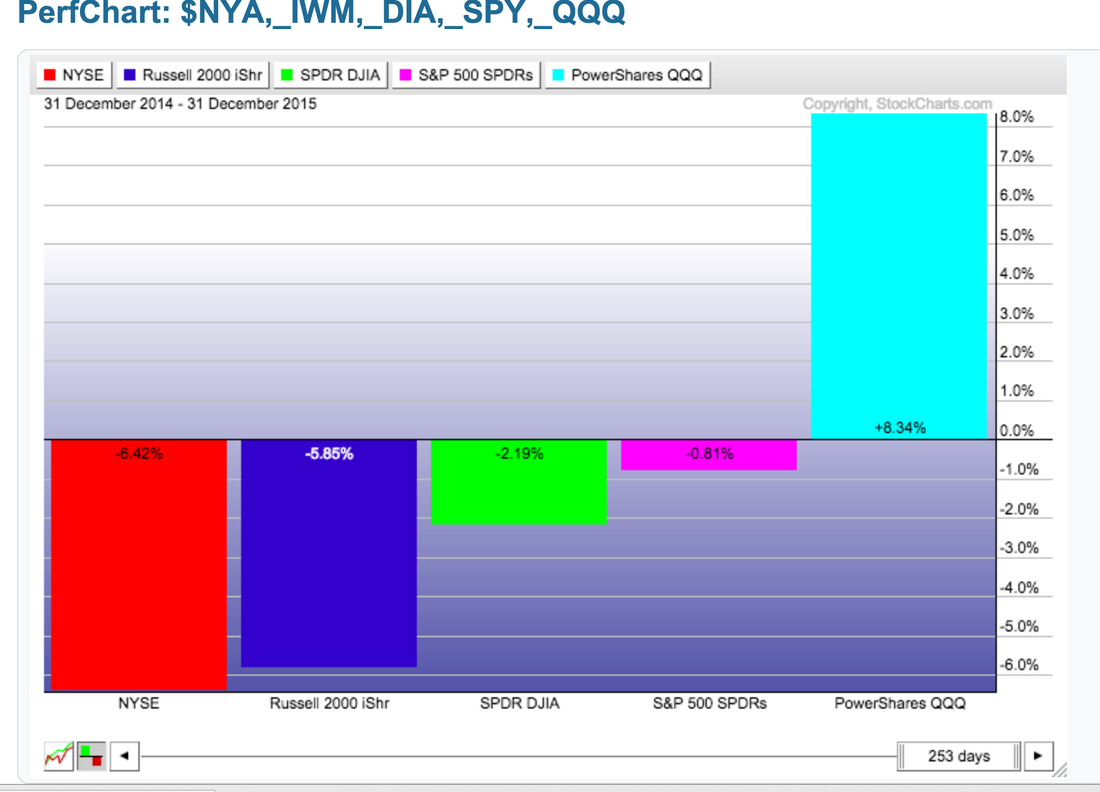

Looking further within stocks, it has been clearly a large-cap technology market. QQQ (without dividends) is up over 8%, while the rest of the major ETFs are down for the year, with small-caps taking the brunt of the selling.

Please refer to the next two charts for the discussion.

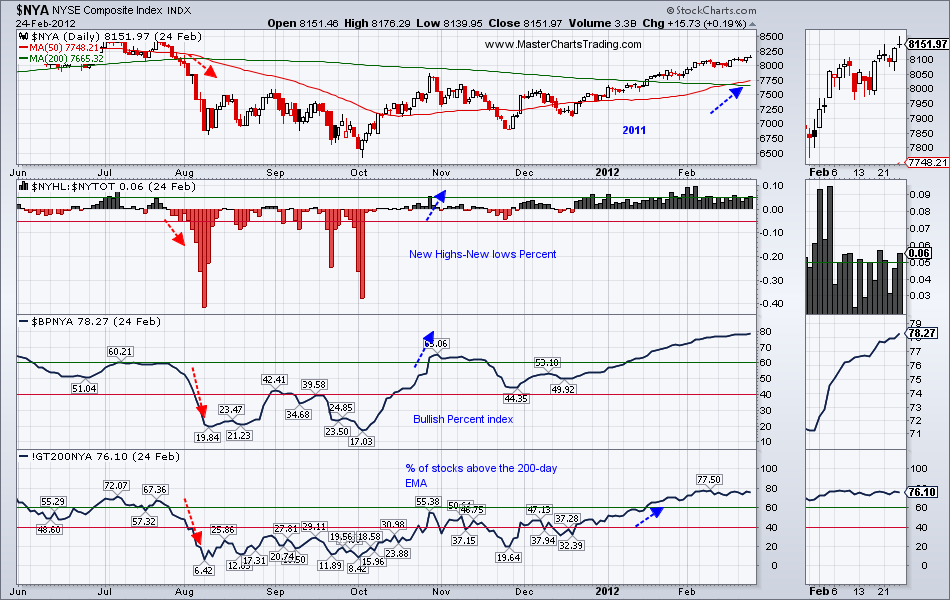

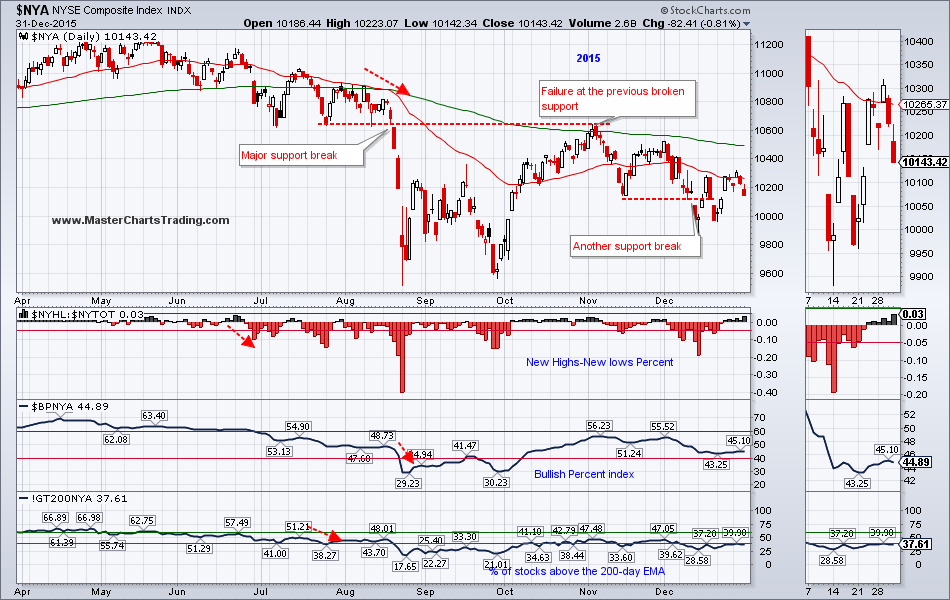

The charts have 4 indicators on them:

1. 50-day and the 200-day moving averages

2. Percent New Highs – New Lows

3. Bullish percent index

4. Percent of stocks above the 200-day exponential moving average

Notice that in 2011 NYA had a bearish moving average cross that was followed by the rest of the indicators turning bearish. It then took around 60 trading days for the first pair of indicators to turn bullish again. 110 Trading days later the third indicator turned bullish. Finally 132 trading days later we got a bullish moving average cross.

What about 2015 to present?

First of all the bearish moving average cross was preceded by the New Highs-New lows percent bearish flip almost 2 month prior, and by the Percent of stocks above the 200-day EMA 1 month prior. As of the writing of this blog post on January 1, 2016, zero of the above mentioned indicators have turned bullish, and we are already 95 trading sessions following the bearish moving average cross.

In conclusion: the current market picture is significantly weaker then that which occurred in 2011.

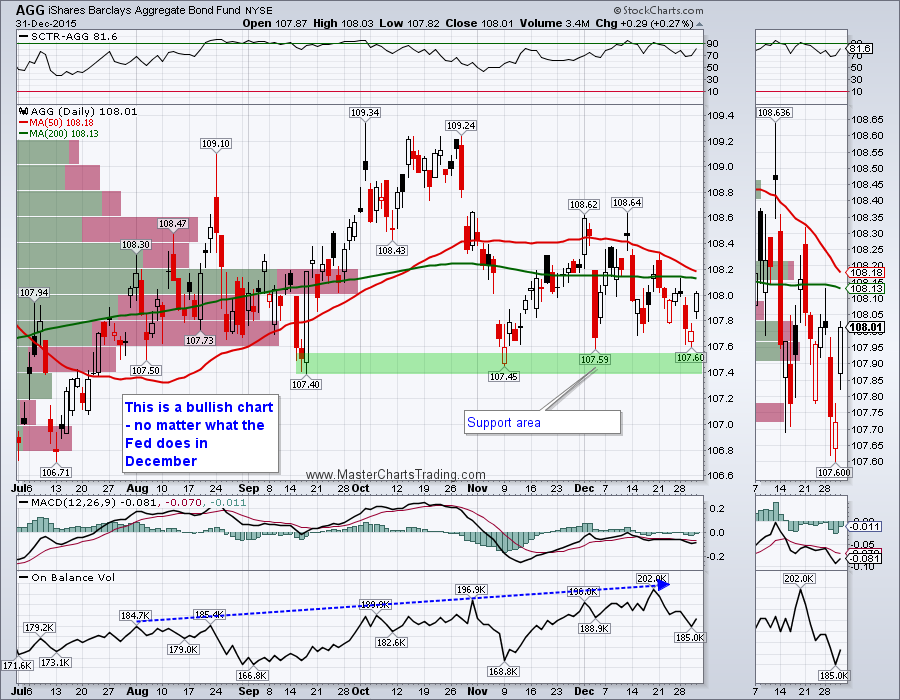

I think the bonds (AGG) have again held support in the $107.50 area and are in the process of rebounding. If AGG manages to break above the high volume resistance around $108, the door will be open to challenge the recent highs of around $109 or higher.

CHART OF AGG

Municipal bonds (MUB) again hit another all-time high this week. To me this looks like a clear case of a rotation away from stocks and into other asset classes. Should stocks come under more selling, bonds are likely to benefit further.

CHART OF MUB

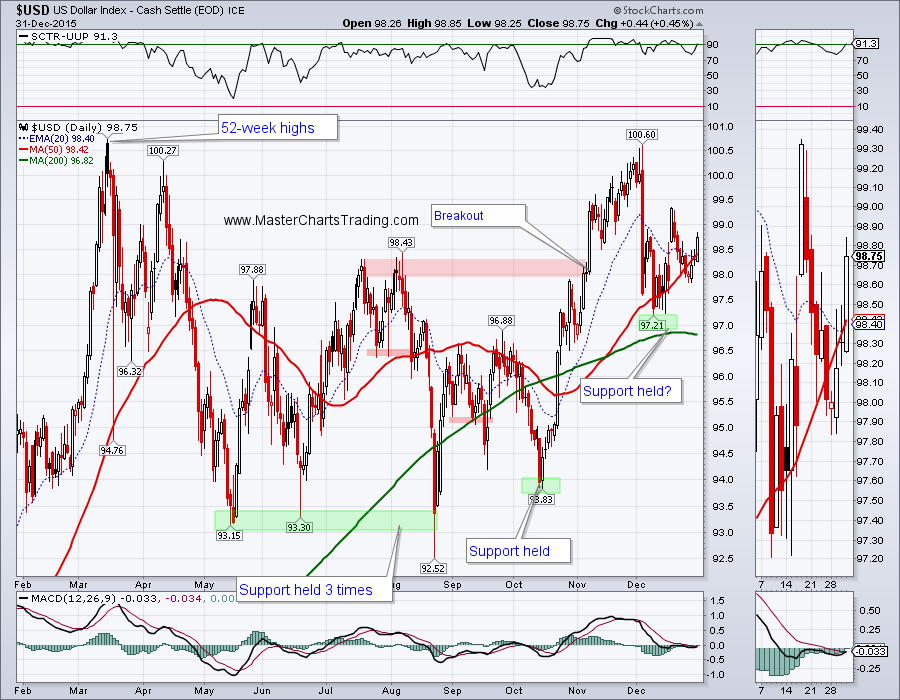

CHART OF $USD

Last week I pointed out a slight bullish divergence on the chart of GDX as the price made a lower high, but the underlying market breadth and volume patterns made a higher high. This week there was no follow-through, but this divergence remains in play still. We could still see a short-term rebound to a rather wide area defined by the December high and the falling 200-day MA. I will look for signs of failure in that area to short again.

CHART OF GOLD

CHART OF GD

CHART OF OIL

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

P.S. Trade Alerts Service is now live – please sign-up here!

RSS Feed

RSS Feed