|

Stocks closed out the first week of trading sporting a dubious distinction. Dow Jones delivered the worst first 5 trading days of the year performance ever. Ever, as in the entire history of Dow Jones Industrial Average that goes back to February 16, 1885! If you are a stock bull you certainly don’t want to hear anything of this nature. If you are currently a stock bear like me – this is music to your ears. What now? This is the most common question on everyone’s mind

|

|

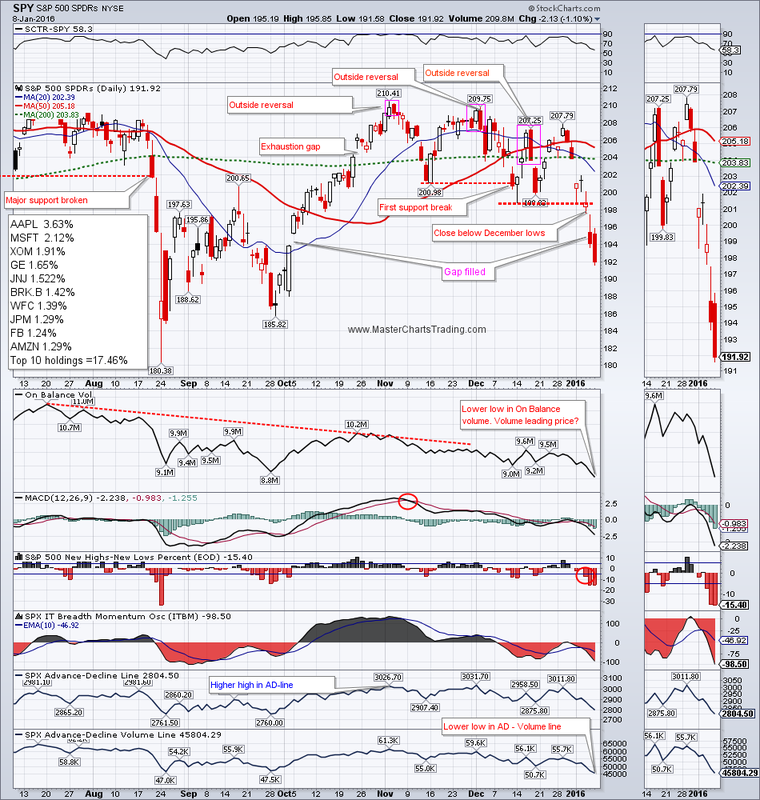

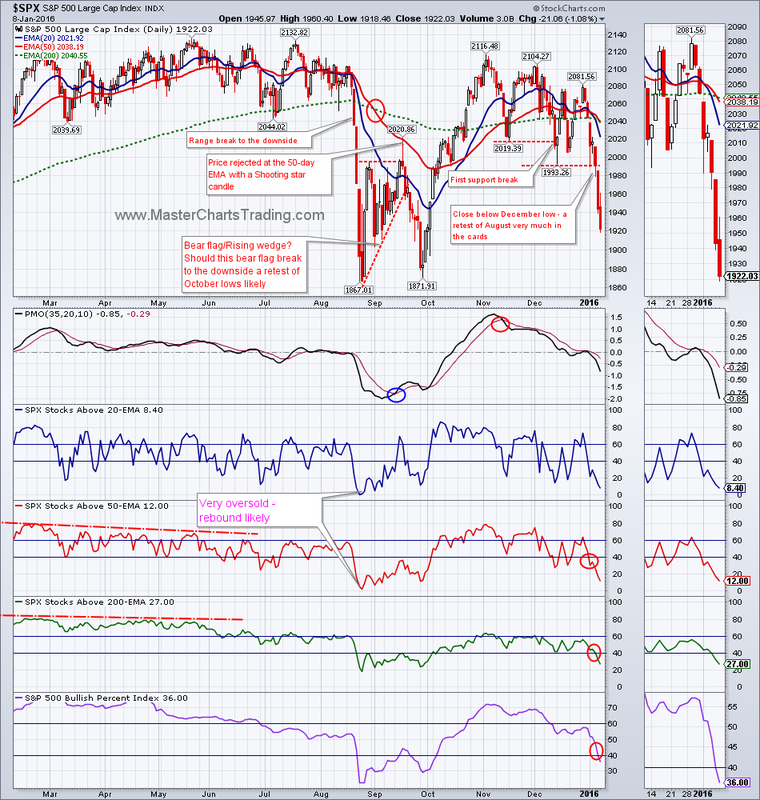

At this point a retest of August lows for S&P500 appears extremely likely. A break below the August 2015 lows would be quite bearish. The On Balance volume and the Advance-Decline Volume line for SPY has already hit a new low for the move – before the index even got to the August lows. Could volume be the leading indicator of events to come?

Very short-term SPY is somewhat oversold and could bounce to the $200 area. But this could be an opportunity for those short sellers who missed the shorting opportunity in late December to get short.

CHART OF SPY

CHART OF $SPX

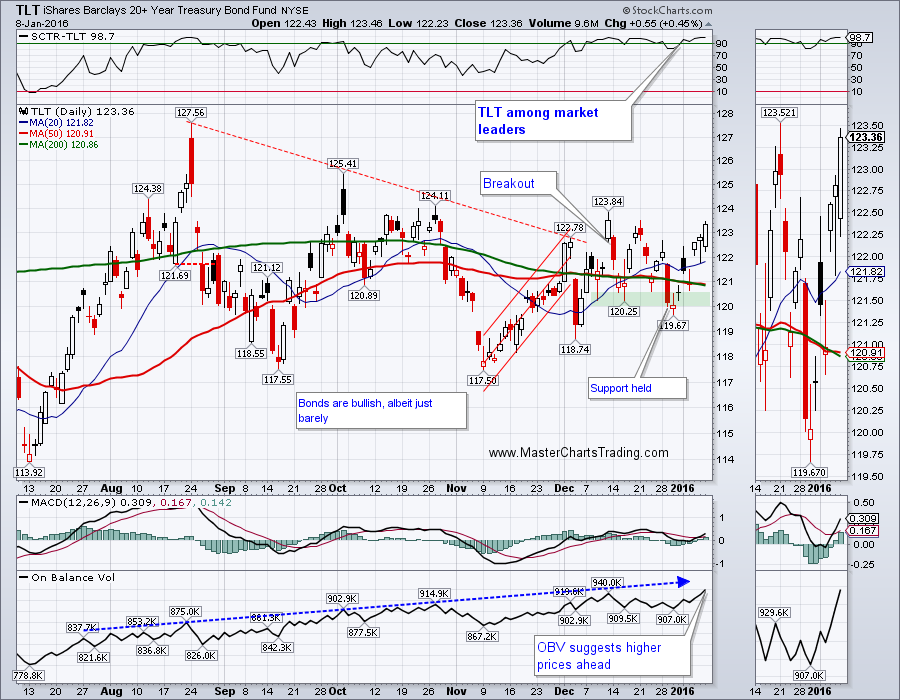

CHART OF TLT

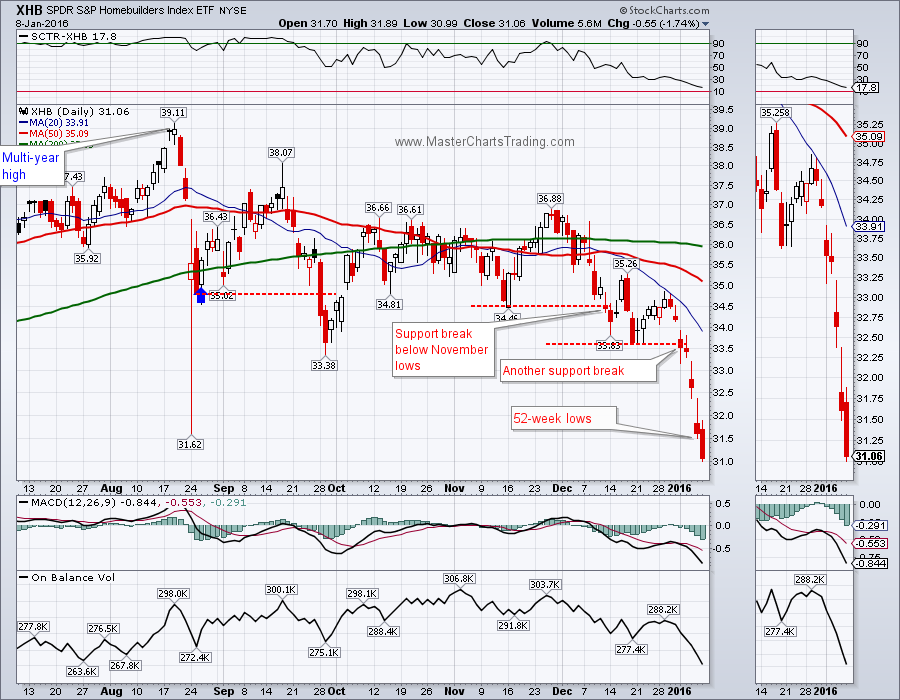

CHART OF MUB

CHART OF BSV

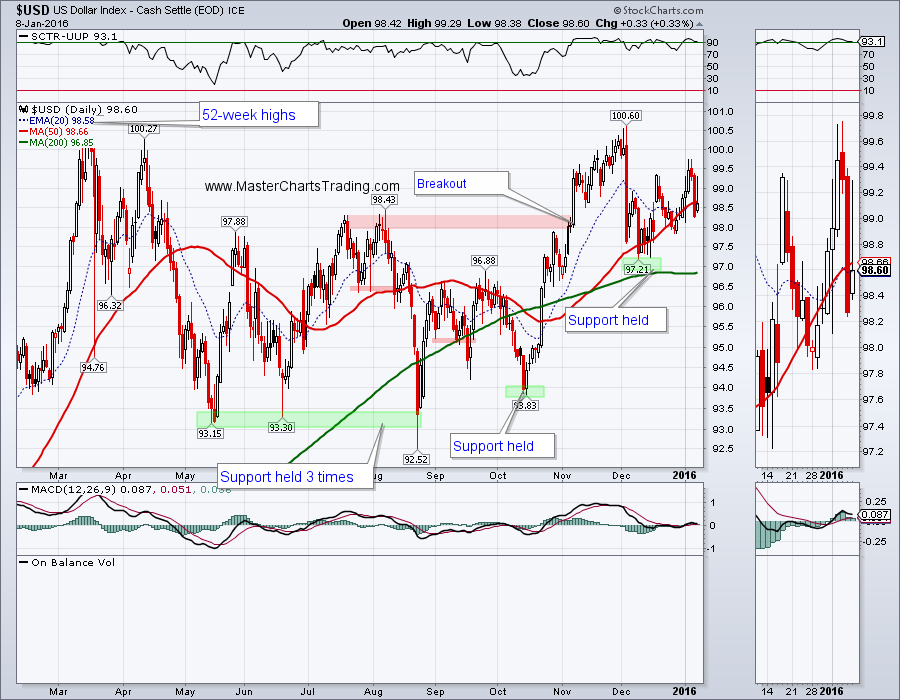

CHART OF $USD

GOLD CHART

CHART OF GDX

I had a question from a subscriber recently asking whether USO is a good investment vehicle? Here is my response:

USO is OK for trading, but it is put together using futures and does not track oil spot price in the long term. See this chart of USO. Notice that it hit an all-time low today. But oil ($WTIC) itself only hit multi-year low, not an all-time low. If you hold USO for a long time (several month) the performance will vary significantly from an underlying security.

CHART OF $WTIC

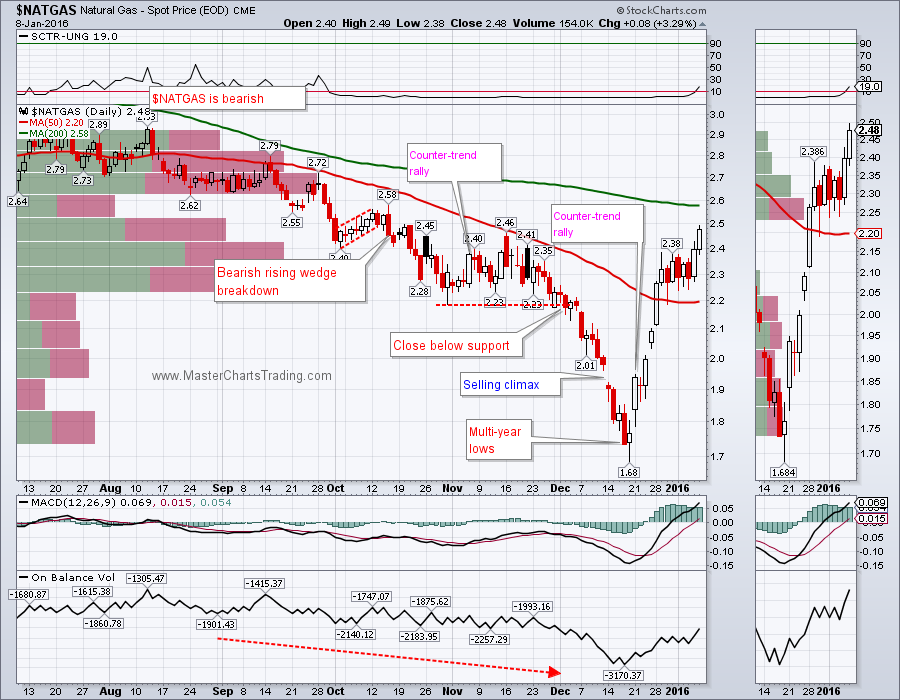

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Trade Alerts Service is now live – please sign-up here!

RSS Feed

RSS Feed