Monday April 14, 2014

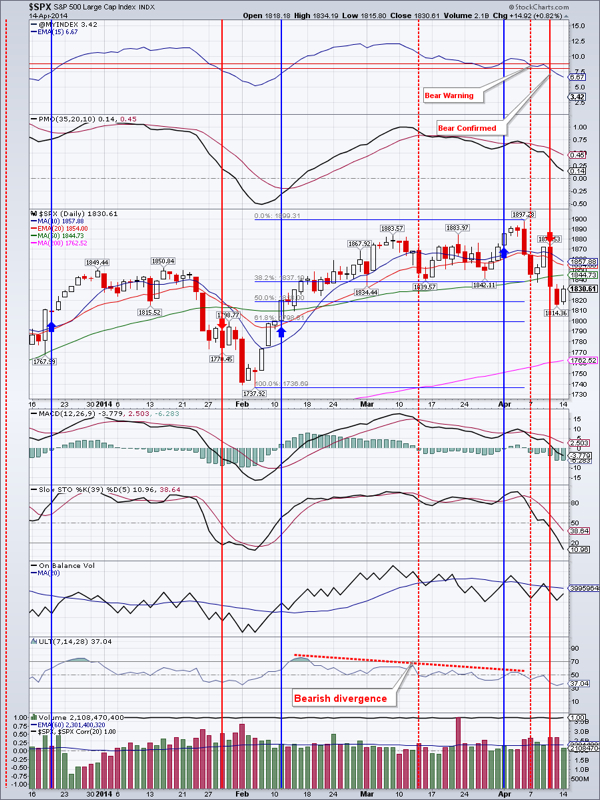

Markets Rebound, but No Buy Signal Yet. Emerging Markets Rolling Over.

Markets are bouncing from oversold levels led by the Blue Chips. Yet momentum sectors such as biotech, continue to underperform. $SPX now has established some support in the $1814 area, while resistance is just overhead around $1840. Many of the indices also had inside days today, and a close above or below these ranges would clarify the future direction.

TLT is holding the gap-up from Friday. It also had an inside day. A close above $110.79 would not only resolve the inside day to the upside, but negate the shooting star candle from March 31st. Failure here would likely cause a fall to the first support to around $109.

Emerging markets (EEM) are rolling over to the downside. As I mentioned before, they should find support around $40 and turn around. Once a turnaround is in, it could be a great buying opportunity.

Gold gained 0.66% and closed above the 50 day moving average (DMA) for the fourth day in a row. Again, the volume was light and I am afraid it just might roll over to the downside. Especially due to...

... the action in GDX. GDX gapped up, but closed basically flat with a doji candlestick, also on low volume. It has not managed to close above the 50 DMA so far. Gold miners need to play catch-up quickly. First support is at $24.13, then $23.27. Should $23.27 fail, GDX might collapse all the way back to the December-January range of $20-21.

IYR seem to have held support at $67.38. I want to see a bullish turnaround in momentum oscillators before adding to our open position.

Oil again printed a shooting star candlestick. There is definite resistance in the $104.50 area. First support is around $102.24.

Natural gas has run into resistance at $4.70. A close below $4.52 would confirm a range break to the downside.

Bottom line: Stocks are rebounding, but market breadth is still bearish.

Open positions: GDX, NUGT, IYR, TLT, EEM

Hedging positions: SPXU

|

Ready to trade? Sign-up Today

0 Comments

Leave a Reply. |

Archives

July 2024

|

RSS Feed

RSS Feed