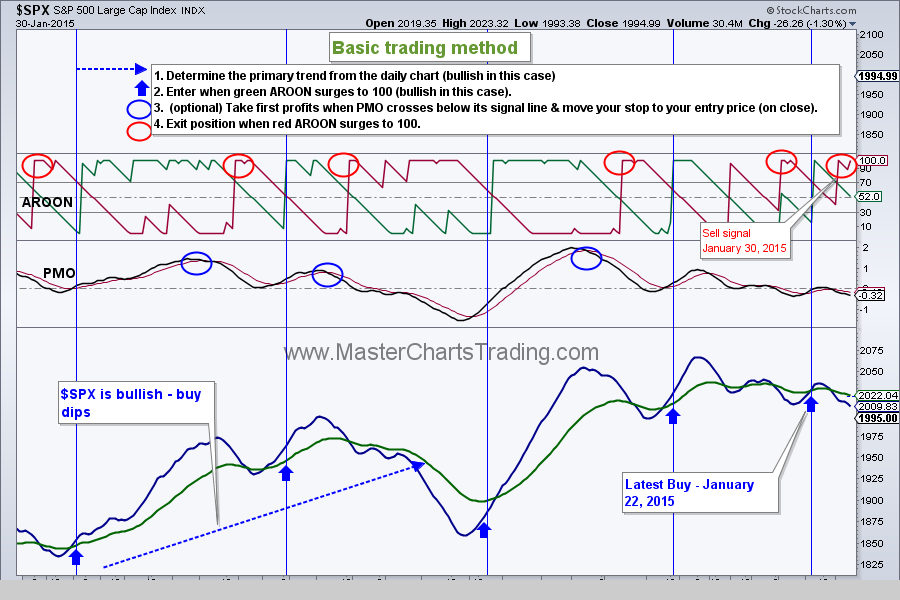

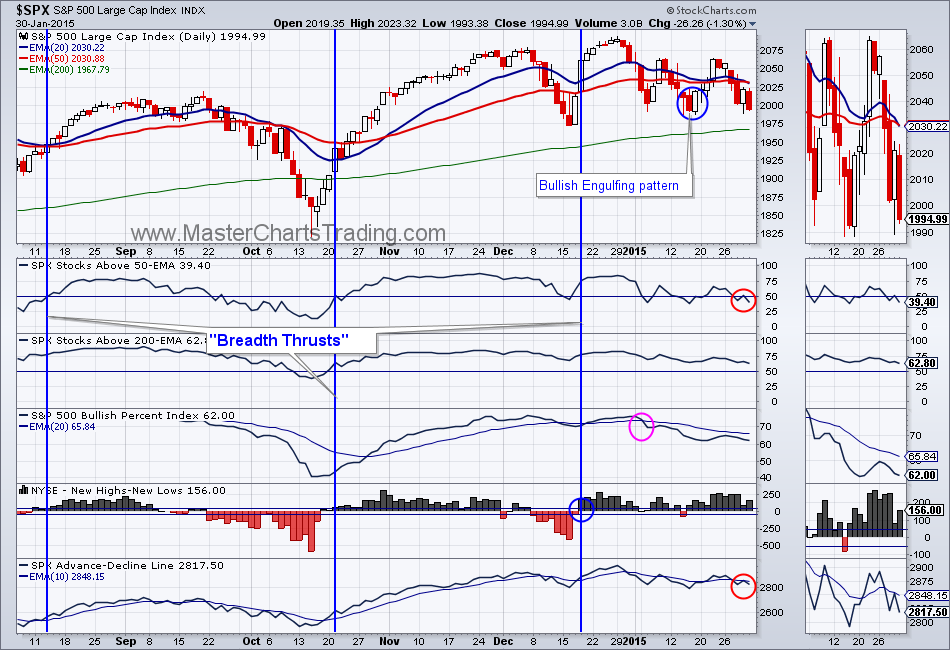

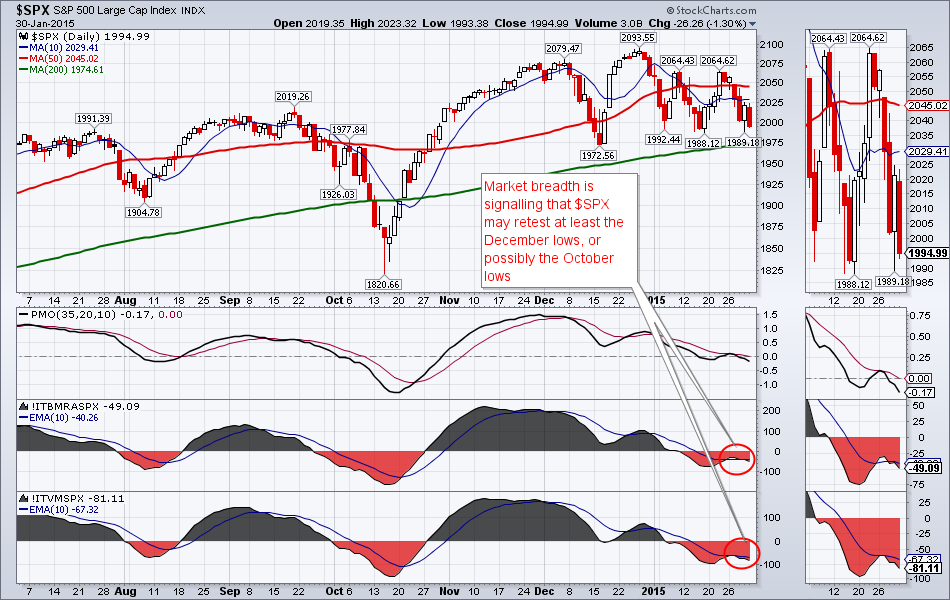

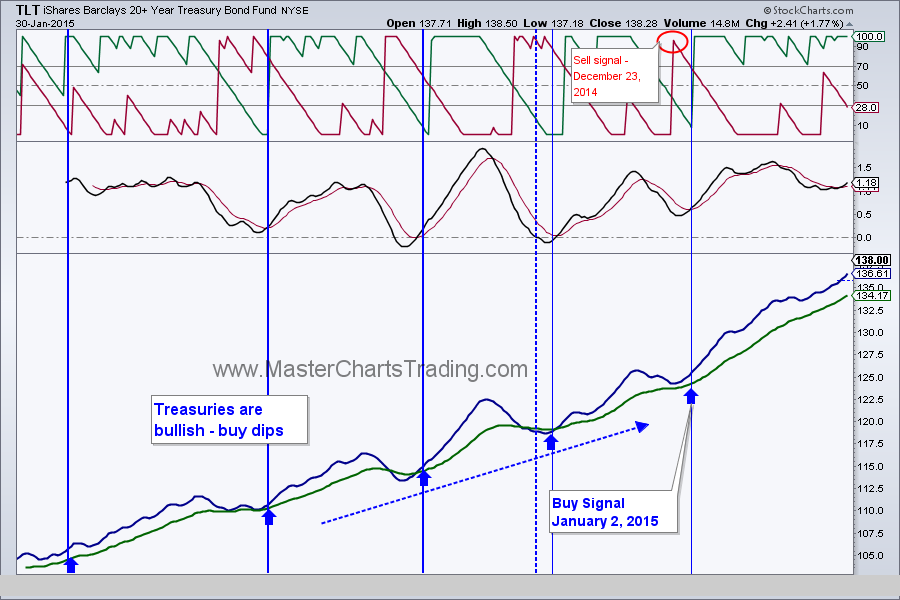

| | Friday, January 30, 2015 Weekly Market Recap. Year 2015 so far could be characterized as a year of a very choppy action. TheS&P 500 fluctuated within a tight 4% trading range for the entire January. Finally today, we got our sell signal in $SPY, but I think it may actually be a short to an intermediate term short signal and we opened a short by purchasing an inverse ETF called $SDS. Continue reading below and watch video here: http://youtu.be/2NRSjJjKxkQ |

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: TLT, GLD, GDX

New position: SDS

Closed position: SPY

RSS Feed

RSS Feed