•S&P 500 is within striking distance to fresh highs. (SPY)

• NASDAQ breaks out, while Small caps trend lower (QQQ, IWM)

•I would continue avoiding European & Emerging equities. (EEM, VGK)

•Japanese stocks look shaky (EWJ)

•Strength in bond proxies is explained by a drop in the long-term yields (IYR, PGX, PFF)

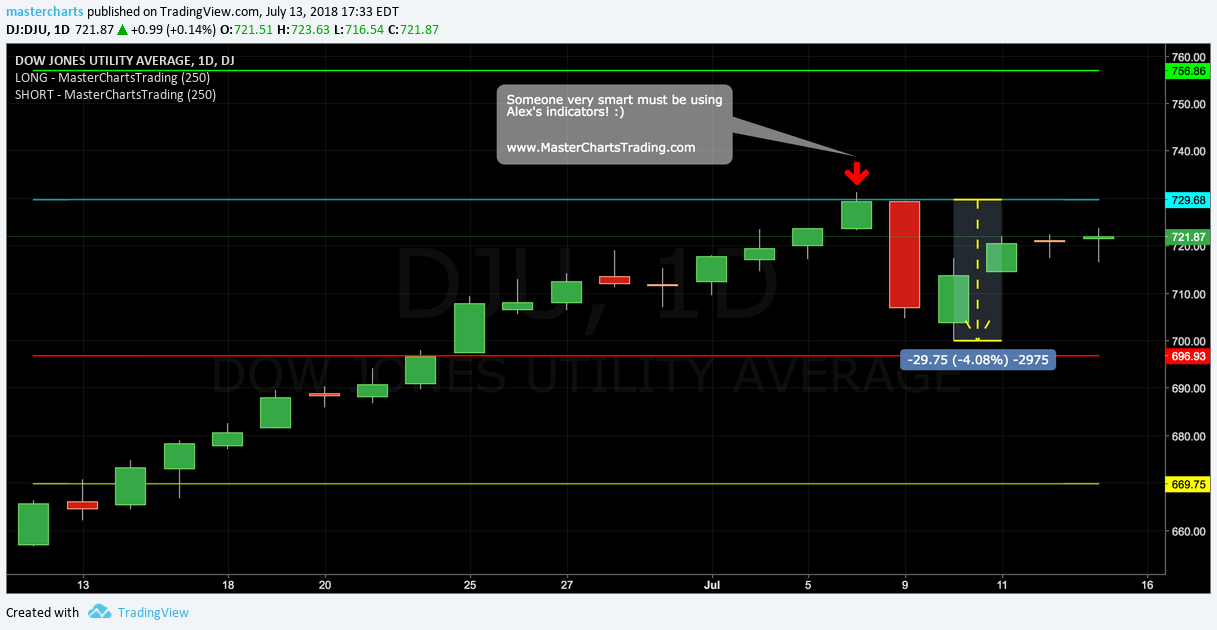

•Price action in Utilities may be indicative of a brewing breakout (XLU)

•Staples clear important resistance levels (XLP)

•Aggressive traders could short the high-yield debt now (JNK, HYG)

•Investment-grade bonds & Treasuries gain for 5th straight week, but still vulnerable (TLT, IEF, AGG, LQD)

•Dollar could correct slightly, but the major trend is Up

•Gold makes a new low for the move.

•I would short gold and gold miners on any strength (GLD, GDX)

•Oil needs to do more correcting (USO)

•Hopefully you shorted Natural Gas (UNG)

•Crypto review

•

Follow me on Twitter, StockTwits, YouTube, TradingView, Stockcharts, and FaceBook!

Watch this video on YouTube!

RSS Feed

RSS Feed