Stocks continued to push higher, while bonds (and interest-rate sensitive sectors) came under pressure, while rebound in commodities and gold continued.

- New York Stock Exchange Composite Index (NYA) closed at a new all-time high today. I mentioned in the past that the underlying Advance-Decline lines for NYA were hitting new highs and now the actual index caught-up with them. This development is clearly bullish.

- Small caps also hit an all-time high

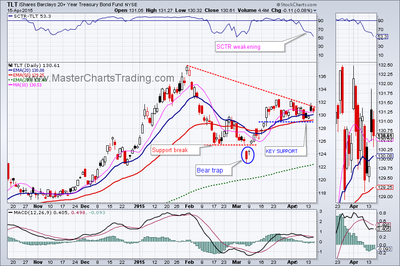

- Bonds are underperforming, but are still long-term bullish. A break below $129 for TLT may cause a serious sell-off in bonds

- Interest-rate sensitive sectors such as Utilities and Real Estate are also under pressure. XLU failed at the 50 day exponential moving average for the 6th time in the past few weeks. While IYR might be headed for a retest of March lows

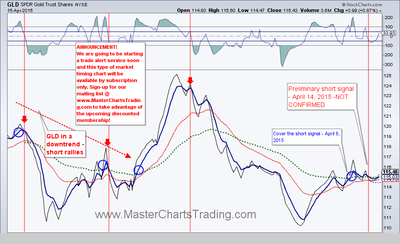

- Gold miners did not confirm an earlier short signal in gold.

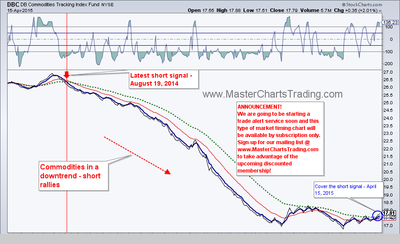

- A diversified commodities fund DBC had a cover the short signal today. DBC is still long-term bearish.

- Oil ($WTIC) managed to close above resistance as it extended its rally off the March lows. This is short-term bullish for oil

- Russia ETF - RSX gapped-and-ran above resistance and we covered our short in RSX

All of the charts discussed are located here: http://stockcharts.com/public/1229503

RSS Feed

RSS Feed