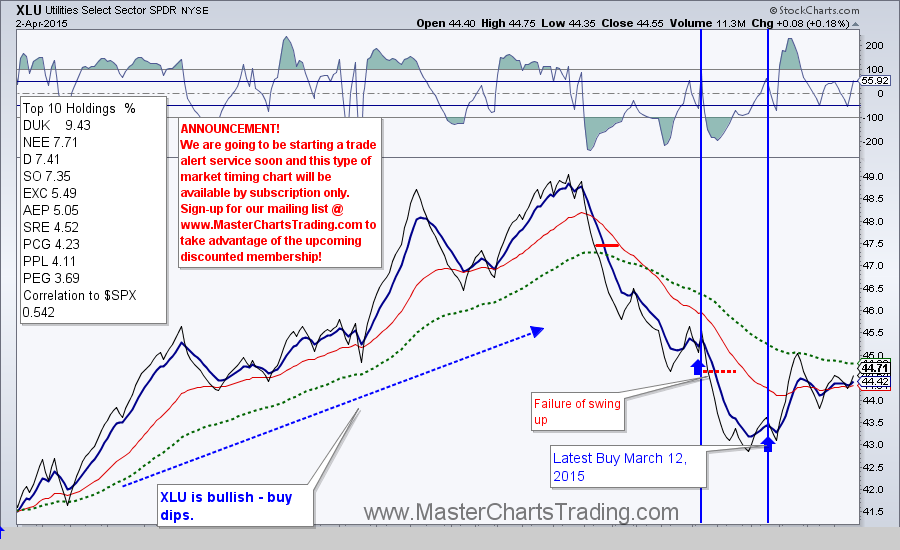

Now it looks like a bearish divergence is forming between the price of XLU and its AD Lines. On the chart below you can see XLU making a higher low, while both the AD Line and the AD Volume line are making a lower low.

Will this matter going forward? Its difficult to say, but during a general market correction Utilities will also be sold (possibly not as strongly as the general market). A close below March 26 low would likeley mean that our upswing entry from March 12 has failed. We still have a position in XLU open. XLU charts are located here and here

RSS Feed

RSS Feed