We had quite a bit of events happening today on May 6th, as multiple sell signals were triggered per our trading system.

1. Sell signal on the S&P 500. Stocks are still bullish long-term, so I will be looking for a re-entry opportunity.

2. Sell signal on the QQQ - NASDAQ 100. Same comments as the $SPX apply

3. The small caps IWM had a sell signal as far back as April 29th and remain in a short-term downtrend. No buy signal yet.

4. Selling in bonds continues. Bonds are still bullish long-term, but have weakened significantly relative to other asset classes.

Major stock and bond funds charts located here:

5. Gold and gold miners came up on our short signal and we opened a position in DUST. GDX looks especially vulnerable as it may have broken a rising wedge formation on its chart. This is usually a bearish sign. Gold and gold stocks here

6. An Outside bearish reversal looks to be confirmed in the Energy sector ETF - XLE. First target to the downside would be around $79

7. Sell signal on the XLK - Technology fund. Same comments as the $SPX apply

8. Biotech is looking vulnerable and may easily correct around 10%

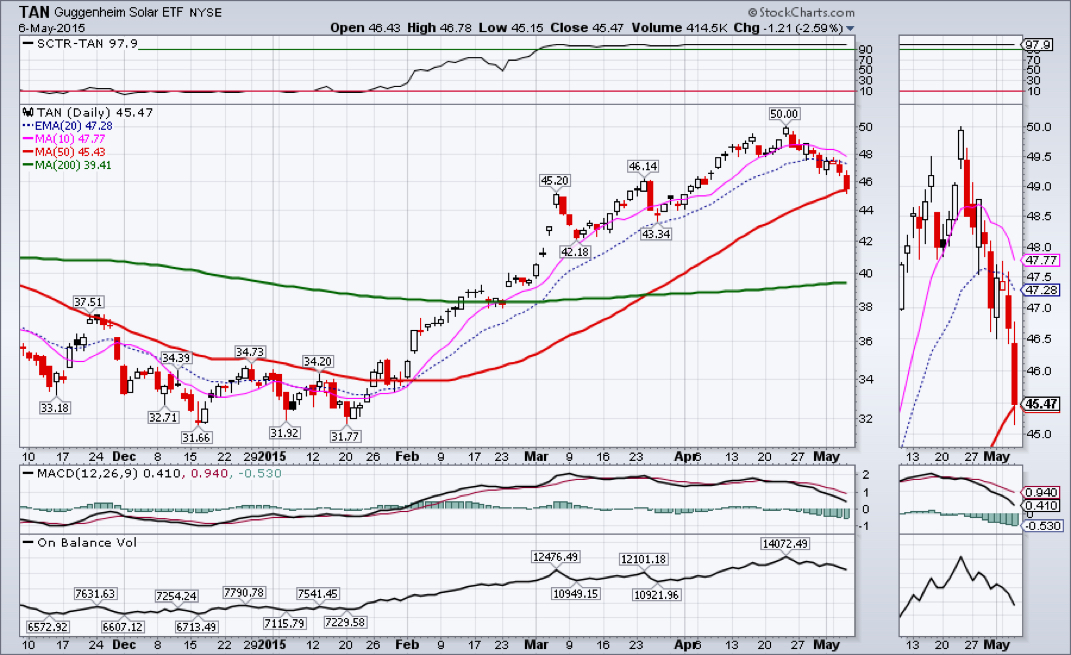

9. Sell signal on the TAN - Solar Fund. Same comments as the $SPX apply

10. Sell signal on the SMH - Semiconductors Fund. Same comments as the $SPX apply

11. Russia ETF - RSX is again looking vulnerable with a possible Outside bearish reversal on the chart.

RSS Feed

RSS Feed