Tuesday, April 29, 2014

New Highs in Dow Possible

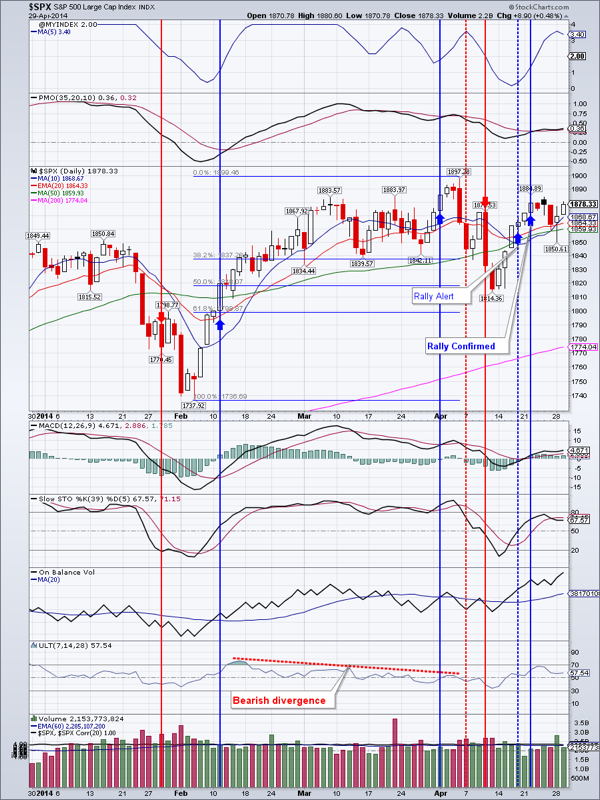

As we are nearing the end of an upswing that began April 11 it is becoming clear that a rotation is taking shape from small caps into the large caps. The Dow is poised to take out the highs from April 4th, while the Russell 2000 could easily breakdown and retest February 5 lows.

SPY - Sideways consolidation is likely for the next few days. After that this is the place to look for new highs

DIA - looks even better then SPY. New highs likely

IWM - Inside day (entire yesterday’s range within today’s range). It is somewhat oversold so unless we fall thru the 200 day moving average, we could see a bounce soon.

QQQ- is similar to IWM, but much stronger. My best guess is 1-3 more down to sideways days, followed by a bounce higher. Important resistance is at $88.21

TLT-lots of important economic news this week and a Fed statement that is sure to reverberate here. TLT tested the 20 day exponential moving average (EMA) and held it for now.

EEM-rebounded for a second day in a row and gapped up at the open. Still thinking that we will see lower prices first before the higher once

Gold-formed a doji spinning top candlestick on the daily chart, indicating indecision. Its just that-indecisive

GDX rose 1.33%. Will the gains hold? Decent support is at $23.04

IYR is pushing higher

Oil tried to rally, but was met with selling. A close below 100.33 would be bearish and open the door to prices around $98

Natural gas may have broken to the upside from the bullish flag consolidation pattern. Initial target is $5

Open positions: TLT, IYR, NUGT, EEM, DIA, UGAZ

Closed positions: QQQ, IWM

RSS Feed

RSS Feed