Our current long only allocation is 50% bonds and 50% cash. (Last week's email said 50% bonds and 50% stocks, I meant to say 50/50 bonds/cash.)

The past week exhibited more choppy action, but the trends did not change much.

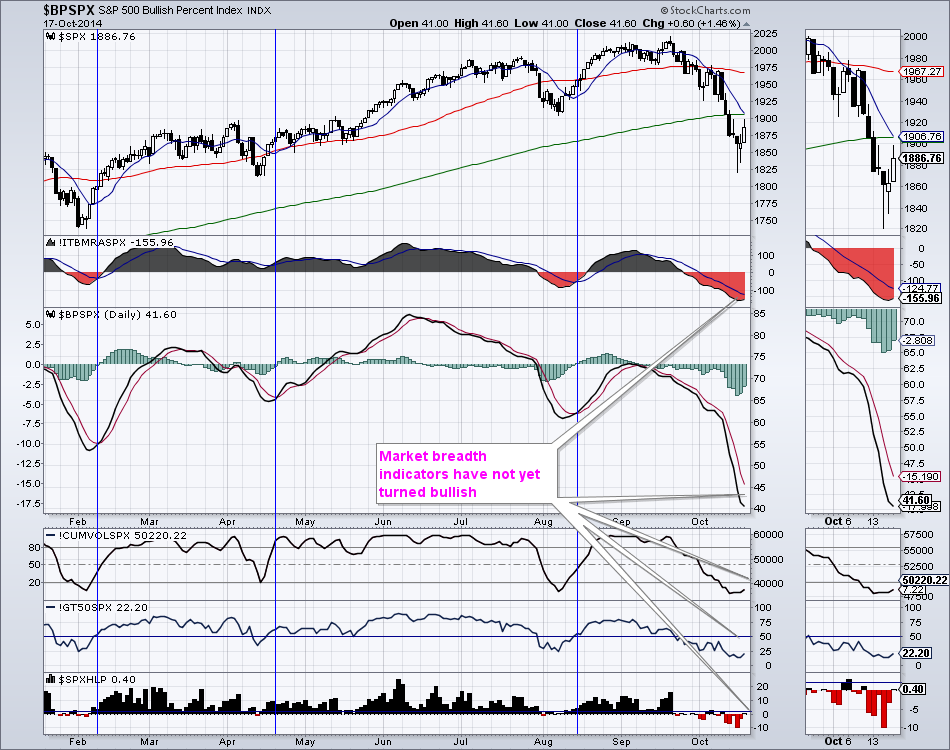

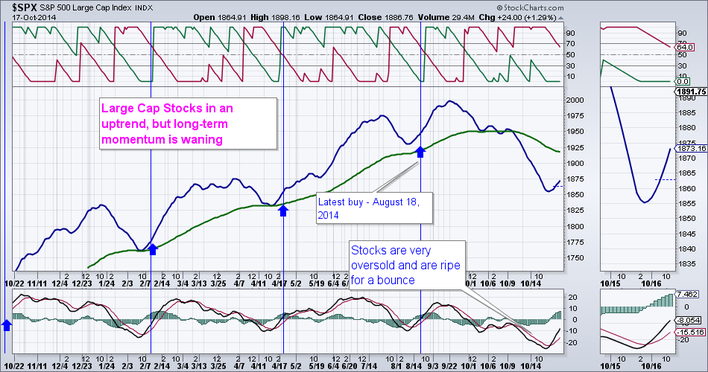

$SPX, along with other major indices, is attempting to rally, but the long-term momentum is clearly waning. Nevertheless, I still consider large cap stocks to be in a long-term uptrend until proven otherwise. Barring further weakness, I will be buying into the coming rebound rally. From the low on October 15, $SPX has rallied over 4% - not bad! However, I am not convinced that this correction is over, due to the fact that market breadth indicators have not turned bullish yet,

Bonds, especially long dated Treasuries (TLT), had a stellar week, but are now short-term overbought. We may reduce our allocation to bonds next week depending on price action.

Hopes were high for Gold Miners ($GDM/GDX), but I fear that this very minor rebound is failing and we may see yet more of 52 week lows very soon. I will send out a special email if/when gold miners break either up or down.

We continue to be bearish on commodities. Commodities Research Bureau Index ($CRB) lost a little over 1% last week.

Reply to this email with any questions. Best Regards,

Alexander Berger

www.MasterChartsTrading.com

RSS Feed

RSS Feed