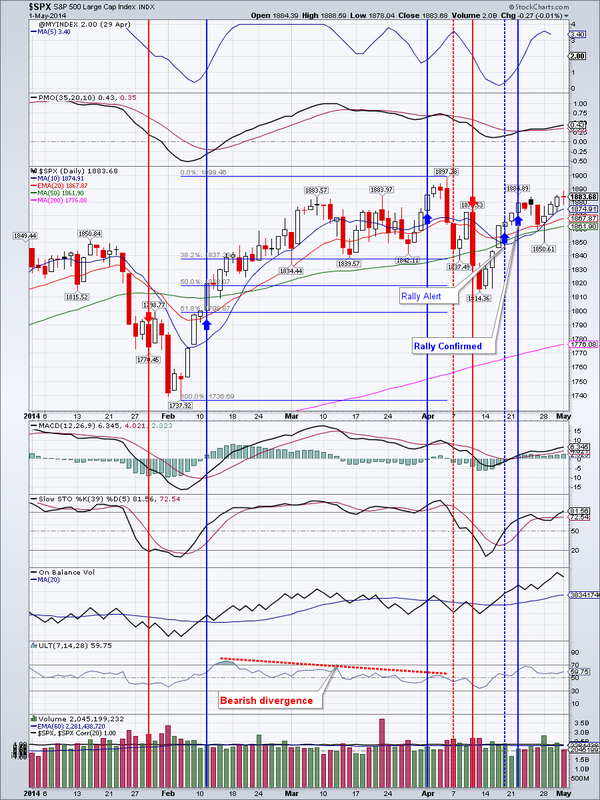

Pushing Higher

Indices were mixed with S&P 500 inches away from making new all time highs. Small caps lagged again and we did not yet get our short-term buy signal.

SPY: New highs very much possible soon. Support at 186

DIA: Very similar to SPY. Support in the $164 area

IWM: Basically flat for the day. This one is very close to a short-term and possibly an intermediate-term buy signal. Once the signal is in place, it could pop

QQQ: Also very close to a short-term buy signal. Today it tested the strong resistance in the $88 area for a second time. I believe it will push through it and may retest the highs from March

TLT: negated a topping candlestick from 4 days ago by closing at $112.02 on excellent volume. Perhaps bonds know something about the upcoming jobs report?

EEM: More indecisive action. I still believe EEM will retest the $39-40 area before heading higher (should it hold support there)

Gold is teetering on the brink. A close below $1277.40 may cause a selloff that would retest December lows.

GDX gapped down at the open-not a nice sign. A close below $23.27 may cause a retest of December lows.

IYR keeps pushing higher, low interest rates are surely helping real estate.

Oil dropped another 1/2 percent, but I think it should find support here and bounce.

Natural gas lost 1.31%. A close below $4.64 would call the bullish argument into question

Open positions: TLT, IYR, EEM, NUGT, DIA, UGAZ

RSS Feed

RSS Feed