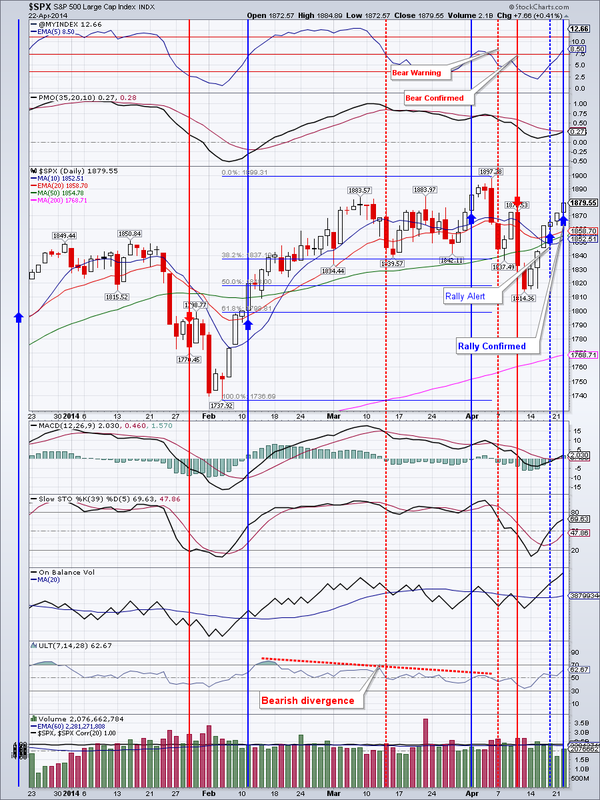

Rally Confirmed

On Wall Street stocks gained. All indices were up today with small caps and the NASDAQ leading the markets higher. Some sectors were up strongly such as biotech (IBB). It gapped up and ended over 3% higher on good volume.

Market Breadth Index, has confirmed rally that may take indices to new highs. We have added to our long positions yesterday.

TLT held support at $109.70 and closed in the plus about 1/3 of a percent. This is concerning for the stocks. Perhaps bonds are seeing something stocks do not?

EEM lost about a quarter of a percent. As I mentioned before, EEM may roll over here and retest at least the April 15 low at $40.60, but possibly the 50 day moving average, currently at $40.01.

Gold is at a critical juncture here. Today it closed below April 15 low at $1283.10. A close below April 1st low at $1277.40 may cause selling all the way down to December lows at $1181. However, there seems to be a bullish divergence developing in the Ultimate oscillator. On April 1st, the ultimate oscillator made a lower low then today, while the price of gold made a higher low today. Coupled with the fact that gold is oversold short-term, we may get a bounce.

GDX may have already put in a short-term low yesterday and started this rebound in gold related assets. There is resistance just ahead at $24.19 from the gap down.

IYR is pushing yet higher possibly propelled by lower interest rates.

Oil failed at resistance with a drop of almost 2 percent. Next support is at $101.34, then $100.83

Natural gas is tracing out a bull flag pattern and we opened a small position in UGAZ. My initial target is around $5

Open positions: TLT, IYR, EEM, DIA, QQQ, TNA, UGAZ (new small position)

Hedging positions: DUST

Bottom line: Markets are pushing higher for now

RSS Feed

RSS Feed