Tuesday, March 31, 2014

Renewed Push Higher

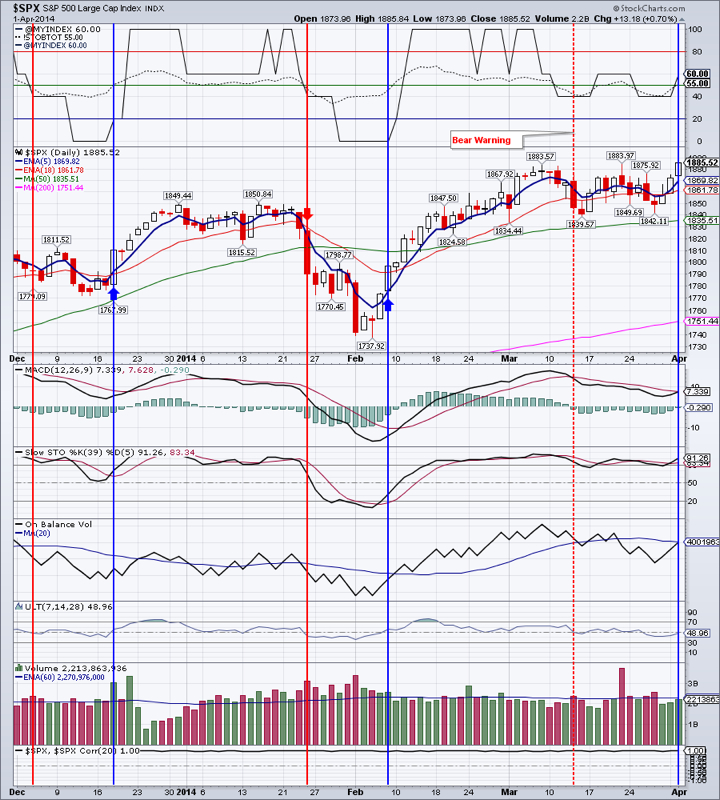

Indices gained strongly on decent volumes today. NASDAQ was the leader gaining 1.64%, followed closely by the small caps that tacked on 1.34%. The Dow almost made a new intraday high while the S&P 500 closed on all-time high.

Market breadth improved significantly. I am lifting the Bear Warning on the daily charts and changing the current state of the markets to Bull Confirmed. We are likely to continue making new highs.

EEM had another great day, making it the 9th straight up day in a row. We are almost upon resistance at $41.85 so a throwback to around $39-40 would not surprise me. This should be a good buying opportunity.

TLT seems to have confirmed the Shooting star from yesterday with a significant drop on large volume. TLT needs to find support in the $105-106 area quick, or it will risk undoing the entire 2014 up-move.

Gold is showing signs of life. It only dropped $4.50 on very small volume. A rebound is extremely likely at this point.

GDX is looking as if it already started the rebound. A close above $24.35 would confirm the change in direction to up, while a close below $23.27 should cause further selling to at least $21.80. I believe the former is about to happen.

IYR is looking much better then just a few days ago. It cleared first resistance at $68.07. It also just had a positive MACD crossover. It is likely to take out $68.54 and continue higher.

Natural gas is continuing its downward slide; today it lost almost 2.5%. My minimum downside target is $4.00, but it could go lower. I may add to DGAZ should this slide continue.

Oil had a nasty day closing down 1.84%, slicing through and closing below both the 200 day moving average (DMA) and the 50 DMA. As long as it finds support around $97 it could still continue its rally, but more likely a retest of January low should soon transpire.

Bottom line: Markets are rebounding and making new all-time highs, which show strength in stocks.

Open positions: GDX, IYR, TLT, DVY, ETV, EEM

Hedging positions: DGAZ (may add to shortly), SDOW (will close shortly)

RSS Feed

RSS Feed