Wednesday, April 30, 2014

Small Caps May Present a Buying Opportunity.

Generally it was a good day for stocks on Wednesday. All major indices gained lead by IWM, which tacked on almost ¾ of a percent. The stage is set for IWM to play catch-up with the other indices and make new highs.

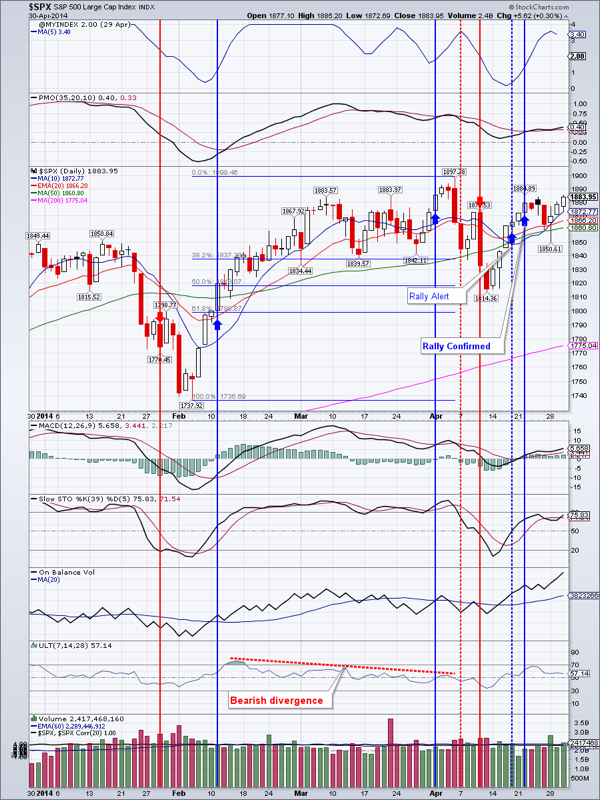

SPY: pushing higher towards new highs. Good support is around $185

DIA: new all-time closing high. More of the same is likely. Good support is around $162.70

IWM: A buy signal is almost here. Below the 200 day moving average should provide good support. Overhead, resistance at $115.02

QQQ: should continue higher. Support is at $85.11, resistance at $88.21

TLT: overbought. Bearish divergence from March 1st peak in the Ultimate oscillator continues

EEM: Still struggling to regain upside momentum. There now appears to be some support in the $40.60 area

Gold: This could still fail spectacularly should it close below $1268. For now support is at $1268.40 and plenty of overhead resistance at $1300, $1306,$1318 and $1331.40-take your pick

GDX: Similar to gold-lots of overhead resistance

IYR: Its unstoppable-until something breaks (probably TLT). First support is at $68.89

Oil: may have broken down. There is support at $98.86, then $97.50 area. Should that give, oil may retest January lows

Natural Gas: I believe it broke above resistance the day before yesterday when it closed at $4.83. Consolidation at these new levels would make sense before a push higher

Open positions: TLT, IYR, EEM, NUGT, DIA, UGAZ

RSS Feed

RSS Feed