Wednesday April 16, 2014

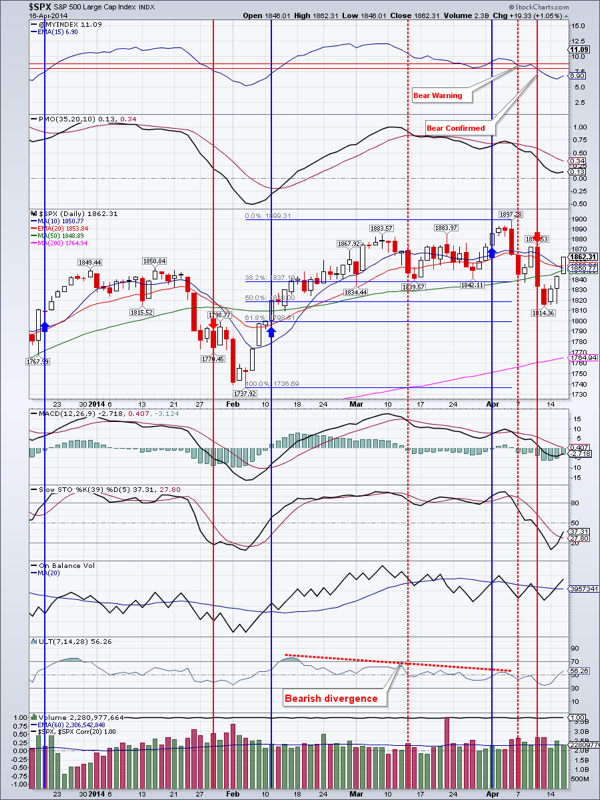

Still No Buy Signal.

Indices experienced a rather strong rally today. $SPX even gapped up and closed at day’s highs indicating good buying pressure. Yet, we are still waiting for a buy signal.

From the market breadth perspective, this signal has not yet occurred. Market Breadth Index has turned up, but is still in the negative territory indicating contraction.

EEM gained 1.26%. It is possible that this was it as far as a throwback. But I still feel that we may retest $39-40 area before resuming the uptrend. This is because MACD has rolled over and is now negative and On Balance Volume is making lower lows.

Gold stabilized somewhat with an Inside day, but I have a sinking feeling about it. A break below yesterday’s low at $1284.40 would almost surely cause a retest of December lows.

GDX is hanging on by the tips of its fingers. A close below $23.27 would open the road down to around $20. We have sold all of our gold related funds and opened a very small position in DUST. Should GDX break below $23.27 we will add to DUST position.

IYR has taken out the high from April 10 by closing above it. Real estate is likely to benefit from the lower interest rates.

TLT is pushing higher towards my target of around $115. It is short-term overbought so a retrace to around $109.50 is likely

Oil seems to be having a lot of trouble getting above $105 and might roll over here. First support is around $101.90.

Natural gas is still hanging in there. It may have found support around $4.53.

Bottom line: Markets are rebounding, and we will enter if/when a buy signal is given.

Open positions: IYR, TLT, EEM, Closed: GDX, NUGT

Hedging positions: SPXU, DUST (new very small position)

RSS Feed

RSS Feed