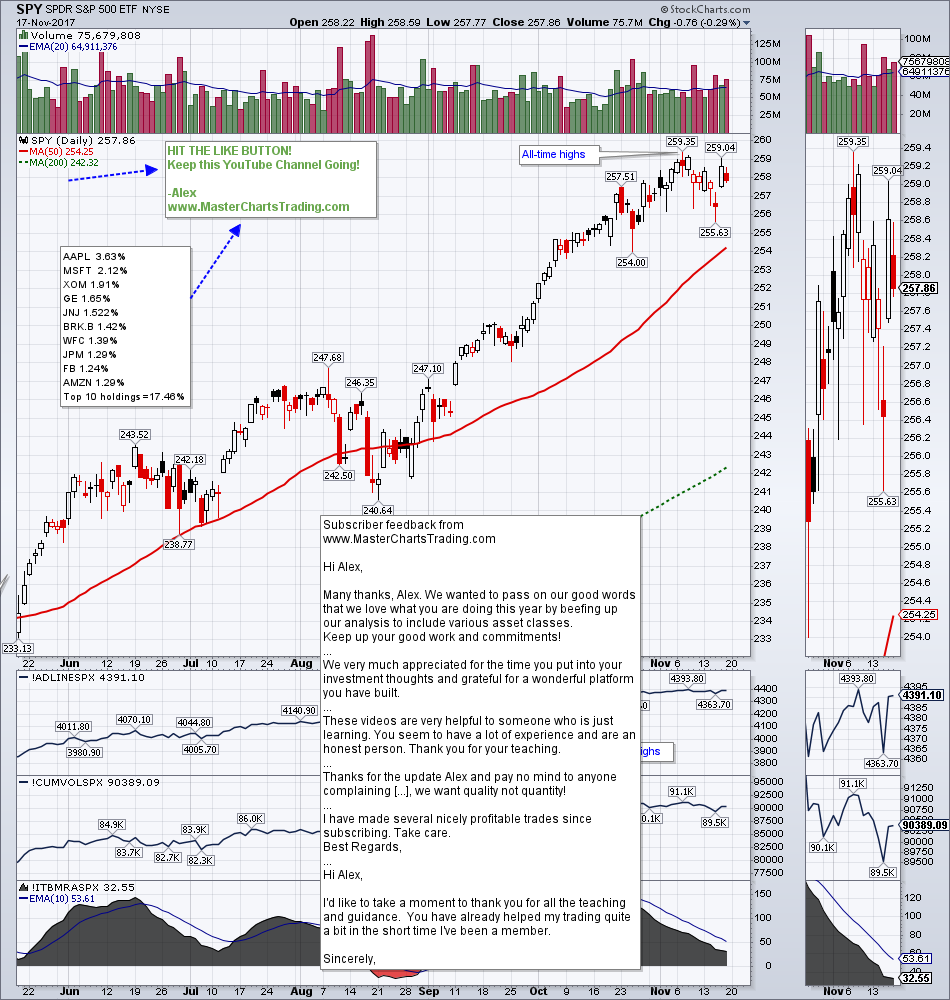

•SPY looses a fraction of a percent, while QQQ and IWM push strongly higher

This is a “risk-on” posture

Consumer Staples (XLP) continues with its up-move

Transports (IYT) likely weigh on the general market

Utilities (XLU) find resistance at R2 Pivot, but bullish overall

Biotech is bullish, despite the recent selling

Solar stocks keep pushing higher

•Bearish patterns in bullish instruments usually do not work out

•Junk bonds find support and rally

TLT turns choppy as it gaps down, then fills the gap same week (TLT is more volatile then SPY)

•The Dollar may have already rolled over, as Euro and Yen surge

Time to buy Mexican Peso?

•Oil bounces off 1st support, while Energy (XLE) diverged lower

•Natural gas is leaning bullish

Sign up here to get the Elite indicators for Tradingview (they are currently part of the Basic service, but will cost higher soon): Featured Products

Charts mentioned in this video are located here: stockcharts.com/public/1229503

Watch this video on YouTube here: youtu.be/Qs1M2f4LJs0

RSS Feed

RSS Feed