|

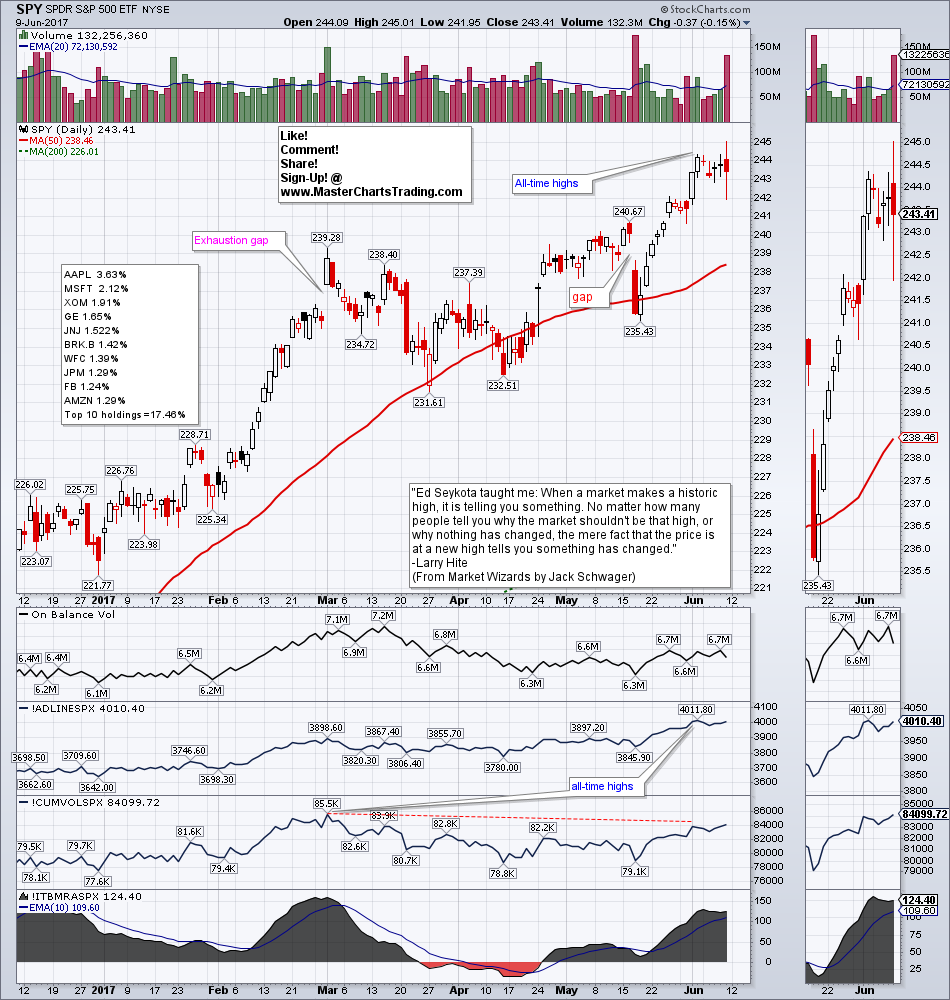

•Stocks experience a violent Friday as NASDAQ sells-off hard. Other indices make fresh all-time highs and close in the green. Selling in QQQ is due mostly to selling technology stocks. SMH losses almost 4%, while XBI holds up relatively well. AAPL drops for disputable reasons – make your life easier and stick to the technicals! XLF narrowly avoids a Head and Shoulder break and rallies. IWM makes fresh high ignoring divergences. Other sectors pull back from all-time highs in an orderly fashion.

•Bonds pull back from 2017 highs. Stocks slightly outperform TLT for the week. •US Dollar could be done dropping and ready to retest its support break. November lows could still be retested though. •Gold hits resistance zone and pulls back. If Dollar is going to strengthen, gold will suffer. Mild bearish divergence shows up on GDX chart. This could be simply due to overbought conditions being “worked-off”, or the beginning of a bigger pullback. •Oil drops for the 3rd consecutive week as it approaches May lows. XLE is approaching 52-week lows, but has a strong weekly candle suggesting a bounce might materialize. •Natural gas prints somewhat weak bottoming weekly candle Charts mentioned in this video are located here: stockcharts.com/public/1229503 |

Watch this video on YouTube!

|

|

Ready to trade? Sign-up Today

0 Comments

Leave a Reply. |

Archives

July 2024

|

RSS Feed

RSS Feed