Stocks Are Poised For a Correction

Friday was a very large distribution day for the major indices. Even though the losses were very limited, the volume for Friday was very telling - it was huge! The indices printed what appear to be shooting star candlesticks. Coupled with the large volume, it looks be an ominous sign.

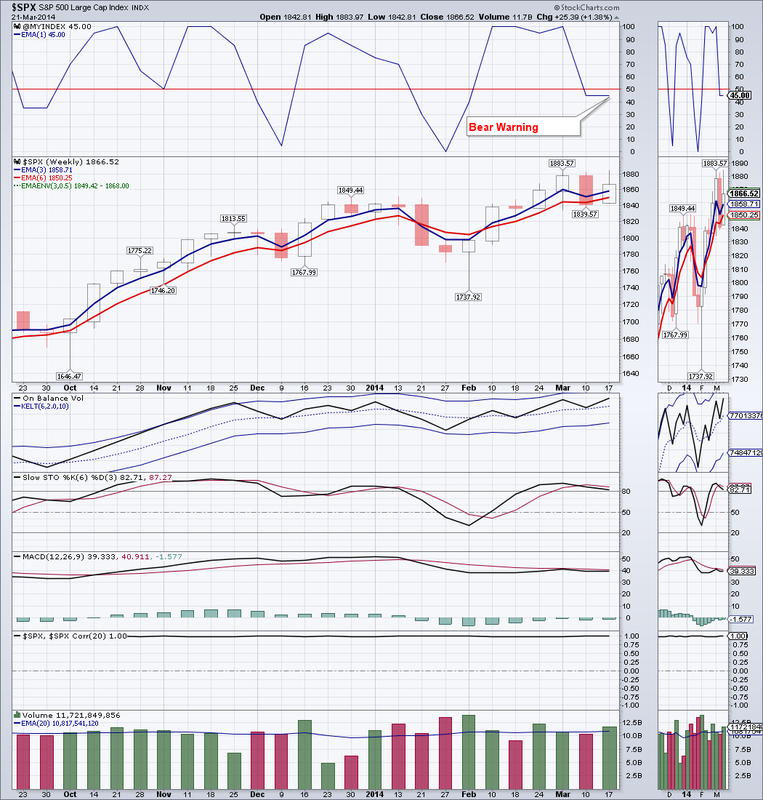

Market Breadth Index, the $VMBI, has flipped into Bear Warning on the weekly charts. As a result we have further pared our equity exposure.

TLT gained strongly on Friday on good volume. This further indicates that a shift away from risk assets is taking place. A close above $109.18, preferably on weekly basis, would continue this rally in treasury bonds that started in late December

Gold lost almost 3.5 percent for the week, but it may have found support in the $1320 area. Next week we will see if a turnaround is upon us and a rally will continue.

IYR held up well and may have found support in the $66.60 zone. Ideally a close above $68.85 should confirm a turnaround; otherwise we are still in danger of rolling over and meeting with the 200 day moving average.

Oil may have found at least a temporary support in the $97.30 area. We still think that the bigger trend is down and a retest of early January low at $91.24 is highly likely.

Natural Gas is deeply oversold, so a rebound to the 50 day moving average is possible. Again, we believe the bigger trend is down to the 200 day moving average, currently at $4.00

Bottom line: Stocks are poised for a correction

Open positions: GDX, IYR, DVY (reduced position further), ETV (reduced position further), TLT (increased position)

Hedging positions: TZA, SDOW, DGAZ

RSS Feed

RSS Feed