Monday, March 24, 2014

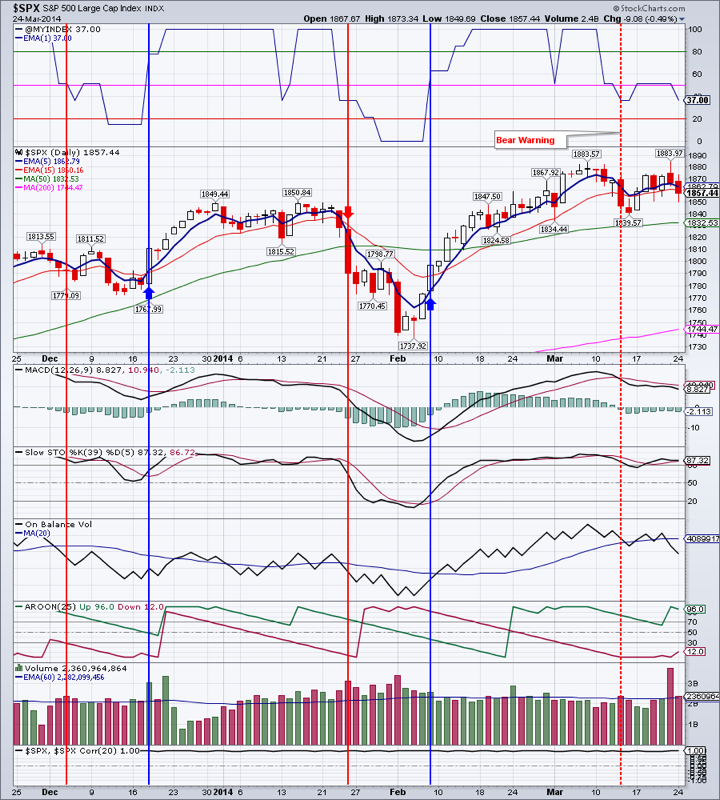

Stocks Look Precarious, While Bonds Near a Breakout

Major indices dropped on heavy volume for a second day in row. NASDAQ was especially hard hit, closing just above the 50 day moving average (DMA) - a line in the sand where many investors will sell.

Market Breadth Index, the $VMBI, is confirming this decline and we further cut our stock holdings

TLT gained in the face of market selling. It currently stands only 18 cents away from closing at 10 month high. On Balance Volume is showing continuing interest in Treasuries. It should also be noted that a Golden Cross (50 DMA crossing above the 200 DMA) occurred in TLT on March 5th.

Emerging markets bucked the trend and gained almost 1 percent. There is a still lot of overhead resistance in the $39.40-40.22 area. EEM needs to close above its 200 DMA to prove itself before we get interested again.

Gold was a big looser today. It closed down almost 2% to end at $1309 on a bearish candlestick and above average volume. These all point to lower prices ahead. The 50 DMA lies just below at $1300.48. Should gold close below it, we will likely cut our GDX holdings.

GDX lost 4.68% and closed below its 50 DMA. This is an ominous sign for both gold and the miners.

IYR sold-off together with the markets. It is looking rather unsteady also. The momentum indicators (MACD, Stochastic) have rolled over in early March. On Balance Volume is still positive, so we are not ready to call the top in IYR just yet.

Natural Gas may have found at least a temporary support. We have pared our position in DGAZ and locked in profits. A rebound to somewhere between $4.50-4.80 is likely.

Oil is knocking at the 200 DMA, but is yet unable to break above $100. Momentum is still to the downside. A re-test of January low is likely.

Open positions: GDX, IYR, TLT, ETV (very small), DVY (very small)

Hedging positions: TZA, SDOW, DGAZ (took profits)

RSS Feed

RSS Feed