Monday, April 28, 2014

The Moment of Truth for Small Caps.

Indices were mixed today with large caps and blue chips gaining while the small caps underperformed again. IWM today touched the 200 day moving average (DMA), but pulled back with what appears to be a hammer candlestick. Failure here would be rather bearish for the small caps.

Market breadth deteriorated slightly more, especially for the NASDAQ, but it may be approaching oversold levels and a breadth thrust should commence soon.

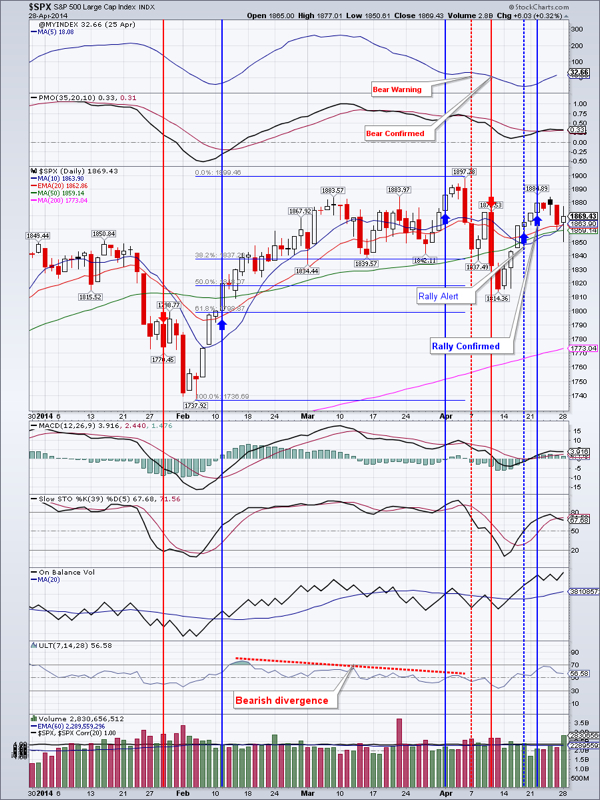

SPX reaffirmed support in the 1850 area. Initial resistance is at 1897

NASDAQ may be finding support in the 4000-4070 area. It may retest the upward sloping 200 DMA currently at 3967 before rebounding to first resistance at 4177.

The DOW looks strong and new highs are very much possible

TLT confirmed a shooting star from Friday and may head lower. It is already at first support. Next support is at $109.98

EEM may have made the bottom for now, but still looks rather weak.

Gold had an inside day. A breakout in either direction should clarify which way it would go.

GDX lost almost 2 percent, but held support for now. Next resistance is at $24.48. I am mildly bullish on gold and GDX

IYR keeps pushing higher

Oil probably stopped correcting. Next support is at $98.86, while strong resistance is at $104.99

Natural gas had a good day and gained over 2%. It almost broke above the bull flag it is tracing out. A close above $4.80 would open the door to at least $5

Open positions: IYR, TLT, EEM, NUGT, QQQ, TNA, DIA, UGAZ

Bottom line: General markets are bullish, but further weakness may cause a sell-off in small caps

RSS Feed

RSS Feed