Tuesday, February 25, 2014

All major indices printed inside day candlestick patterns today. An inside day occurs when the entire today's price range falls within the yesterday's price range. A close above or below February 24's range should provide a short-term direction for the markets.

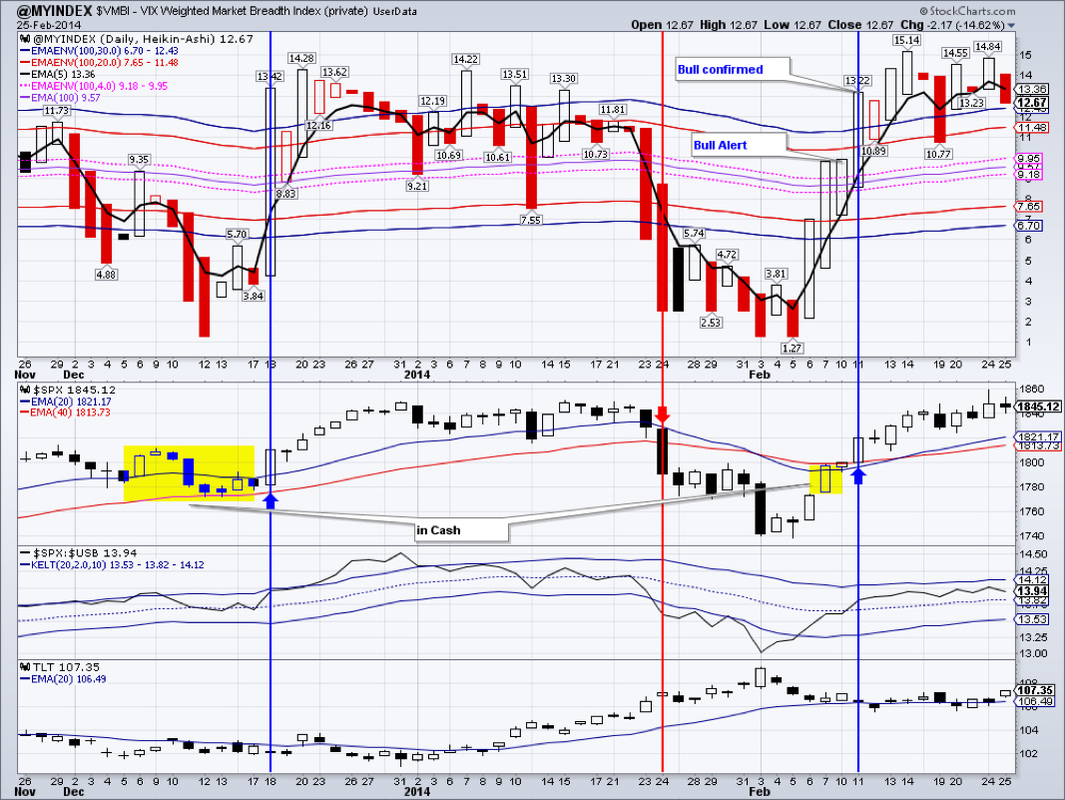

Our market breadth index, the $VMBI, is showing continuing bullish reading.

TLT gapped up at the open and closed at day's highs - an impressive performance! It seems that the bond market may be sensing some unease. A Wednesday close above 20 day eMA may compel us to revisit a long in this ETF.

DBC reaffirmed support in the $26.09 area despite an over 6% drop in natural gas prices and an almost 1% drop in oil prices. It is important for crude oil to stay above $100 in order for DBC to continue rising.

$GOLD continued its steep uptrend. It is getting a bit frothy up here with an almost non-stop upward move since December 31st. However, if gold closes above $1361.80 then the broken resistance will become a new support and a run to $1415 is not out of the question.

GDX has started its current run on December 19 and gained more then 33% since. It did close above resistance yesterday, but fell below it today. It seems that gold miners lead gold price. If this premise is true, then we could see some downward pressure in the gold miners and a correction to the $24 area is possible.

IYR is running into resistance. It printed 4 shooting stars over the past 5 days. A pullback to the $65 area is not out of the question.

EEM is again looking precarious with a weak close today as China markets weighed on this emerging market ETF.

We are long: GDX, IYR, DEM, DVY, ETV

RSS Feed

RSS Feed