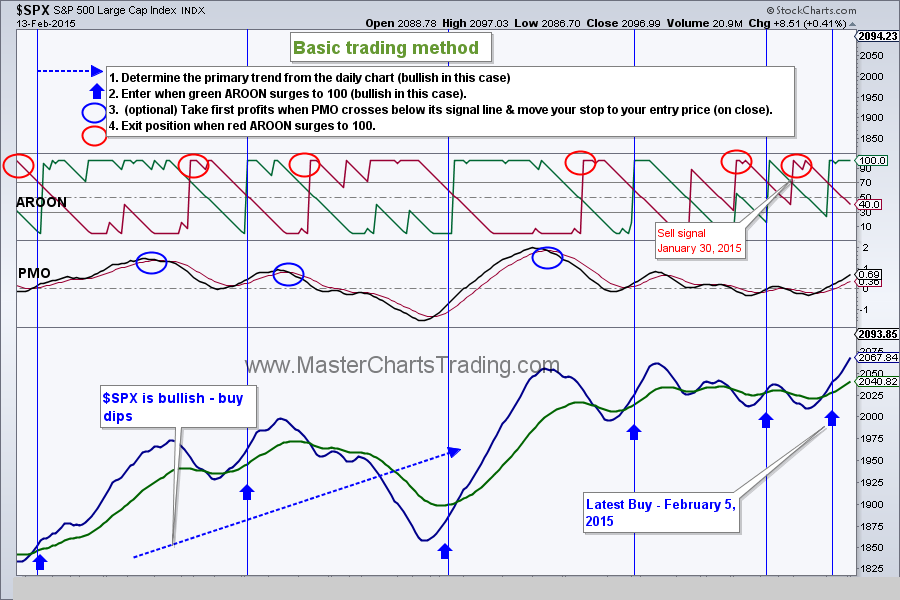

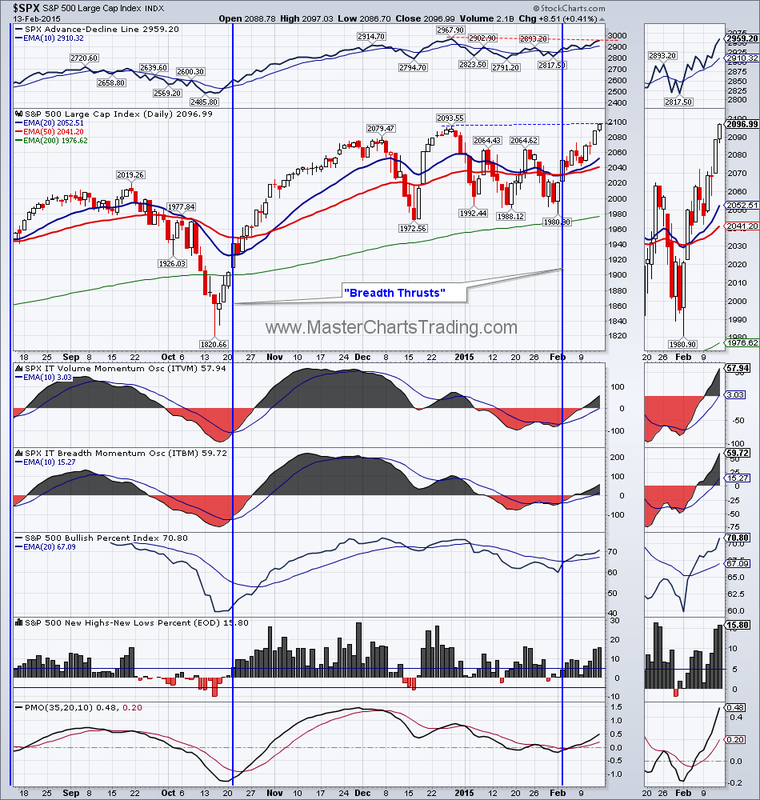

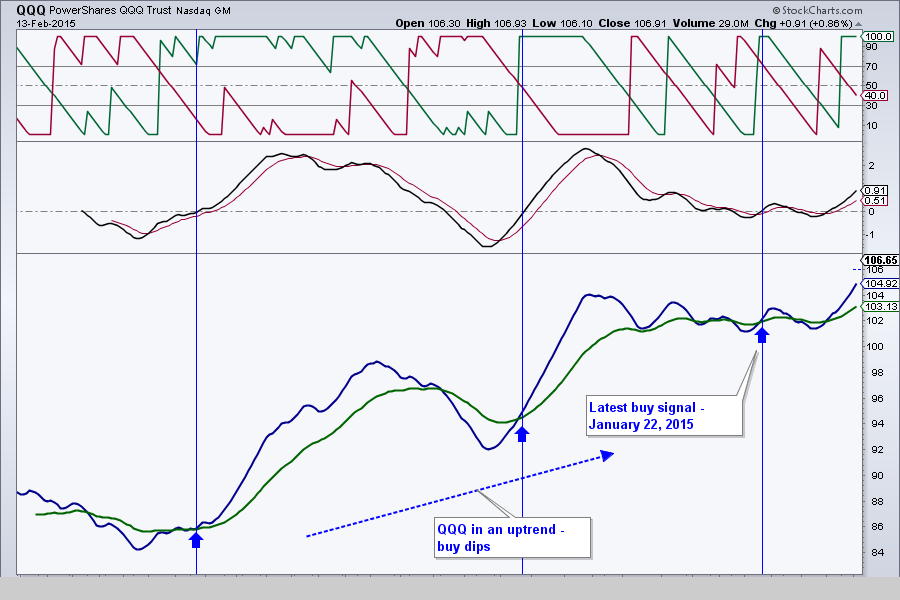

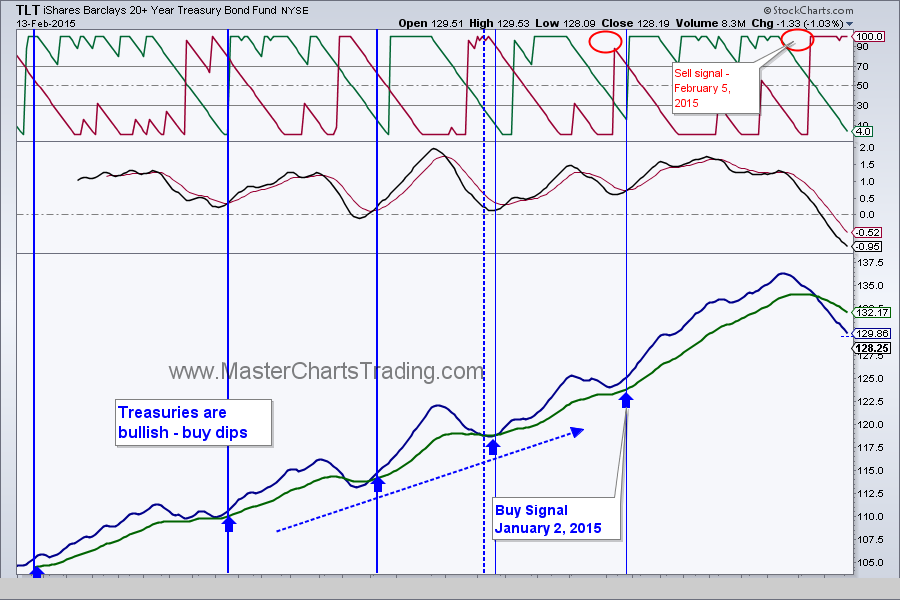

| www.MasterChartsTrading.com Friday, February 13, 2015 Weekly Market Recap. Watch this week's video here Last week I mentioned that we were more likely to get a bullish resolution rather then a bearish one from the trading range that the S&P 500 has been stuck in for the past few months. We indeed got our bullish resolution on February 10 with a close above 2065. Since then, most major indices hit new all-time highs. The indices are not yet overbought and new highs are likely to continue. Charts here and here for $SPX | |

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: SPY, DUST

New position:

Closed position:

RSS Feed

RSS Feed