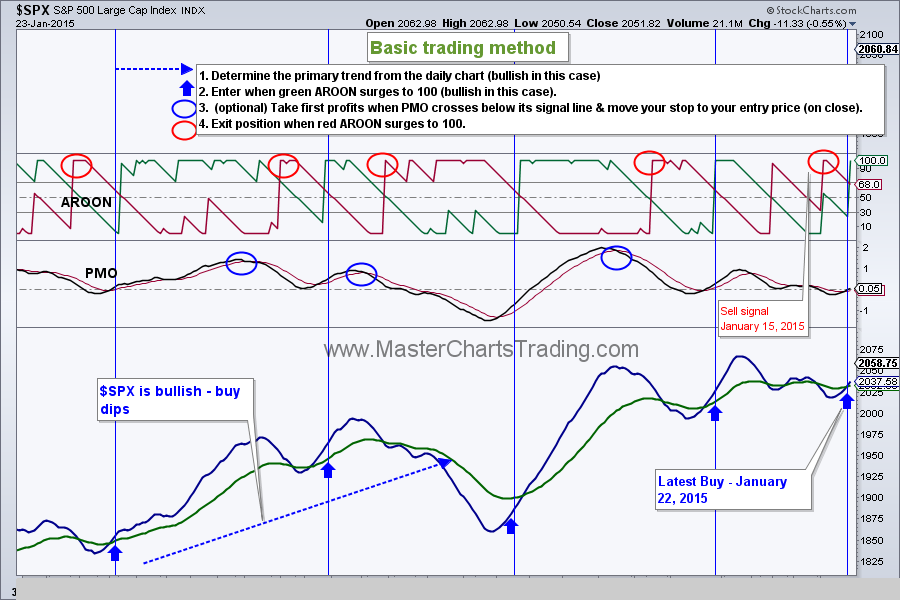

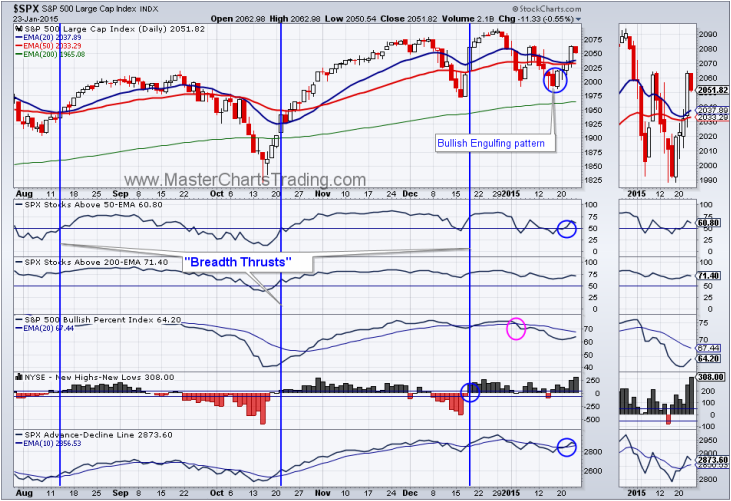

| | Friday, January 23, 2015 Weekly Market Recap. Watch video of this material here. The markets continue with its choppiness. Additionally, we are smack in the middle of the earnings season, which ads to not subtract from choppiness. Nevertheless, we got our buy signal on the S&P 500 on Thursday, January 22 and re-entered the market on the long side. New all-time highs seem likely now. |

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

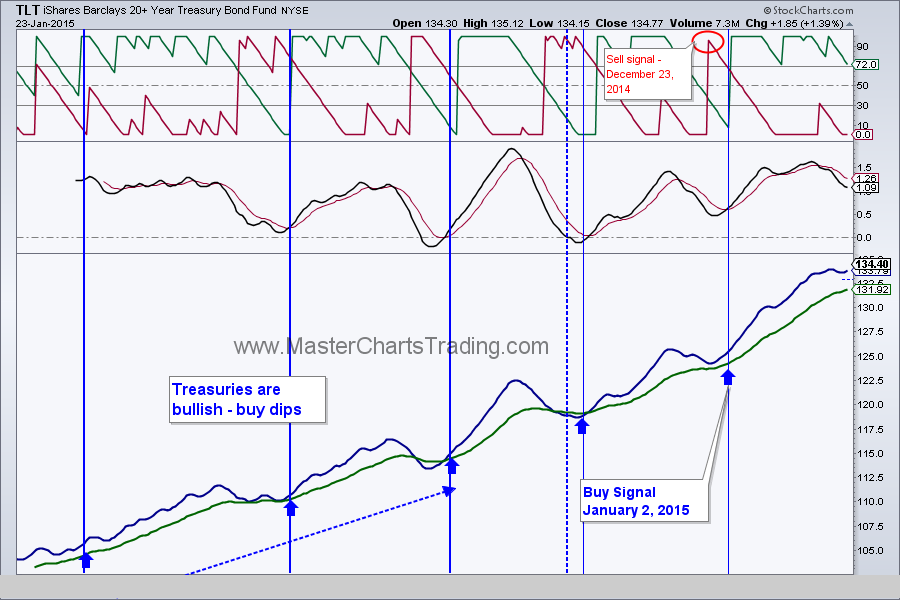

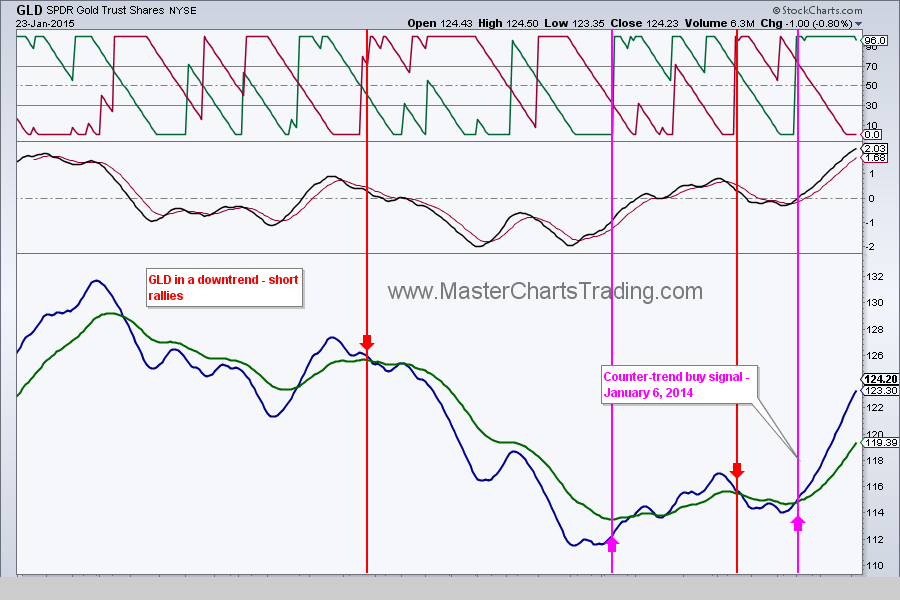

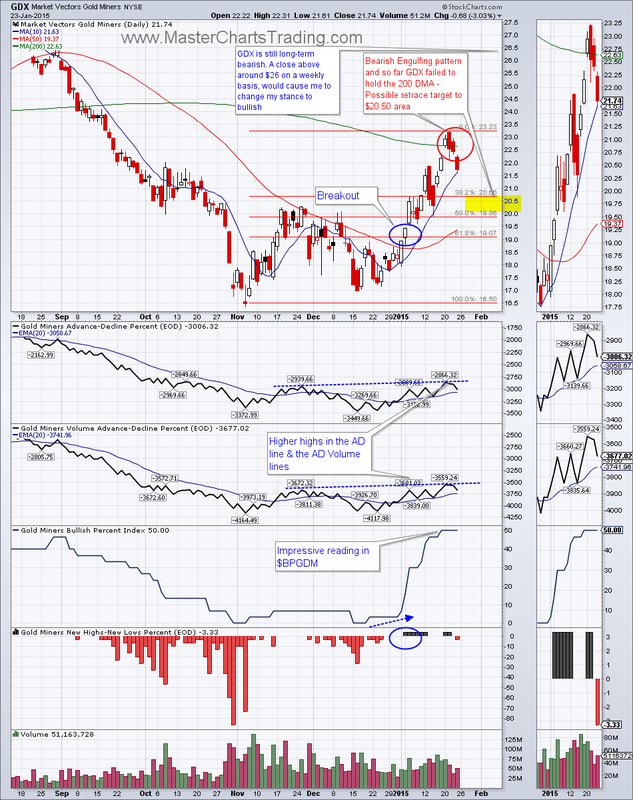

Disclaimer: we have open positions in: SPY, TLT (took profits), GLD (took profits), GDX (took profits)

Closed position: AGG

RSS Feed

RSS Feed