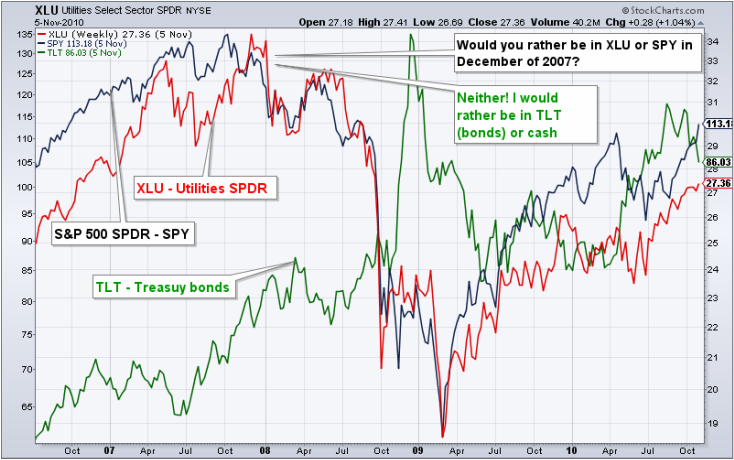

Select sector Utilities SPDR fund (XLU), together with Real Estate (REITs) fund (IYR) suffered the least selling on Friday. They were both down a little over 0.9%. Utilities and REITs both benefit from the lower rates provided by the rising bond prices.

An important caveat is that they are still STOCKS. And stocks have high degree of correlation to the general markets (some exceptions exist). In the case of XLU and IYR, both of these funds positively correlate to the S&P 500. Should there be significant selling in the major indices, XLU and IYR will undoubtedly follow in time.

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer: we have open positions in: TLT (took profits), DUST, ERY

Closed position: SPY

New position: TZA

RSS Feed

RSS Feed