Watch video here

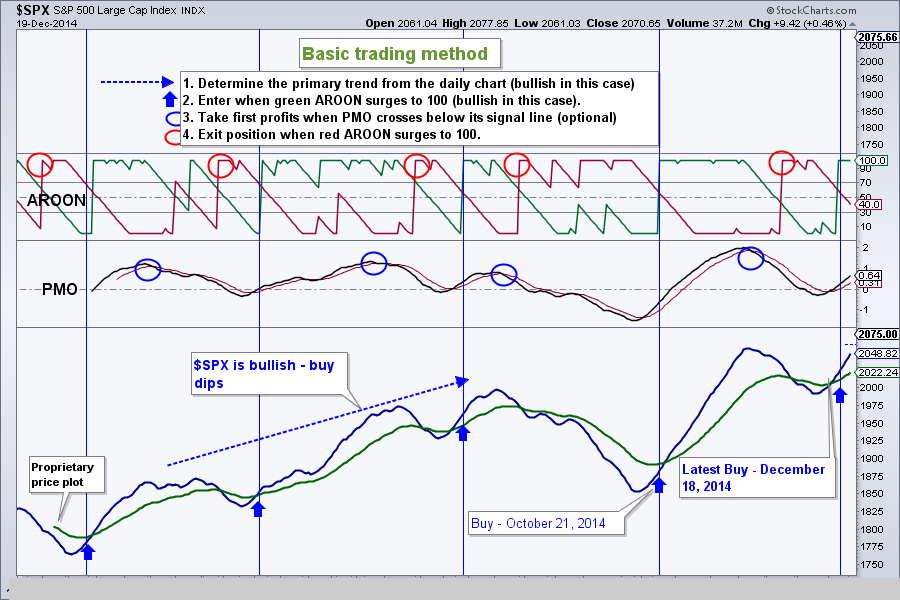

Following a sharp decline, the markets rebounded just as sharply over the past 3 trading days. On the previous upswing from late October, our charts warned us to start taking profits as early as previous Wednesday and we closed our position in SPY Friday before last on December 12th.

However this Wednesday, December 17th the S&P 500 reversed very sharply and followed through next 2 days to close near all-time highs. We re-entered the market on December 18th.

a. The short-term indicators told me to cover and more importantly

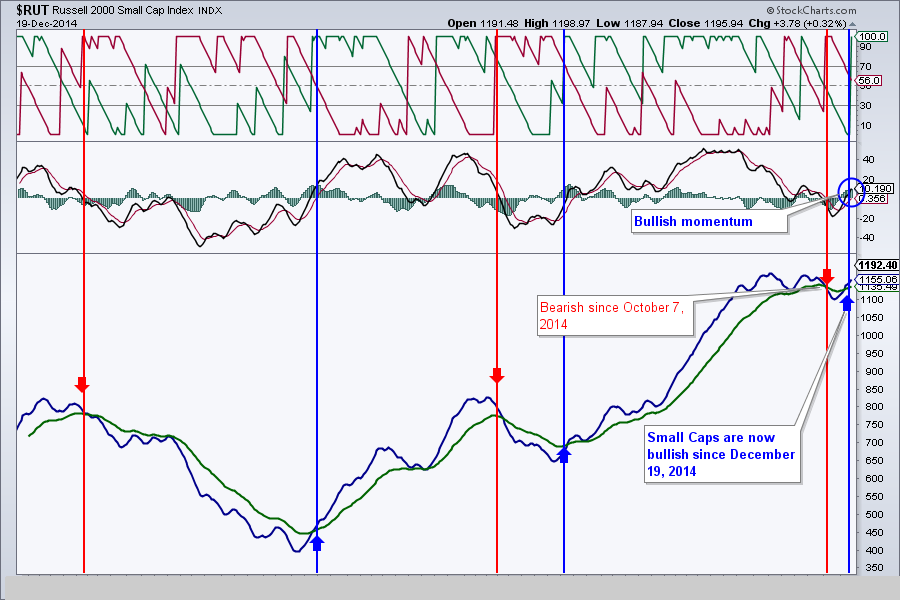

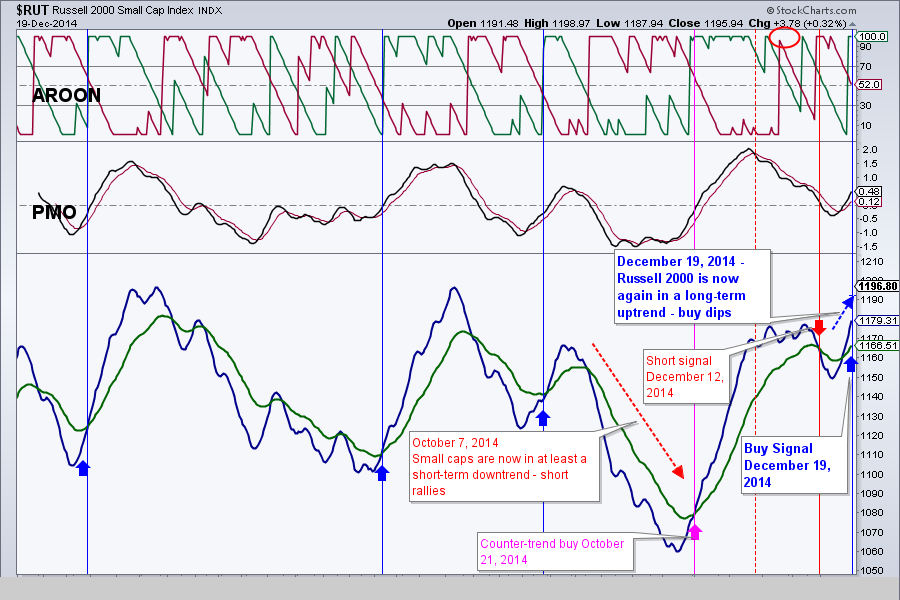

b. Long-term, the Russell has flipped into the bullish mode. The daily charts now shows that the double top I spoke about before, will likely be negated and I expect new highs as well in the Russell (barring unforeseen dramatic events)

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

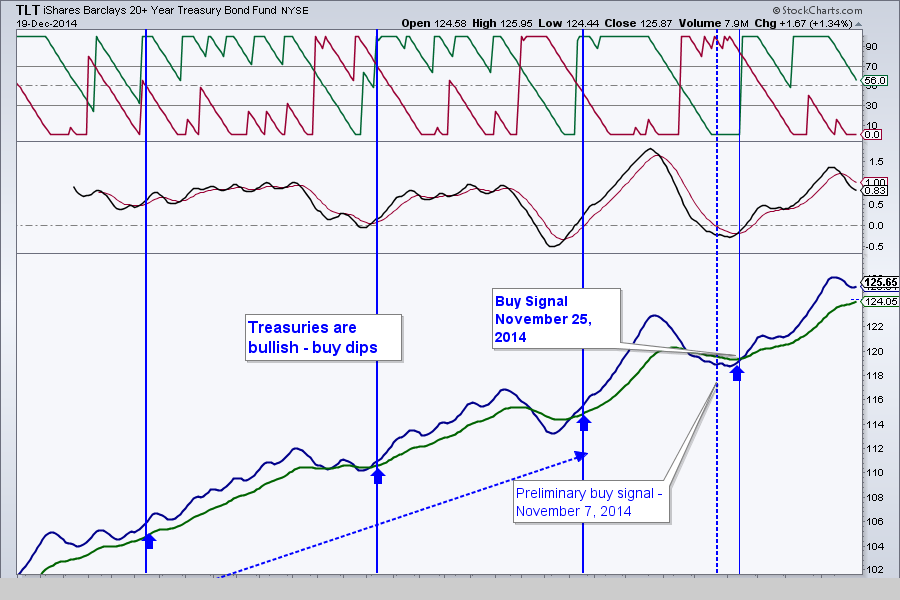

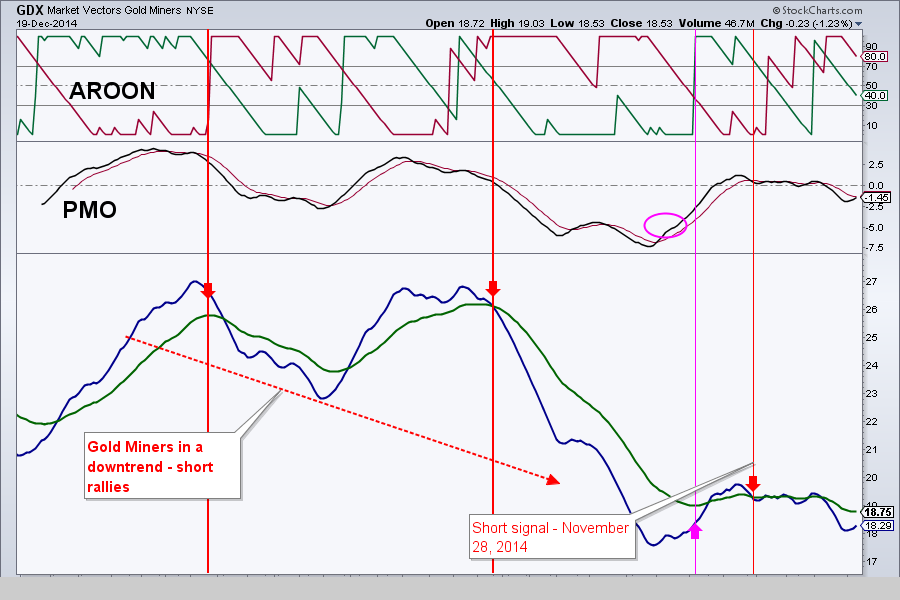

Disclaimer: we have open positions in: TLT (took profits), DUST

New position: SPY

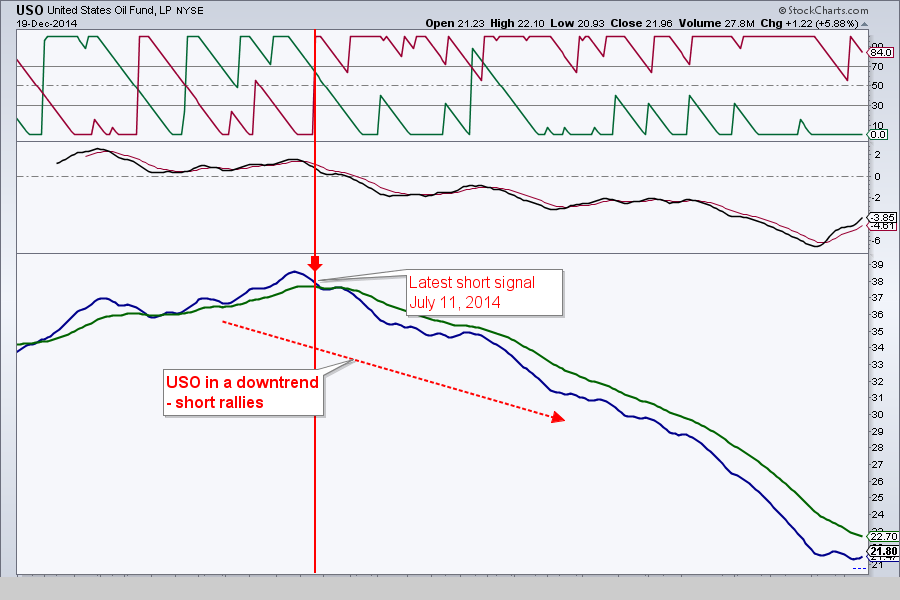

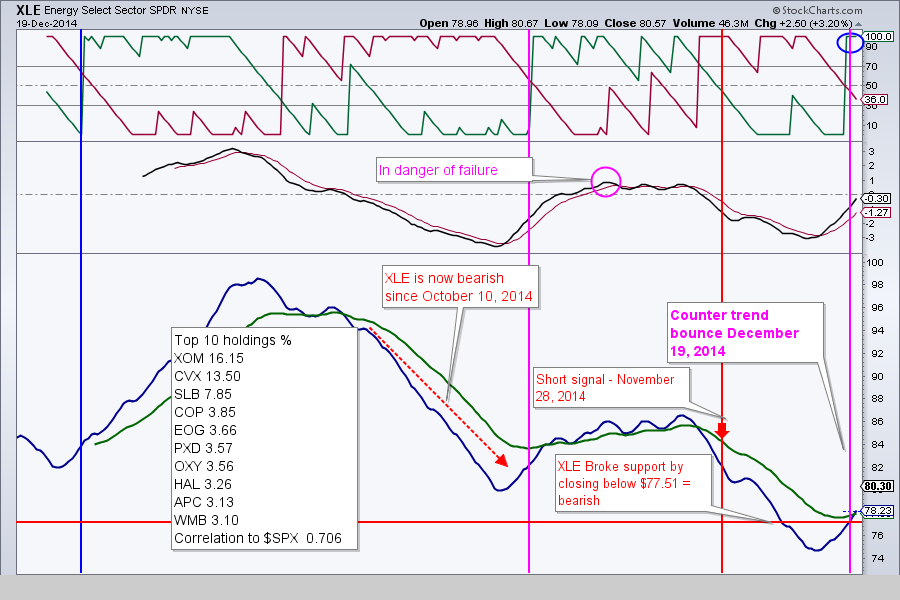

Closed position: TZA, ERY

RSS Feed

RSS Feed