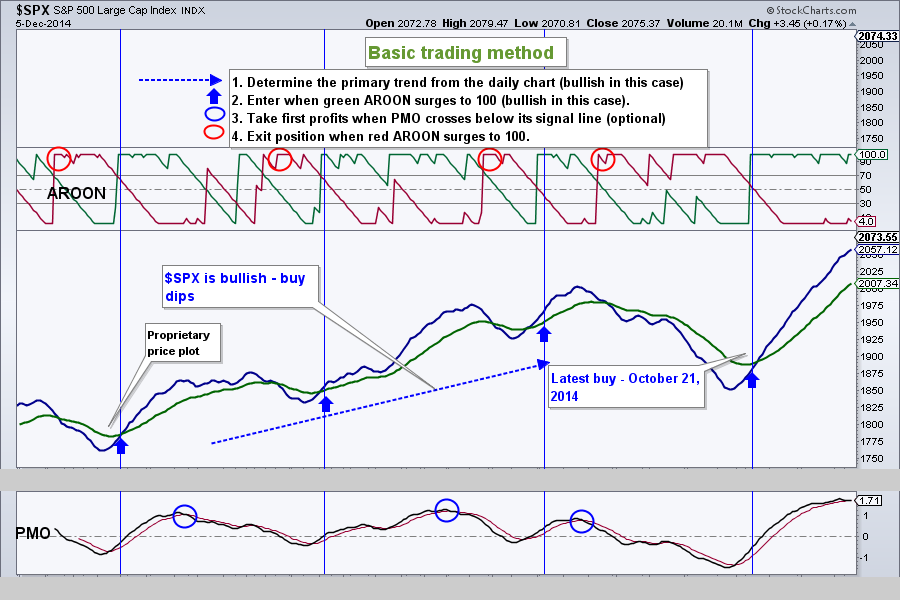

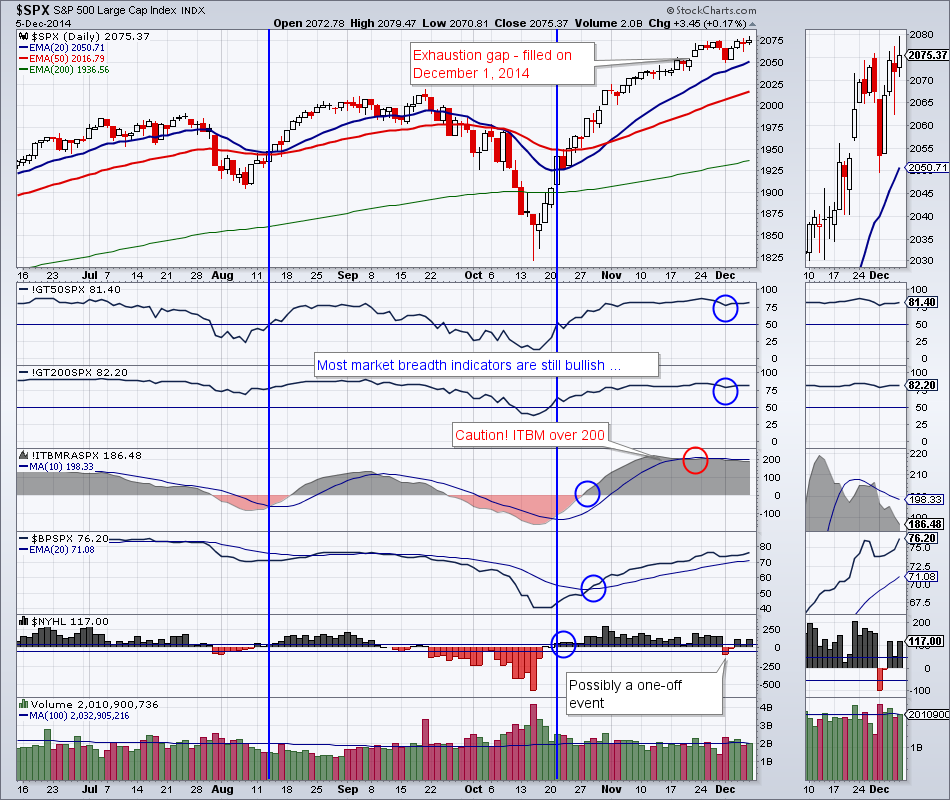

Large Cap stocks truly have gone nowhere in the past 2 weeks. The S&P 500 is stuck in a tight 25 point trading range between 2050 and 2075. At this point, no sell signal was given by our trading system and we still have a position in SPY open.

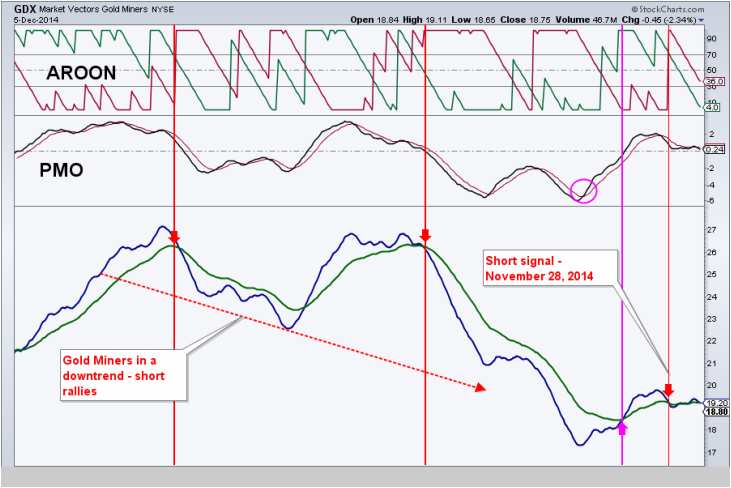

Gold miners are indecisive. We have an open position in DUST (inverse gold miners), but GDX has been stuck in a trading range. A break below $18.40 would open the door to a retest of lows at around $16.60.

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

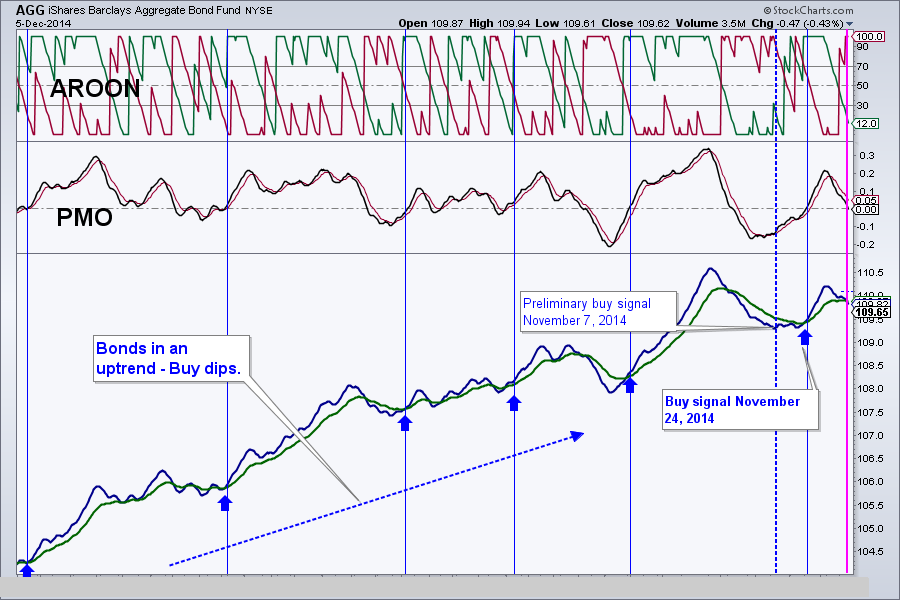

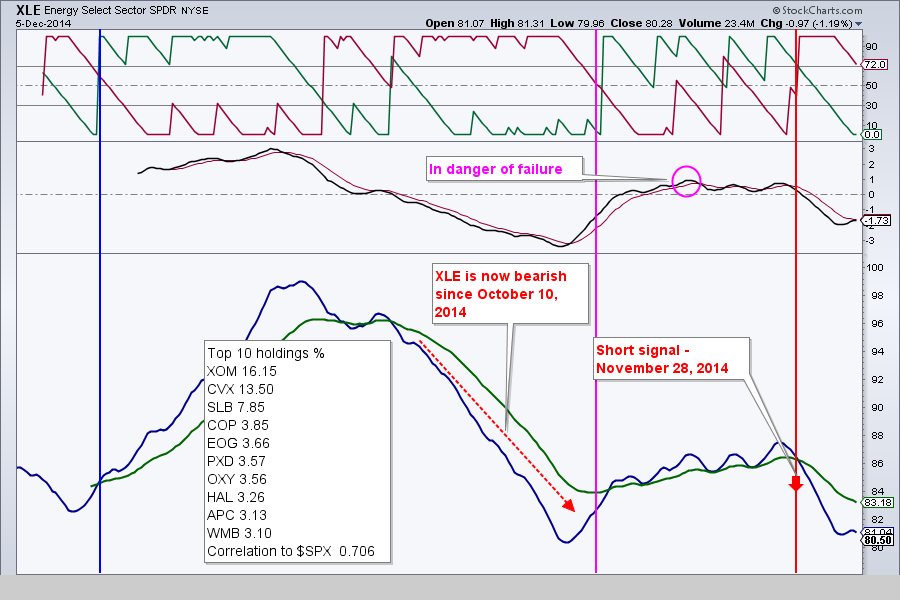

Disclaimer: we have open positions in SPY, TLT (took profits), DUST, ERY

Closed positions: AGG

RSS Feed

RSS Feed