|

Friday, March 27, 2015 Weekly Market Recap.

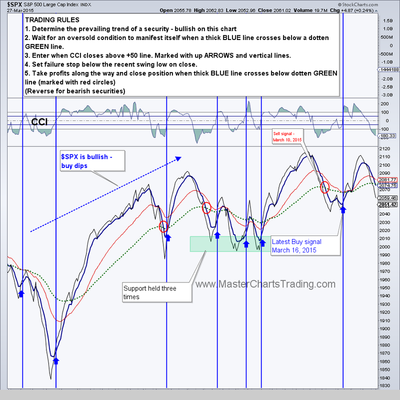

This week’s news was dominated by a strong sell-off on Wall Street on Wednesday. The selling was indeed broad and touched almost all sectors. But by the end of the week most major indices have found support and are rebounding. Large caps bore the brunt of selling, while the small cap Russell 2000 dropped some, but is not yet close to the early March support. Market breadth remains mixed with large cap breadth trending lower, and the small cap breadth still in the positive territory. This is pointing to a possible sideways consolidation, provided the supports from early March hold. Charts are here |

|

Gold miners (GDX) underperformed gold, but managed to close the gap from early March gap down. Should gold extend its rally, gold miners are sure to follow. Again, as with gold, I would be looking to re-enter the market on the short side once the trigger is hit. Gold and gold miners charts here

Best Regards and have another great trading week!

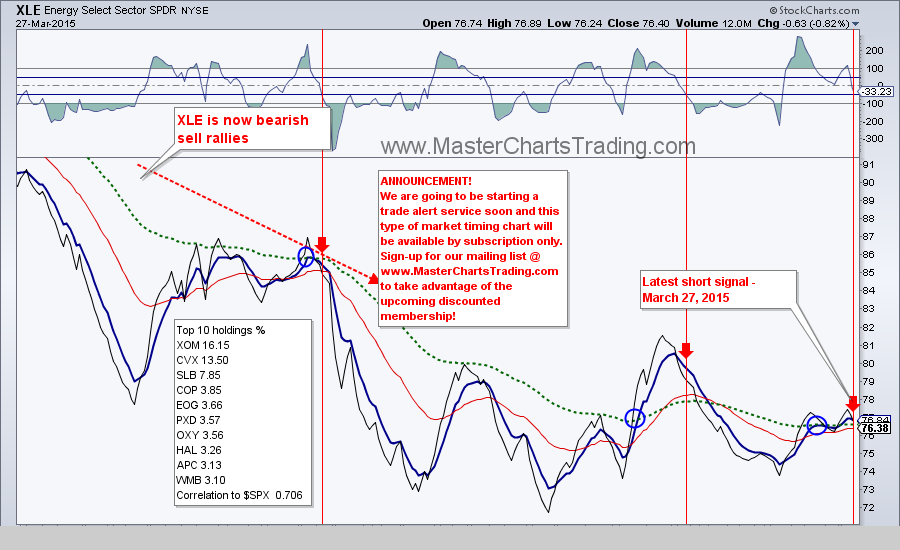

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: TLT, SPY, IYR, XLU

New position: ERY, LULU

Closed position: SCO

RSS Feed

RSS Feed